PHOTO

The food sector in the Gulf States is witnessing a steady growth, thanks to rising population, high per capita income and increasing tourist inflow. However, a high dependency of food imports poses a significant challenge to the economies.

Due to unfavorable climate, limited water resources and arable land in the region, the GCC countries import around 85 percent of the total food consumed. This has exposed the GCC to global food price fluctuations. Geo political risks in the region will also have an adverse impact on the food supply in the region, Alpen Capital said in its GCC Food Report.

"The ongoing US-China trade war could have supply implications in the food sector within the region. Also, with a strong dollar you could have lesser European tourists visiting the region," Krishna Dhanak, Executive Director, Alpen Capital Middle East said.

"The economic slowdown, the rationalization of fiscal expenditures and the new tax regimes in various Gulf states challenge the GCC food industry. We have seen an extended period of low oil prices, which have resulted in fiscal policies by the government as well as rationalization of costs. All of this will directly impact consumers’ spending power," he added.

According to the report, the GCC countries are meeting most of their food demand from imports, due to limited internal resources for production. While net food product imports grew at a CAGR of 5.2 percent between 2011 and 2016 to reach 41.9 million metric tonne (MT). Total net import value grew at a 3.1 percent CAGR during the period to reach $29.5 billion.

Top consumers

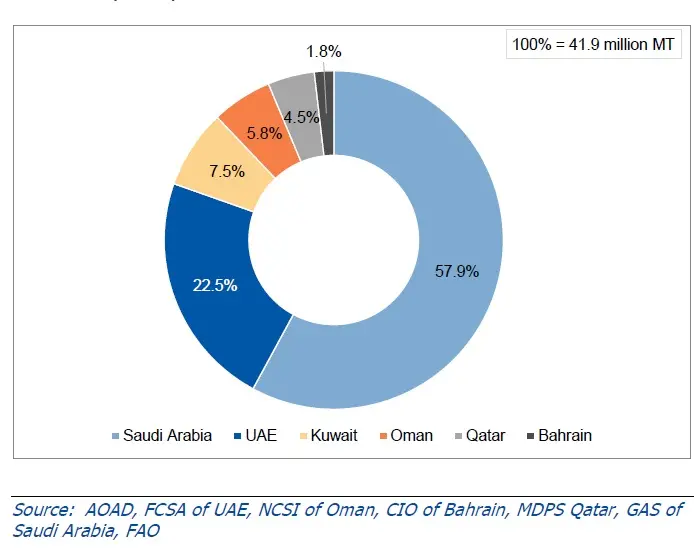

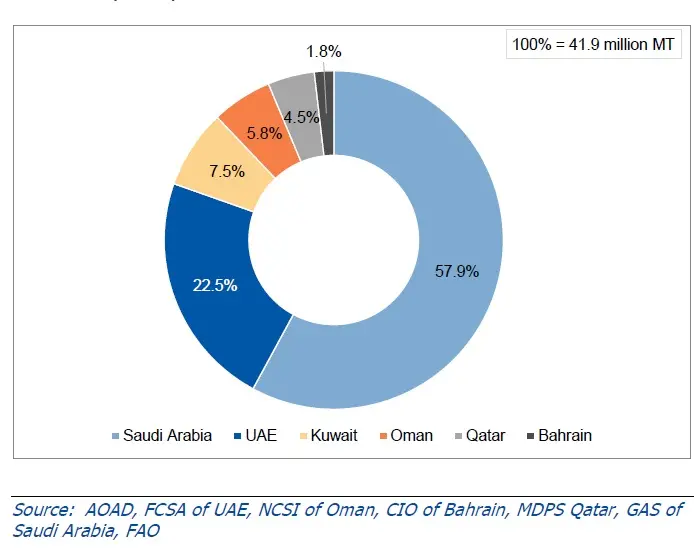

Saudi Arabia and the UAE are the major importers owing to the large consumer base in the nations.

During 2016, both nations collectively accounted for 80 percent of the region’s net imports. Total volume of net food imports in Oman, Qatar and Bahrain grew at an annualized rate of 11.5 percent, 8.6 percent and 7.8 percent respectively between 2011 and 2016, fairly faster than Saudi Arabia (5.3 percent) and the UAE (3.1 percent), the report noted.

Both Saudi and UAE are expected to remain the largest food consuming nations, according to Alpen Capital.

Saudi Arabia’s food consumption is forecasted to reach 39.0 million MT in 2023 from 33.2 million MT in 2018.

Job creation initiatives by the government, religious tourism and direct distribution of allowances to Saudis are steps towards economic growth and higher consumer spending, the report said.

UAE’s food consumption is forecasted to reach 10.3 million MT in 2023 from 8.7 million MT in 2018.

Increase in population and international tourist arrivals along with high disposable income will contribute to the growth. Oman is expected to experience the fastest annualized growth of 4.6 percent, it noted.

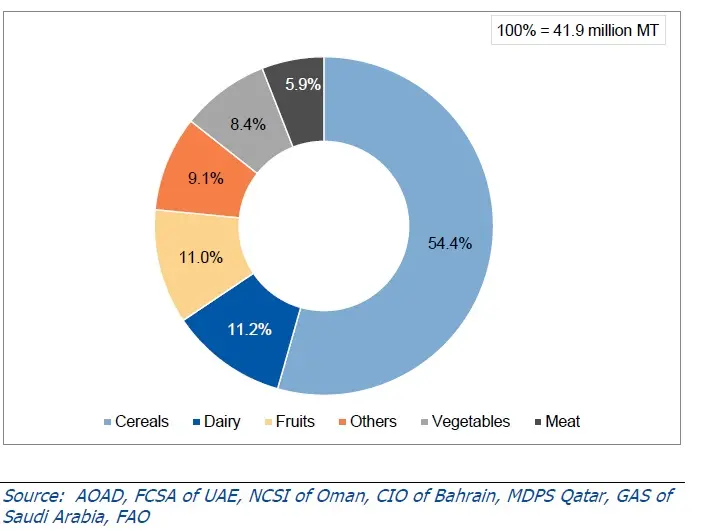

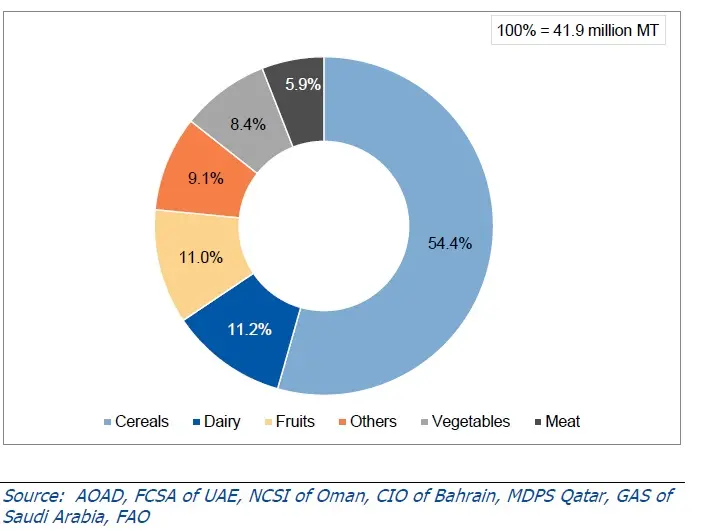

On the composition of imports, cereals and dairy remained the most imported food item, accounting for 54.4 percent and 11.2 percent of the net food imports respectively in the GCC in 2016.

Net imports of cereals, fruits, vegetables, meat and others grew in the range of 4 percent to 7 percent between 2011 and 2016 (in CAGR terms), while that of dairy and vegetables grew at a slower pace of 1.3 percent and 2.7 percent respectively, the report said.

Increasing food production

Gulf countries are constantly looking for ways to improve local food production.

The inherent growth potential of the industry coupled with the regional governments’ efforts to enhance local food production is encouraging international as well as local players to expand their foothold in the sector.

"To reduce imports dependency and build a sustainable supply, the GCC countries are looking at ways to boost the domestic food production by investing in modern agriculture methods like aquaculture, hydroponics and vertical farms. Some of the countries are also investing in overseas farmlands," Krishna said.

"The UAE and Saudi Arabia are particularly more active in investing in lands abroad," he added.

Saudi Arabia continues to purchase farmland in different parts of the world with the most recent being in Sudan and Australia. The UAE has made investments or partnerships for agricultural development in Egypt, Liberia, India, Mozambique, Romania, Sudan, Uganda and Uzbekistan, the report said.

(Writing by Seban Scaria seban.scaria@refinitiv.com, editing by Daniel Luiz)

© ZAWYA 2019