PHOTO

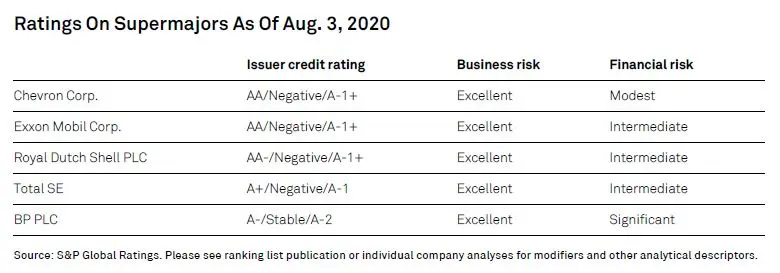

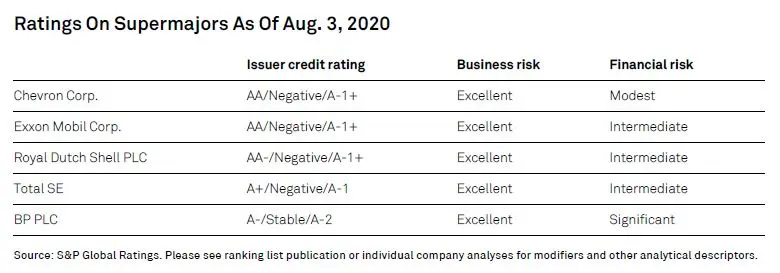

Write-downs and production cuts on their own aren’t often enough to trigger rating actions for oil and gas supermajors, S&P Global Rating said in a report.

According to the ratings agency, declining profitability, heightened volatility, and uncertainty about companies' responses to the energy transition are weighing far more on its business risk assessments.

“This is not to dismiss supermajors' strengths. In fact, given the high ratings we have on these companies, even with modest deterioration, bond investors are likely to continue benefiting from the supermajors' solid balance sheets, substantial operating cash flows, and contribution to the global energy mix for many years,” S&P said.

“Indeed, write-downs aside, the two biggest challenges facing the oil sector and supermajors are its volatility and cyclicality, which is not a new issue but one that the pandemic is testing to the maximum, and how to respond to the existential and structural questions posed by climate change and the energy transition,” S&P added.

Oil and gas production continue to be the key factor for the supermajors’ cash generation according to the report. S&P expects production to continue increasing overall after a COVID-19 related drop in 2020.

ESG performance

A decline in long-term oil and gas demand remains a risk for all oil and gas supermajors.

According to S&P, that is a key part of the energy transition as policies and consumers look for more sustainable energy sources. The ratings agency believes that the supermajors’ gas assets provide optionality, even if gas is ultimately also a fossil fuel.

The ratings agency noted that long-dated "net zero" emissions targets are already changing companies' strategies, both directly and indirectly.

“Overall, we see improvement over the past few years--average GHG emissions from operated facilities reduced to about 65 kilograms per boe in 2018 from about 80 kilograms per boe in 2014,” S&P said.

(Writing by Gerard Aoun; editing by Mily Chakrabarty)

#OIL #GAS #WRITEDOWNS #OUTPUT #ENERGY

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020