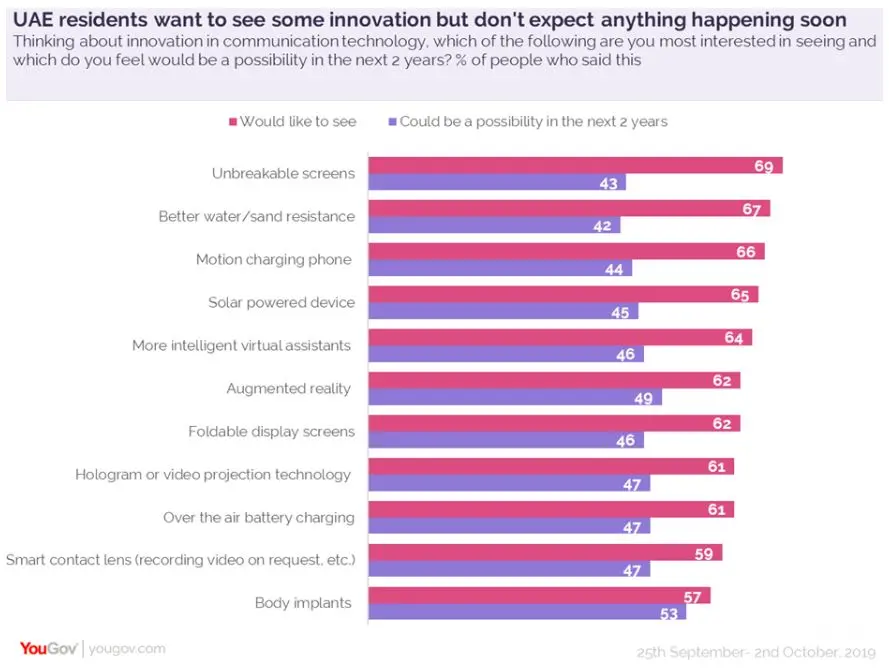

A majority of UAE residents want a range of smartphone innovations but many don’t think they will see them in the near future, new YouGov research reveals.

When presented with a list of advances in communication technology, the data shows that

UAE residents are most interested in seeing the launch of unbreakable screens (69%). This is closely followed by the development of better sand or water resistant features (67%), motion charging phones (66%) and solar powered devices (65%).

However, even though a majority want to see these innovations, fewer expect them to happen in the near future. Just over two in five (43%) feel unbreakable screens will be a possibility in the next two years, with similar proportions feeling the same about the introduction of water and sand resistant devices (42%), motion charging phones (44%) and solar powered devices (45%).

Commenting on this Scott Booth, Head of Data Products & Services, MENA, said, “Not surprisingly, when asked what innovations would be most meaningful to them, consumers focus on durability and battery life. Despite numerous iterative innovations in smartphone technology over the past few years, consumers are still hoping to have a device they do not have to worry so much about breaking or plugging in at any opportunity.”

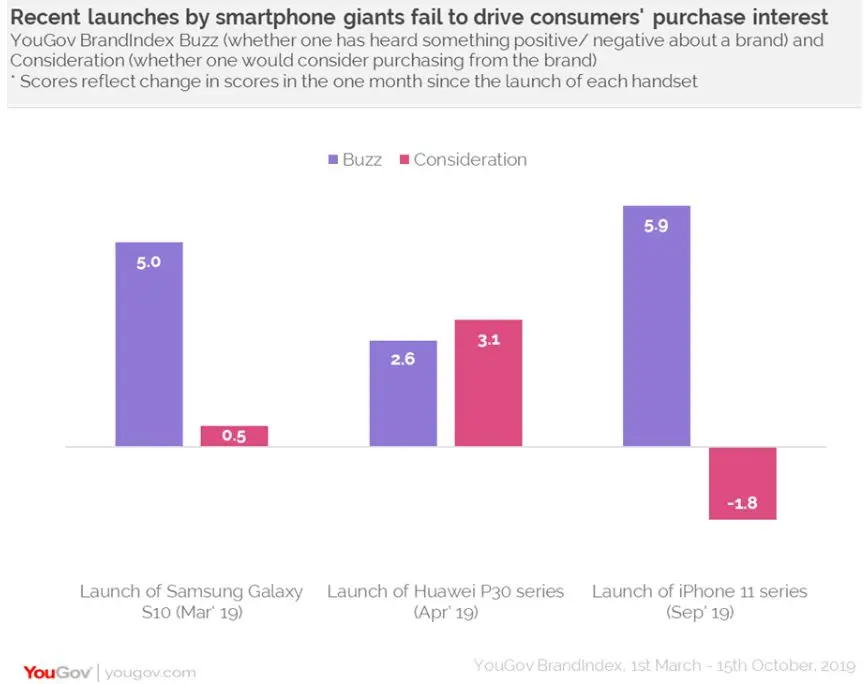

Analysis of YouGov’s brand perception data around new handset launches from Samsung, Huawei, and Apple in 2019 suggests although the incremental innovations introduced by smartphone brands in each new device create some level of media interest, they don’t move the dial in other areas.

UAE’s leading smartphone manufacturer Samsung launched an upgraded version of its flagship phone, the Galaxy S10, in March, with advancements in its display and camera, and world’s first in-display ultrasonic fingerprint scanner. Looking at the one-month period following the launch, we see the brand recorded an uplift of +5.0 in the Buzz – that measures whether one has heard something positive or negative about a brand, from 7th March and 7th April, 2019. However, Purchase Consideration – which measures whether someone would consider purchasing from the brand – remained almost the same (+0.5) around this time period.

The picture is similar for emerging brands such as Huawei. Its flagship P30 series launched on 1st April with a calling card of super zoom lenses. Around the launch time, Huawei’s Buzz score increased by +2.6 between 1st April and 1St May, 2019. Consideration saw an uplift of +3.1 within this time frame.

Huawei’s apparent strategy to undercut competition on price while offering a similar specification seems to be working with consumers. Priced around AED1700, Huawei P30 is more affordable than Samsung S10 - available for AED2400 and iPhone 11 for AED2800. Although Consideration has gone up to some extent, it is likely driven by competitive pricing rather than a true breakthrough innovation.

The story is more worrying for Apple. It launched iPhone 11 Series with double and triple rear cameras on 11th September and the phones went on sale in the UAE from 20th September. The launch boosted iPhone’s Buzz score with a +5.9 increase between 11th September and 11th October, 2019. However, its Purchase Consideration declined by 1.8 points over the same period.

“Although Apple is known as an innovator and consumers look to iPhone for innovation, the flagship innovation in the iPhone 11—its triple camera—came on the back of a number of android handsets already touting a triple rear camera. This appears to have played poorly in the market, as despite a spike in Buzz ahead of launch, the iPhone 11 has failed to push consideration for the brand”, added Scott.

As our data show, it is apparent that any time in the year these smartphone giants have launched new devices, residents in the UAE show notable interest. However, it appears this round of innovations are insufficient to drive new handset purchase. Given the apparent commoditization of smartphone handsets, whoever wins the race to the next major innovation may be poised to win big.

-Ends-

YouGov Spokesperson

Scott Booth

Head of Data Products & Services- MENA

Scott.Booth@yougov.com<mailto:Scott.Booth@yougov.com>

Media Enquiries:

Bhawna Singh

Bhawna.Singh@yougov.com<mailto:Bhawna.Singh@yougov.com>

Mobile: +919769803043

About BrandIndex

BrandIndex is the authoritative measure of brand perception. Unlike any other brand intelligence service, it continuously measures public perception of thousands of brands across dozens of sectors. We interview thousands of consumers every day, yielding over 2.5 million interviews a year. BrandIndex operates at national and international levels, allowing you to track brand perception in just one country, compare across multiple countries or monitor a global picture. More

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.