PHOTO

Sovereign investors in the Middle East are increasingly committed to equities as the core growth asset in their overall portfolios, however, there are significant differences within their approaches to how these investments are made, an Invesco executive has said.

Speaking to Zawya from Invesco’s Dubai office ahead of the publication of the firm’s 2018 Global Sovereign Asset Management Study on Monday, Zainab Kufaishi, Invesco’s head of institutional sales for the Middle East and Africa, said: “The most committed users of active managers are located in the Middle East, although these sovereigns also allocate to passive and factor strategies.”

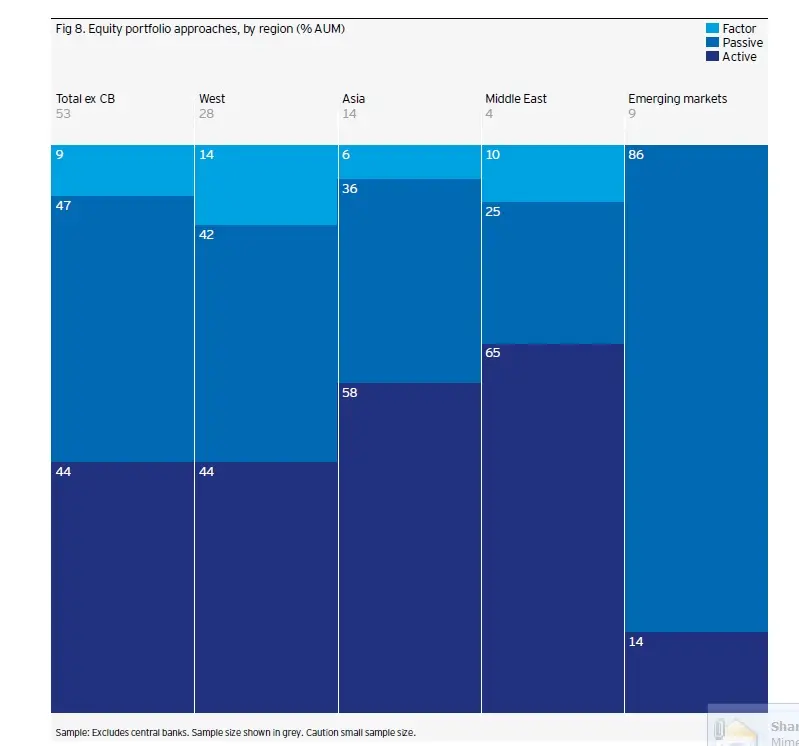

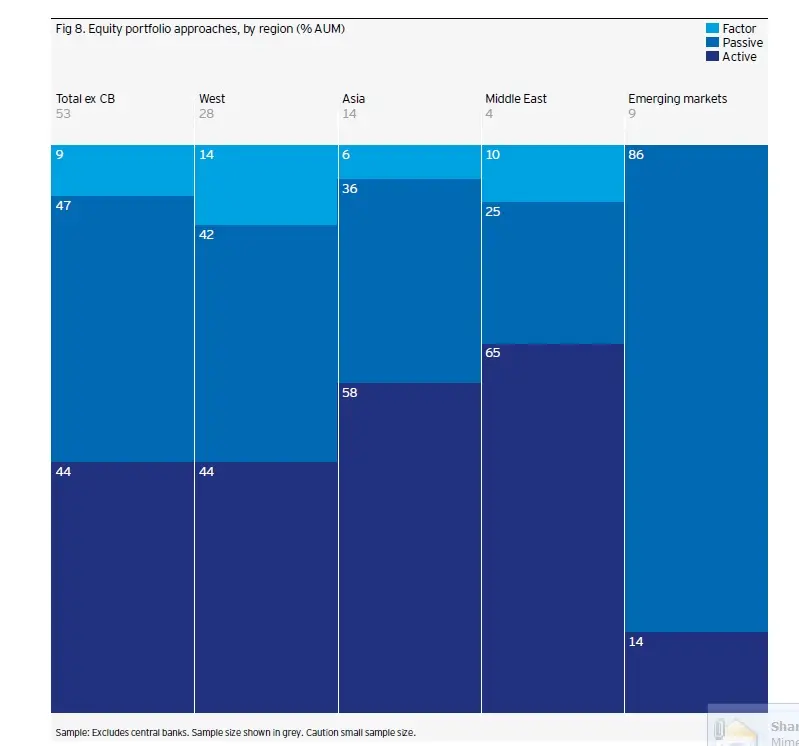

According to Invesco’s report, 65 percent of Middle East sovereign wealth funds (SWFs) use active management strategies for their equity investments, compared to a global average (excluding funds run by central banks) of 44 percent. As a result, allocations to passive funds are much lower in the Middle East (25 percent) than the global average (47 percent).

While Middle East sovereigns, specifically those in the Gulf Co-operation Council (GCC), often pursue opportunities in less traditional, less efficient markets where active management can deliver market-beating returns, their use of internal active equity teams means that they incur higher costs.

“Active management is still seen as highly appropriate to apply in emerging and APAC (Asia Pacific) equity markets, which are considered to be relatively inefficient,” Kufaishi said. “These markets are often less transparent, meaning there is more basis for information advantage and should be easier for active managers to add value.”

In general, investors from the wider EMEA (Europe, Middle East and Africa) region tend to adopt a passive approach for large-cap stocks in the major European markets, but prefer active managers for small caps, smaller European or Middle Eastern markets.

“Big SWFs who have $500 billion- $800-plus billion to allocate are much more targeted in the use of their equity allocation. In more efficient markets they use passive allocation and passive investment strategies but for less efficient markets such as untapped emerging markets they will use more active strategies,” Kufaishi said.

“They allocate to portfolio managers trying to beat the benchmark by 2 percent every year. Then in between, the use of factor strategies, which is a new trend. What we’ve seen is a lot more SWFs are deploying that in their portfolios and getting away from active and passive. It’s another way to invest,” she added.

The market is still largely segmented between active investment management, where fundamental analysis is used to determine a valuation, and passive investment management, where simple funds that will track a market index such as the S&P 500, are used.

Source: Invesco 2018 Global Sovereign Asset Management Study

Factor strategies, meanwhile, involve investing based on certain factors, such as the amount of dividend yield a stock produces, or macroeconomic factors around individual countries’ economies.

Technological improvements are making passive instruments such as index trackers cheaper and easier to use. According to Kufaishi, passive funds are now able to track certain indicators more efficiently using artificial intelligence and data mining.

The use of active, passive, and factor management is fluid, with factor management the clearest near-term beneficiary, Kufaishi said.

“Factor strategies appear to be the clearest winners on a forward view; investors increasingly see factor as a third pillar between traditional active and passive investment,” she said.

Reda Gomaa, portfolio manager at Mashreq Bank said active management is being utilised in regional sovereign funds to enhance returns and diversify portfolio risks.

Investors have not witnessed a substantial increase in credit to the private sector in the Middle East even after the oil price rebounded, so there are limited opportunities to generate market-beating returns, Gomaa said.

Although Mashreq Bank undertakes active management in equities, he argued that during “the next couple of years, active management will not outperform passive management in the Middle East, as we are looking at Saudi Arabia being added to the MSCI EM (emerging market) index June next year”.

He said that Saudi Arabia is likely to represent over 50 percent of the market capitalisation of Middle East stocks in the index, and that most capital inflows (either active or passive) will focus on blue-chip stocks.

(Reporting by Tahani Karrar; Editing by Michael Fahy)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018