PHOTO

Manama:- National Bank of Bahrain (NBB) today announced another period of continued growth reporting a net profit of BHD 40.0 million (USD 106.4 million) and an operating profit of BHD 44.7 million (USD 118.9 million) for the first six months of the year ended 30 June 2019, an increase of 8.7% and 17.3% respectively compared to a net profit of BHD 36.8 million (USD 97.9 million) and an operating profit of BHD 38.1 million (USD 101.3 million) in the prior year period. This was achieved despite provisions of BHD 4.7 million, which were more than double the provision amount in the corresponding period in 2018. For the second quarter of 2019, the Bank’s net profit increased by 14.6% to BHD 19.6 million (USD 52.1 million) compared to BHD 17.1 million (USD 45.5 million) in the second quarter of 2018.

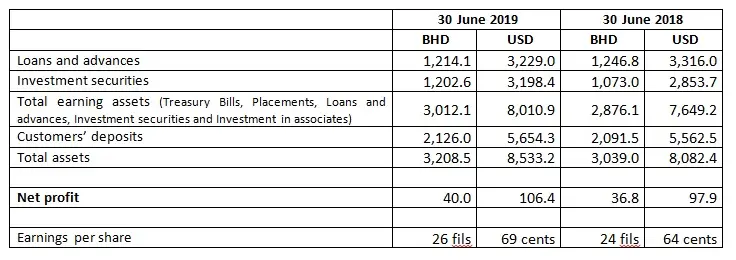

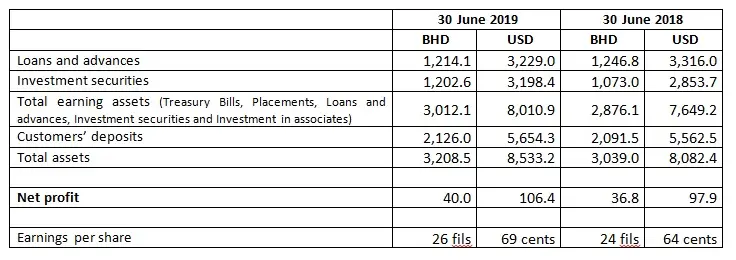

Key financial highlights:

- Operating profit rose by 17.3% y-o-y to BHD 44.7 million (USD 118.9 million) compared with BHD 38.1 million (USD 101.3 million) in the prior-year period. For the second quarter of 2019, it rose by 17.2% to BHD 21.1 million (USD 56.1 million) compared with BHD 18.0 million (USD 47.9 million) in the second quarter of 2018.

- Operating income rose by 12.2% y-o-y to BHD 66.2 million (USD 176.1 million) compared with BHD 59.0 million (USD 156.9 million) in the prior-year period. For the second quarter of 2019, it rose by 10.7% to BHD 32.0 million (USD 85.1 million) compared with BHD 28.9 million (USD 76.9 million) in the second quarter of last year.

- Net interest income increased by 16.8% y-o-y to BHD 48.0 million (USD 127.7 million) compared with BHD 41.1 million (USD 109.3 million) in the prior-year period. Improvements were driven by prudent asset liabilities management and the acquisition of new customers from various sectors across the Bank’s business lines during the first half of the year. For the second quarter of 2019, an increase of 12.6% to BHD 24.2 million (USD 64.4 million) was reported compared with BHD 21.5 million (USD 57.2 million) in the prior-year-period.

- Other income rose by 1.7% y-o-y to BHD 18.2 million (USD 48.4 million) compared with BHD 17.9 million (USD 47.6 million) in the prior-year period. For the second quarter of 2019, it rose by 5.4% to BHD 7.8 million (USD 20.7 million) compared with BHD 7.4 million (USD 19.7 million) in the second quarter of last year.

- Operating costs were up to BHD 21.5 million (USD 57.2 million) compared to BHD 20.9 million (USD 55.6 million), an increase of 2.9% which is in line with the ongoing investments in human capital and technology to support the Bank’s transformation strategy. Cost-to-income ratio was 32.5%, which nevertheless remains well in line with industry norms. For the second quarter of 2019, operating costs stood at the same level of BHD 10.9 million (USD 29.0 million) compared to the second quarter of 2018.

- Total comprehensive income for the period was BHD 44.5 million (USD 118.4 million) compared with BHD 14.4 million (USD 38.3 million) in the prior-year period. For the second quarter of 2019, it rose to BHD 18.8 million (USD 50.0 million) compared with BHD 4.3 million (USD 11.4 million) in the second quarter of last year.

- Total earning assets increased by 4.7% to BHD 3,012.1 million (USD 8,010.9 million) compared with BHD 2,876.1 million (USD 7,649.2 million) as at 30 June 2018.

- Average loans and advances increased by 6.9% to BHD 1,230.5 million (USD 3,272.6 million) compared with BHD 1,150.6 million (USD 3,060.1 million) in the prior-year period.

- Average customer deposits remained steady at BHD 2,108.8 million (USD 5,608.5 million).

- Total equity grew by 14.6% to BHD 486.4 million (USD 1,293.6 million) compared with BHD 424.3 million (USD 1,128.5 million) as at 30 June 2018.

- Earnings per share during the period increased by 8.3% to 26 fils (USD 69 cents) compared with 24 fils (USD 64 cents) in the prior-year period.

Mr. Farouk Yousuf Khalil Almoayyed, Chairman of NBB, said, “NBB continued to deliver strong growth and performance throughout the first half of 2019. Record results once again reflect the ongoing success of our strategy and the achievements made in transforming the bank with a focus on modernisation and further diversification and digitalisation of the business. Continued expansion and income generation from our core banking activities drove strong gains in operating profit with another significant increase of 17.3% reported for the first half of the year. With the new brand identity launched during the first quarter, we have also gone on to introduce our new branch concepts for the future. During the second quarter of 2019, we opened our flagship Seef Mall branch, which embodies the enhanced customer journey we aim to provide across all of our network, which remains the largest and most robust in Bahrain. The second quarter also saw NBB named by Euromoney as Best Bank in Bahrain, an honour awarded to us in recognition of our continued market leadership and the impressive growth, profitability and innovation that our strategy continues to deliver. We are extremely proud of these achievements and of the hard work and dedication of our management and employees. In the second half of the year, we will build on this momentum and are confident that we will achieve continued growth and even greater value creation of our shareholders, customers and community as we work to get closer to all our stakeholders.”

Mr. Jean-Christophe Durand, Chief Executive Officer of NBB, added, “Record profitability and results for the first half of 2019 reflect the success of the transformation underway at NBB. Consistent top and bottom line growth demonstrates that our strategy is working and that our customers and the market are seeing and responding positively to the new and innovative approach, which firmly puts both the customers and the economy at the centre of our journey. Gains in operating income and profits during the period were the result of further business expansion and growth as well as the prudent management of costs. Keeping this balance remains essential to achieving our objectives and ensures we are able to continue investing in innovation and grow in a market that demands we stay at the forefront.”

Mr. Durand added, “We are pleased with the many tangible improvements and progress reported over the past six months and notably of the ongoing and marked increase in NBB’s participation in the local economy. During the first half of 2019, the bank increased by 2.0% its level of loans and financing across individuals, SMEs and corporates. Continued product innovation and effective promotions also helped retain robust levels of retail and institutional customer deposits. On efforts to enhance the customer experience, the first half of the year and second quarter have seen further upgrades across the Bank’s physical and digital platforms. We are better by using technology and automation to raise efficiency while also introducing customer service innovations at our call centre and in branches through new partnerships and on-site services and care. During the period, we also saw more progress in diversification and geographic expansion, central pillars of our business transformation. For SMEs, we are working to create tailored solutions that enable us to be the preferred local partner for business while for large corporates and the economy, we are significantly stepping up our debt capital market and advisory activities. With a market leading team in place, we are now focused on taking a more leading role alongside other sizeable regional banks in the provision of financing and syndications and have already developed a strong track record. On the regional front, we are also now swiftly moving ahead with planned expansion in the Kingdom of Saudi Arabia and the UAE. Over the past six months, we have continued building our team based in the Kingdom’s capital and have recently received approval from the Central Bank of UAE for “reactivation” of our branch licence in Dubai, from where we will focus on growth in corporate and commercial banking operations. We are extremely pleased with the direction that these developments are taking us and anticipate further progress and strong performance throughout the second half of the year.”

Financial Summary (30 June)

-Ends-

About National Bank of Bahrain B.S.C

National Bank of Bahrain B.S.C. (“NBB”), was established in 1957 as Bahrain’s first locally owned bank, incorporated under the laws and regulations of the Kingdom of Bahrain. NBB has grown steadily to become the Kingdom’s leading provider of retail and commercial banking services. With a major share of the total domestic commercial banking market and the largest network of 25 branches and 61 ATMs, NBB plays a key role in Bahrain’s Economy. NBB continues to diversify and develop capabilities to capture business opportunities in the Gulf region and international markets with the Abu Dhabi and Riyadh branch leading the way in this initiative. NBB is listed publicly on the Bahrain Bourse. For more information, please visit: https://www.nbbonline.com

Media inquiries can be directed to:

FinMark Communications

Zahraa Taher

Tel: +973 39630997

Email: ztaher@finmarkcoms.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.