Geo-political tensions and trade tariffs were the main focus of last week with investors being cautious due to news flow of the White House looking to impose tariffs on the Chinese imports. Oil responded positively to the news with crude oil ending the week at USD 66.21 per barrel, up +1.0% on a weekly basis, while WTI ended the week at USD62.34 per barrel.

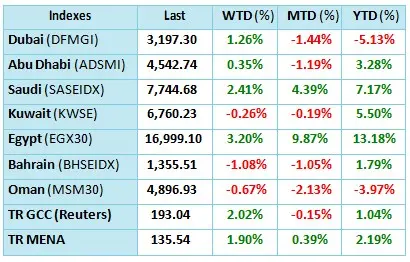

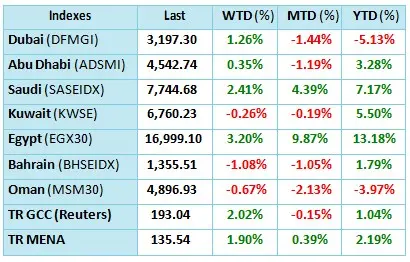

Most of the regional indices ended the week on a positive note with Egypt leading the pack among its peers with gains of 3.2% adding to its YTD performance to reach 13.2%, followed by Saudi Arabia with gains of 2.4% adding to its YTD performance to be 7.2% mostly driven by the expectation of a possible inclusion into the emerging market index. UAE markets ended the week positively with DFM rising by +1.3% and ADSM gaining +0.3% over the week. On the losing team, Bahrain was the worst performer with losses of -1.1%, followed by Oman -0.7% and Kuwait -0.3%.

Moving forward, the regional markets will be driven by domestic developments coupled with sentiments seen within the global markets.

About Al Masah Capital

Al Masah Capital is one of the fastest growing alternative asset management and advisory firms focused on the MENA and SEA regions. Established in 2010 Al Masah Capital provides tailored solutions to a broad investor base, offering private equity advisory (across Healthcare, Education, Food & Beverages, Logistics and other consumer driven sectors), asset management, corporate and real estate advisory as well as public market research services.

With operations in Dubai, Abu Dhabi and Singapore, Al Masah advises qualifying investors on growth opportunities in 13 focus markets in MENA and South East Asia.

For media enquiries, please contact Matrix Public Relations

Aser Ismail: aser@matrixdubai.com or

Krishika Mahesh: Krishika@matrixdubai.com

Or call: 04 34 30 888

© Press Release 2018