PHOTO

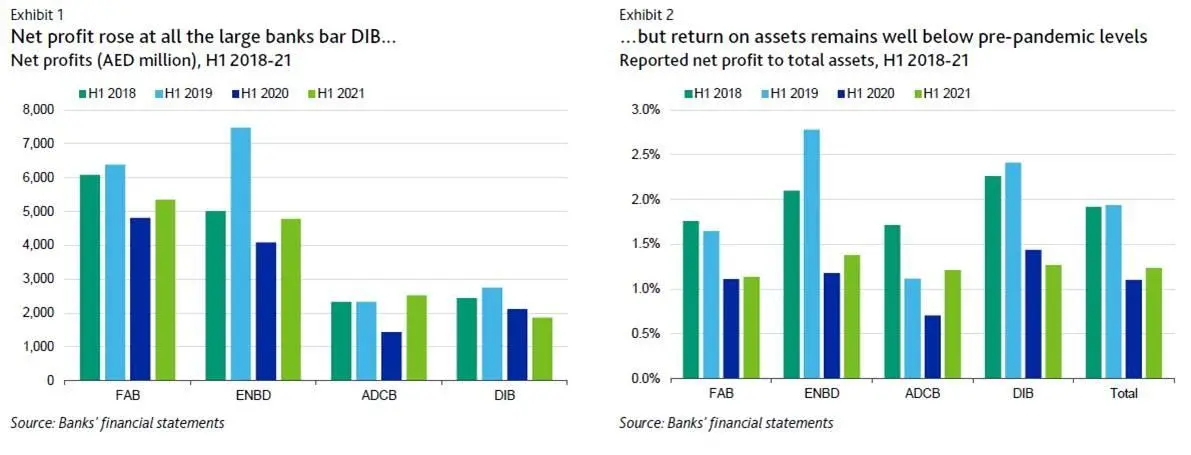

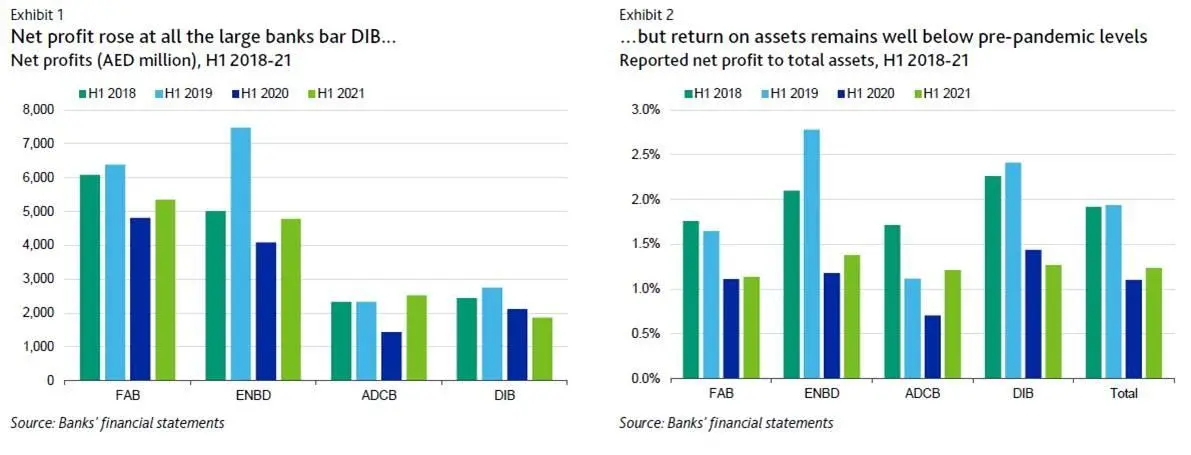

Profits at large UAE banks rose during the first six months of 2021 after a slight improvement in the operating environment led to lower loan-loss provisions, global ratings agency Moody’s said in a report. However, return on assets still remains well below pre-pandemic levels.

The combined net profit of four major banks, First Abu Dhabi Bank (FAB) Emirates NBD, Abu Dhabi Commercial Bank, (ADCB) and Dubai Islamic Bank (DIB) reached $4 billion in H1 2021, up 17 percent compared with the same period last year.

Click on image to enlarge

The four big banks account for 77 percent of UAE banking assets, Moody’s said.

Nitish Bhojnagarwala, Moody’s VP-Senior Credit Office, said: “The UAE’s four largest banks profits rose in the first half of 2021 as they booked lower loan-loss provisions.”

“We expect bottom-line profitability to gradually improve over the next 12 to 18 months as banks ease their provisioning efforts. However, provisioning could potentially pick up once again when the central bank’s loan repayment deferral program ends,” he added.

(Reporting by Imogen Lillywhite; editing by Seban Scaria)

imogen.lillywhite@refinitiv.com

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021