PHOTO

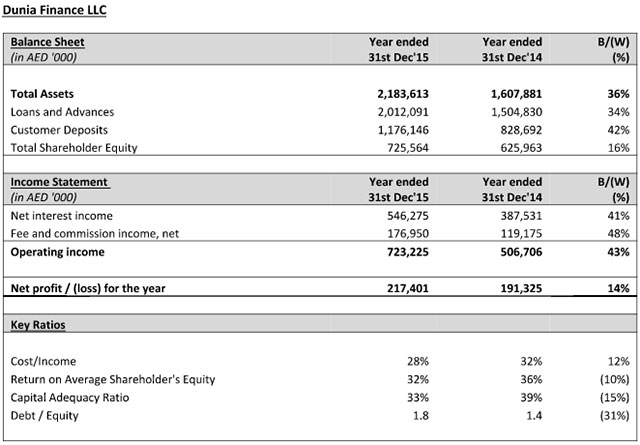

Dunia Finance operating income increases to AED 723.2 million, up 43% compared to FY 2014

Dunia Finance net profit increases to AED 217.4 million, up 14% compared to FY 2014

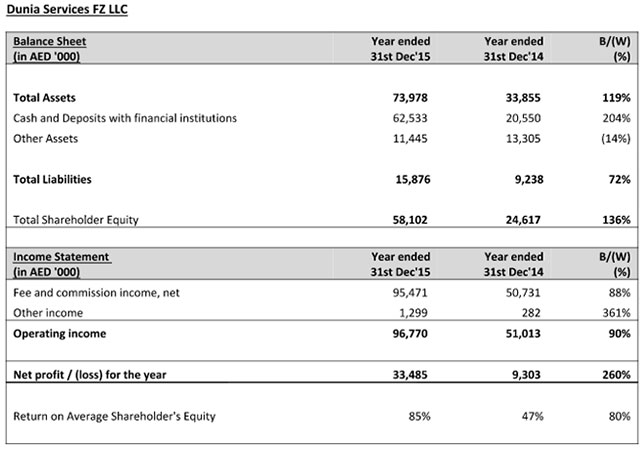

Abu Dhabi - Dunia Group today announced its audited full year financial results for the 12 month period ended 31stDecember 2015, reporting a record full year net profit of AED 250.9 Million. This included Dunia Finance LLC (dunia) reporting a net profit of AED 217.4 million and Dunia Services FZ LLC reporting a net profit of AED 33.5 million.

Despite the challenging global economic environment, dunia delivered operating income of AED 723.2 million in 2015, up 43% on 2014, and net profit of AED 217.4 million, an increase of 14% over the prior year. This record performance was driven by dunia's customer centric strategy of deepening relationships through superior service, customized solutions, and intelligent use of technology, enhanced platforms, highly trained staff and careful expense control. The increase in net profit to AED 217.4 million allowed dunia to achieve a record 32.2% return on equity for the period.

Customer expansion was a key feature of the year, with a 28% increase in total customers, taking dunia beyond 200,000 customers for the first time, reaching 211,000 by the end of the period. As a result, customer assets surpassed AED 2 billion, up 34% on FY14, and customer deposit balances increased 42% to AED 1.2 billion compared to AED 828.7 million in FY14. dunia's balance sheet remained robust, with cash and deposits with banks growing to AED 131.3 million, reflecting dunia's prudent liquidity management.

Careful process control and a strategic focus on risk management underpinned dunia's performance, enabling the company to be a low cost provider; contributing to the positive operating leverage of 18% recorded in the year. dunia's cost-income ratio shows a healthy improvement, reducing to 28% from 32% in the prior year, reflecting greater efficiency across its operations.

dunia's prudent provisioning policy is reflected in a Non-Performing Loan (NPL) coverage of 1.2x and an increase in impairment reserves from AED 43.4 million in 2014 to AED 68.9 million in 2015. As of 31st December 2015, dunia had a 33.1% capital adequacy level, significantly higher than the regulatory required 15% capital adequacy ratio, underlining the company's focus on sound risk management principles and overall standards of governance.

Salem Rashid Al Noaimi, Chairman of dunia, said: "Despite headwinds in the global economy, dunia has delivered another strong financial performance. There were several drivers behind this impressive growth, but a commitment to innovation, significant customer expansion, and a deepening of relationships remained the most important factors. Our customer centric approach has proved to be both successful and sustainable so we are confident of generating even greater shareholder value going forward."

Rajeev Kakar, Managing Director and CEO, said: "This was another year of excellent growth for dunia. We continued to develop flexible and convenient products for customers, while enhancing our efficiency. Underpinning our growth strategy was a strong focus on investing in digitization through the use of new-age technologies and advanced tools for customer acquisition and engagement across various platforms - Social, Mobile, Analytics and Cloud Computing solutions. Our enhanced capabilities of understanding and predicting customer's current behavior future behavior have enabled us to offer a unique and seamless service experience to our customers.

I want to thank the dunia management team and all our hugely talented employees who have not only worked tirelessly throughout the year but continue to strive for new levels of excellence. dunia's people underpin the company's success, so I am truly grateful for their continued commitment and drive."

-Ends-

ABOUT DUNIA FINANCE

dunia is an Abu Dhabi headquartered finance company operating in the UAE. It is a strategic investment and alliance created by a group of leading players namely:

· Mubadala - a wholly owned investment and development vehicle of the Government of the Emirate of Abu Dhabi

· Fullerton Financial Holdings - a wholly owned subsidiary of Temasek Holdings in Singapore

· Waha Capital - a holding company engaged in owning, selling, leasing and investing in various types of fixed and movable assets worldwide

· A.A. Al Moosa Enterprises - one of the leading business groups in the UAE

dunia aims to focus nationally on the key Mass Affluent and Mass Market segments in the Consumer Financial services side, and on the SME and Small business customers on the Business Finance side. Through a nationwide presence in the UAE, dunia provides a full-function product range, including a secured and unsecured loans, credit cards, financial planning services, deposits, financial guarantees and payroll processing for non-individual customers.

dunia is unique in its use of a customer-centric approach that aims to deliver a differentiated, yet relevant and unique value proposition that caters to the holistic product, convenience, experience, and service expectations of people in the UAE. All this is delivered sustainably and predictably to customers through processes and a proposition that is supported by investment in state-of-the-art technology and capabilities; and through partnerships with service providers who excel in their individual areas of expertise. dunia is led by a senior management team comprising of talented and seasoned business leaders with significant global experience.

dunia means 'the world' in Arabic and in several other languages spoken in the UAE. dunia aims to offer its customers a world of opportunities.

FOR MORE INFORMATION, PLEASE VISIT WWW.DUNIA.AE OR CONTACT:

Mariam Elsamny, Chief Marketing Officer

Dunia Group

Email: mariamelsamny@dunia.ae

Tel: +971 528559555

MEDIA CONTACTS

Georgia Lewis or Sam Turvey

Bell Pottinger

Email: glewis@bellpottinger.com or sturvey@bellpottinger.com

Tel: +971 55 4593 260 or +971 555597383

© Press Release 2016