PHOTO

Highlights

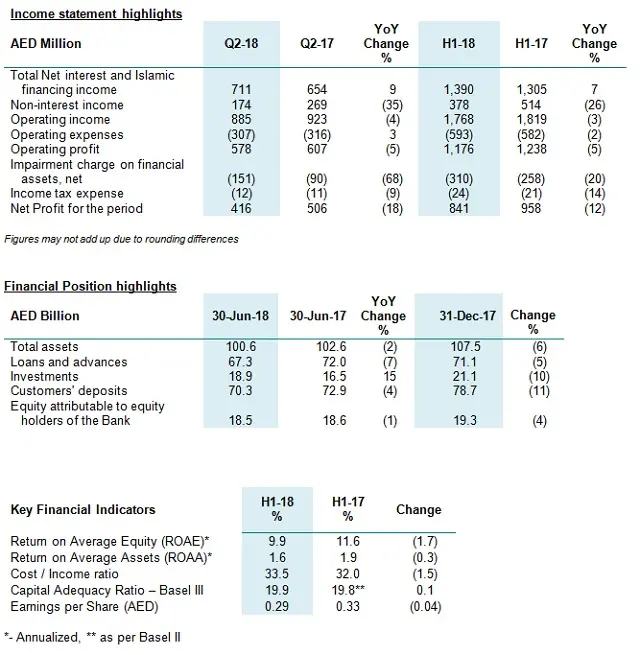

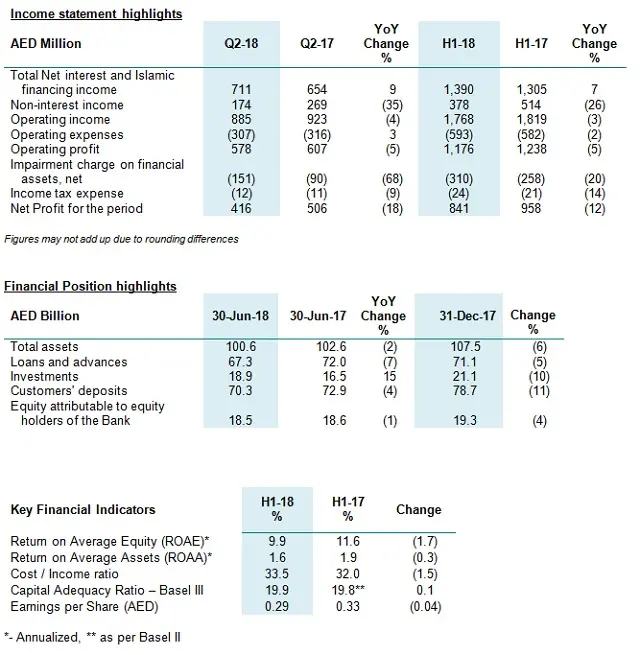

- Operating income marginally lower by 3% in H1-2018 to AED 1,768 million

- Operating profit for H1-2018 of AED 1,176 million, lower by 5% for the same period in 2017

- Loans and advances of AED 67.3 billion as at 30 June 2018, as the Group continues to follow a selective approach to booking new business

- Optimal liquidity position maintained with loan to deposit ratio at 95.8% and advances to stable resources of around 85% as at 30 June 2018

- Improved NPLs to gross loans ratio of 3.8% and loan loss coverage ratio of 132.6% as at 30 June 2018

- Strong capital position with overall and Tier 1 capital adequacy ratios as per Basel III of 19.9% and 18.8% respectively as at 30 June 2018

Financial Review

Union National Bank (UNB), one of the leading banks based in the United Arab Emirates, recorded a profit of AED 841 million for the first half of 2018. The profit for the second quarter of 2018 of AED 416 million was lower by 2% quarter-on-quarter as the Group continued to remain selective to book new business amid scheduled repayments of loan facilities.

Commenting on the results, Mr. Mohammad Nasr Abdeen, Chief Executive Officer, Union National Bank said “Whilst maintaining strong balance sheet, sound liquidity position and solid capital ratios, UNB continues to maintain its strategy to cautiously pursue loan growth while managing the downside risks. Margins continue to improve during the year on the back of increasing yield on assets compared to the cost of funds. He further added that “The Group is well placed to take advantage of growth opportunities through our well established franchise, product offerings and strong balance sheet as the region and more specifically the United Arab Emirates continue to innovate and diversify for a sustainable future”.

The operating income for the six month period ended 30 June 2018 was lower by 3% at AED 1,768 million on year-on-year basis due to a decline in non-interest income by 26% that was partly offset by an increase in net interest income which grew by 7%. The reduction in the non-interest income over the same period in 2017 was mainly due to reduction in fees and commission income and lower gain on dealing in foreign currencies and derivatives. Partially this decline was offset by an increase in net interest income led by a growth in the net interest margin on account of higher yield on earning assets partly offset by an increase in cost of funds; the net interest margin for H1-2018 was 2.73%, higher by 16 basis points compared to corresponding period of 2017.

Balance sheet

As mentioned earlier, the Group has continued to maintain a selective approach to booking new business. This approach along with routine repayments and impact of IFRS 9 transition adjustment has led to the net loans and advances being lower in the first half of this year by 5% and were AED 67.3 billion as at 30 June 2018. Various business deals are in the pipeline and some of these are expected to be completed in the second half of this year. The total assets of the UNB Group dropped marginally by 2% on year on year basis to AED 100.6 billion as at 30 June 2018.

In keeping with the recent trends for the loans and advances, the customers’ deposits level has been adjusted to ensure balance sheet efficiency. This has resulted in customers’ deposits decreasing to AED 70.3 billion as at 30 June 2018.

The Group’s liquidity position has continued to remain strong with the related metrics showing consistent trends. Liquid assets, including investments constituted 28% of the total assets; loan to deposits ratio was 95.8% as at 30 June 2018. Key regulatory liquidity ratios remained sound with advances to stable resources ratio being below 85% as at 30 June 2018. The Bank remained well ahead of the Central Bank of the UAE set requirements both for Liquidity Coverage ratio and the Eligible Liquid Assets ratio.

Operating expenses

Operating expenses increased modestly by 2% in the first half of 2018 over the same period of 2017. The increase in the expenses was to support ongoing business activities. The cost to income ratio of the Group was at 33.5% for the first half of 2018.

Credit quality

The ratio of non-performing loans and advances to gross loans and advances improved in the first half of the year and was 3.8% as at 30 June 2018 (31 December 2017: 4.3%). Effective 1 January 2018, the Group has implemented IFRS 9: Financial Instruments, with the overall loan loss coverage improving to 132.6% as at 30 June 2018 (31 December 2017: 97.1%).

Profitability measures and Capital strength

The annualized return on average equity, excluding Tier 1 capital notes, for the six month period ended 30 June 2018 was 9.9% (H1-2017: 11.6%) and the annualized return on average assets was 1.6% (H1-2017: 1.9%). The earnings per share for the same period ended 30 June 2018 was AED 0.29 (H1-2017: AED 0.33).

The capital adequacy ratios for the UNB Group have remained strong and as at 30 June 2018 were:

Overall capital adequacy ratio (CAR) - 19.9% (31 December 2017: 19.4%)

Tier I CAR - 18.8% (31 December 2017: 18.3%)

Common Equity Tier 1 CAR – 16.7% (31 December 2017: 16.5%)

All the above capital ratios as per Basel III and computed in accordance with the Central Bank of the UAE guidelines remain well above the regulatory thresholds.

Awards and Accolades

- The World Confederation of Businesses (WORLDCOB) has recognized UNB CEO with the honors of ‘Excellence in Business Management’ for being a successful leader who works in an innovative, knowledgeable and systematic manner”. UNB has also been bestowed with the ‘Glory’ award for being an inspirational company by WORLDCOB at The BIZZ Europe 2018 Award ceremony.

- UNB won the prestigious Dubai Human Development award from the Business Excellence Centre, Department of Economic Development, the organizers of Dubai Quality Award.

- UNB was honored with the Best Employee Engagement Program and the Best Workplace Sustainability program at the inaugural Happiness @ Work Award Ceremony.

- UNB CEO was honoured by the internationally renowned World Finance (WF) magazine to be amongst its prestigious WF 100 list for 2017.

- UNB received the Dubai Chamber CSR Label for the third consecutive year.

-Ends-

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.