PHOTO

Despite feeling the weight of falling oil and gas prices, Algeria's government has pledged to continue supporting its social programmes in key areas like housing, even as it unveiled further spending cuts at the end of August.

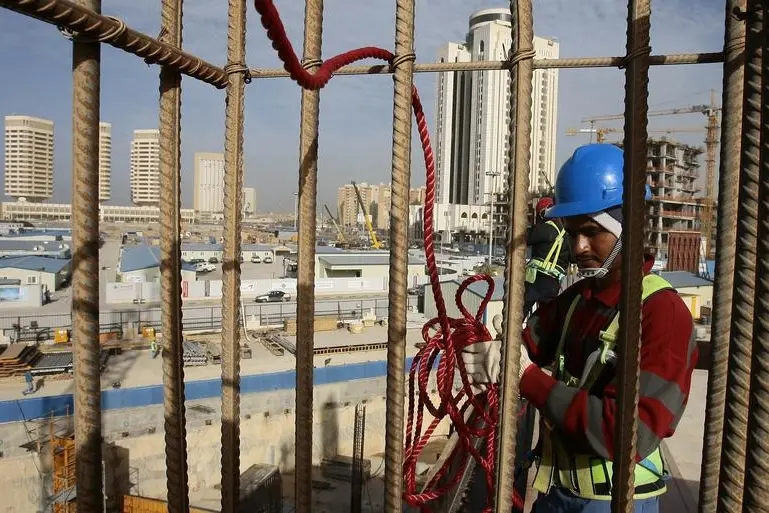

Building new homes is a priority issue for Algeria's leaders, following several years in which demand regularly outstripped supply. According to the Ministry of Housing, the social housing shortage was last estimated at 720,000 units.

Several factors have contributed to the deficit, including an expanding population, which is forecast to reach 40m by the end of the year, according to the national statistics office, up from 25m in 1990. Urbanisation is also gathering pace, particularly in the northern coastal areas.

Lengthy waiting lists and limited access to housing have sparked intermittent protests in recent years. Against this backdrop of social pressure, government officials have pledged to push forward with ambitious plans to eliminate the housing deficit by 2019.

In particular, the government is working to scale back the informal housing that has developed as a result of the housing shortage. "Our ongoing efforts to address and eliminate the problem of slums, especially in large cities like Oran, Annaba, Algiers and Constantine, will allow us to achieve our goal of making Algiers the first capital in the Maghreb and Africa to be without slums," Abdelmadjid Tebboune, minister of housing, told OBG.

Scheduled cutbacksWith Algeria's energy sector accounting for 60% of state revenues, Prime Minister Abdelmalek Sellal said the government plans to cut spending next year, after trimming its budget by 1.3% earlier in 2015 due to falling oil and gas prices. "We need courageous decisions for 2016, so we have decided on a 9% cut in the budget," Sellal said at the end of August, adding that cutbacks would not impact housing, health or education.

Officials confirmed plans to maintain the targets set out in the 2015-19 housing plan at a meeting in Algiers in late August attended by the government and the walis - governors of the country's 48 provinces. A total of 1.6m housing units are set to be constructed, half of which will be publicly-owned rental units, known as logements public locatif. Of those, 400,000 are earmarked for rural areas with the remaining 400,000 offered as part of the government's lease-to-own programme, managed by the state's Agence Nationale de l'Amélioration et du Développement du Logement, according to media reports.

"The different programmes and projects of the housing sector will be implemented despite the falling price of oil," Tebboune told OBG, adding that policies have already had a measureable impact on living conditions across the country. "The occupancy rate per dwelling has decreased from 6.1 in 1998 to 4.3 in 2014."

Housing shortfallHouse completions are expected to rise to around 300,000 per annum − the number needed to eliminate the shortage built up over the past two decades, according to government estimates - with up to 60% of the new houses to be built by private-sector contractors, Tebboune said.

Local and international building companies are already making moves to address the shortfall, with the government signing deals in recent years to commission foreign contractors with experience building large numbers of houses.

In late 2012 Algeria signed agreements with the governments of Portugal and Spain, commissioning a total of 100,000 homes to be built through joint-venture agreements with each country. This followed on another 2012 programme to build 15,000 government rental units in the wilaya (province) of Oran, with contracts allocated to Chinese and Indian contractors.

In August Egypt-based Arab Contractors announced it was carrying out a series of large-scale housing projects in Algeria, with its portfolio of ongoing projects in the country rising to $186.4m, including the construction of three new developments with a combined 4500 residential units.

Moving forwardThe government continues to face roadblocks in achieving its ambitious goals. The previous five-year plan saw just 693,000 of the 1.2m promised units delivered. In recent years housing completions fell below the 100,000 mark due to challenges ranging from securing land to lengthy construction approval processes. Some architects have also raised concerns that the housing programme focuses too heavily on achieving numerical targets at the expense of concerns such as urban planning, transport, services and amenities.

Fiscal and macroeconomic policy adjustments could help Algeria meet its housing objectives, with an estimated $158bn in foreign currency reserves giving the country room to manoeuvre, despite lower hydrocarbon revenues. The government has already allowed the dinar to depreciate to curb its import bill, with the currency falling by nearly a third against the US dollar in the first eight months of the year, in a move that also gave some impetus to the domestic economy.

In a further significant development, the authorities announced an amnesty for companies and individuals trading on the informal market in July, which will allow them to deposit previously undeclared income with banks for a 7% fee. This could see a significant degree of liquidity enter the market, with the informal sector's annual turnover estimated at around $40bn. "The government is counting on these funds to diversify its extra-budgetary sources of finance," Abderrahmane Benkhalfa, minister of finance, told local media.

© Oxford Business Group 2015