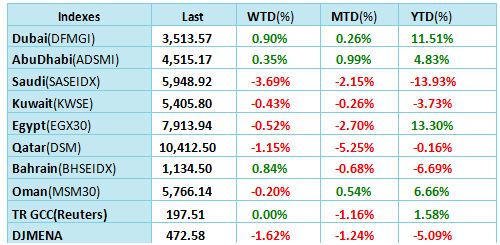

GCC - Over the past week global monetary news was the region's main trigger. The fed's decision to keep rates unchanged while hinting of a probable rate hike by year end coupled with Bank of Japan policy change and decision to provide additional stimulus if needed, both had a positive effect on investors sentiments nullifying early week negativity and reflecting a regional markets' performance that was close to unchanged on average. However, over the weekend oil prices tumbled after a report showing an increase in rig counts by Baker Huges (highlighting a fourth such straight increase) had a negative effect on global markets performances with almost all indices heading south.

A close eye will be kept on OPEC's meeting on the 28th, with markets expectations that OPEC members aren't likely to reach a supply deal in Algiers even though Saudi Arabia signalled for the first time in two years that it's willing to cut production (with the caveat that Iran do the same). For the coming week, MENA markets are expected to remain volatile mimicking its main mover oil with country specific macro news also possibly playing a role.

Egypt ended the week with a surprising decision by the CBE not to change its rates, against all expectations; such a decision could have a negative effect on investors' sentiments as it indicates that the expected currency devaluation won't be as sooner as was anticipated.

About Al Masah Capital

Al Masah Capital is one of the fastest growing alternative asset management and advisory firms focused on the MENA and SEA regions. Established in 2010 Al Masah Capital provides tailored solutions to a broad investor base, offering private equity advisory (across Healthcare, Education, Food & Beverages, Logistics and other consumer driven sectors), asset management, corporate and real estate advisory as well as public market research services.

With operations in Dubai, Abu Dhabi and Singapore, Al Masah advises qualifying investors on growth opportunities in 13 focus markets in MENA and South East Asia.

For further information, please visit www.almasahcapital.com/

For Media Enquiries please contact: Matrix Public Relations

Aser Ismail- aser@matrixdubai.com

Krishika Mahesh- Krishika@matrixdubai.com

Or call 04 34 30 888

© Press Release 2016