PHOTO

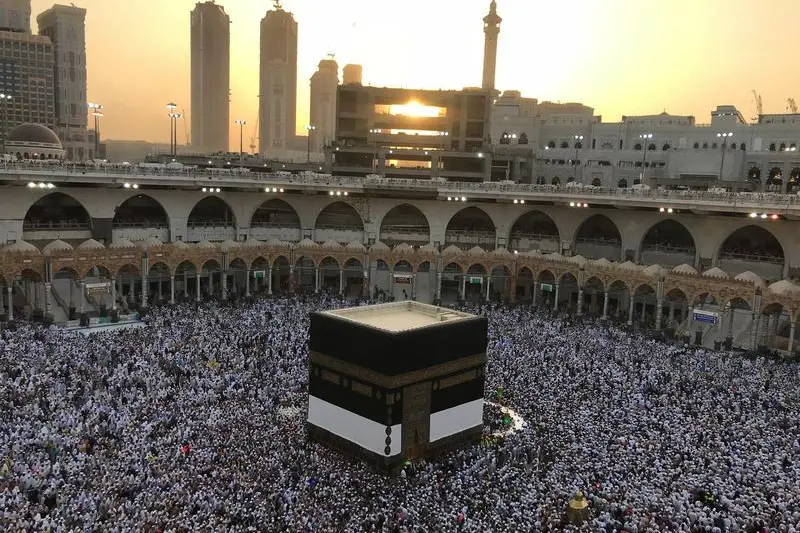

Makkah is likely to see increased investment in its retail sector in the coming years, as the number of pilgrims to one of Saudi Arabia’s holiest cities increases exponentially, according to a new research paper published on Monday.

Real estate consultancy firm Colliers said the city is undergoing a strategic overhaul in a bid to hande a 223 percent surge in anticipated visitor numbers over the next 13 years to meet the kingdom's Vision 2030 target of handling 39.1 million visitors by 2030. Visitor numbers to the city last year were 12.1 million, according to Colliers' estimates.

At the same time, the city currently has a low level of retail density, especially compared to other major Saudi cities like Riyadh, Jeddah, Dammam, Al Khobar and Madinah. The Colliers report said Makkah has a retail density of around 140 square metres per 1,000 people. This is around one-third less than Madinah, which has a similar demographic in terms of income levels but a population that is 43 percent smaller.

Some of the major infrastructure projects scheduled to take place in Makkah in the coming years in order to improve pilgrim capacity include the Holy Haram Expansion, the expansion of Jeddah's King Abdulaziz International Airport and the opening of the Haramain High Speed Railway, which links Makkah and Madina via the expanded airport.

“We expect this trend to intensify in the medium to long-term, as key retail projects in the planning stages are scheduled for construction in the coming years,” the Colliers report said, adding that the amount of shopping mall space in the city is predicted to increase from approximately 280,000 square metres (sq m) at present to 804,000 sq m by 2025.

However, the report outlines a number of factors investors should take into account when considering investments in Makkah’s retail sector:

- While the predicted increase in pilgrim numbers is signifcant, the majority of these visitors come from low income backgrounds, with 59 percent coming from countries with a gross domestic product (GDP) per person of below $5,000, meaning their spending power will be limited. Retail offerings should cater to this demographic, it added.

- That said, 30 percent of pilgrims are domestic visitors or from other Gulf Cooperation Council (GCC) countries, and have an average GDP per person of around $23,773. Makkah is not currently seen as a major luxury shopping destination for such pilgrims, so it would need to work to rectify this shortfall.

- Currently the retail mix of Makkah’s shopping malls is heavily skewed towards fashion, which accounts for 51 percent of merchandising space. Indoor family entertainment only accounts for 12 percent and health and beauty just 8 percent. With the conservative kingdom beginning to open up more as a result of the Vision 2030 cultural and economic reforms, these two areas will need to be addressed and prioritised by investors.

- Additionally, there is room for the city to develop its own local retail brands, with the report indicating that the market “is dominated by mainstream brands which often do not fully cater to the aspirations and needs of the younger generation”. It said that “fresh concepts” needed to be developed in order to compete with more mature markets like Jeddah and Riyadh.

- The majority of the retail offering in the city is made up of traditional souqs and lines of shops, with organised centres accounting for just 23 percent of supply.

- Of these shopping centres, only 15 percent would be classed as regional malls, meaning there is demand for larger, destination-style malls similar to those in other GCC cities.

- In terms of development, one stumbing block is the supply of land, with the number of suitable plots in short supply, mainly due to the city’s mountainous topography, meaning land prices are higher relative to other cities.

“The key challenges facing Makkah’s retail sector could be mainly attributed to a combination of the shortage of large and suitable land plots for mall developments and the high land prices relative to other cities in the kingdom. High infrastructure costs and the city’s residents’ preference towards shopping in Jeddah have limited the development of new shopping centres,” Imad Damrah, managing director of Colliers International KSA, said in a press release issued to accompany the white paper.

“With the execution of several strategic infrastructure and transportation projects, along with the Vision 2030, capacity is expected to rise substantially, translating into significant growth in the numbers of visitors/pilgrims. This will fuel the city’s local economy, resulting in an increase in consumption, retail sales and demand for new retail projects,” he added.

Further reading:

• 490,000 new jobs await Saudis in retail sector

• Saudi represents 70% of Gulf's $170bln retail value

• Makkah holy sites to witness technology-based massive development

• Jeddah, Makkah, Madinah hotel occupancy increases

• Makkah: The destination of Meetings, Conventions Industry

(Writing by Shane McGinley; Editing by Michael Fahy)

(shane.mcginley@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018