PHOTO

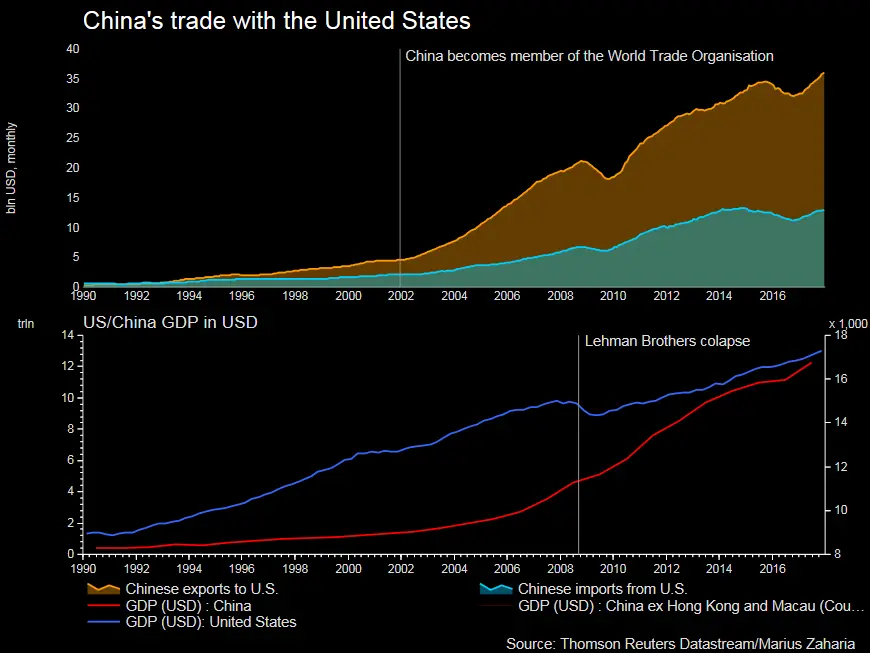

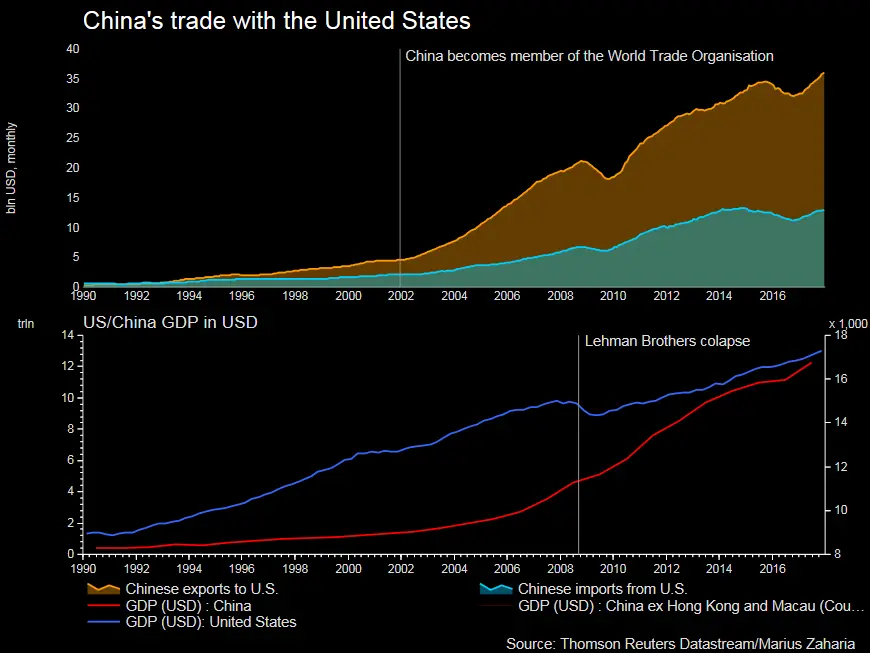

The United States and China slapped tariffs on $34 billion worth of each others’ goods on Friday.

Duties on a range of Chinese goods imported into the United States took effect on Friday and were immediately countered by measures from China.

Global markets

Global markets rose on Friday, but gains were limited by concerns over an escalating trade conflict between the U.S. and China. The tariffs imposed on Friday were already priced in by investors.

MSCI’s gauge of stocks across the world rose nearly 0.8 percent to the highest level since June 22 while Asian stocks climbed nearly half a percent, led by a rebound in Chinese shares.

Stocks edged higher in Europe, with the pan-European FTSEurofirst 300 index closing 0.2 percent higher.

On Wall Street, the Dow Jones Industrial Average rose 99.74 points, or 0.41 percent, to 24,456.48, the S&P 500 gained 23.21 points, or 0.85 percent, to 2,759.82 and the Nasdaq Composite added 101.96 points, or 1.34 percent, to 7,688.39.

“The trade headlines are at this point keeping the market uncertain,” Quincy Krosby, chief market strategist at Prudential Financial, told Reuters.

“Trade war concerns have shot up to the top of our concerns for investors,” Isabelle Mateos y Lago, chief multi-asset strategist at BlackRock Investment Institute in London, told Reuters.

“We have to be aware that we are only one tweet away from much broader tariffs becoming a reality,” she said, adding that investors were trimming broad exposure to riskier assets.

The United States imposed on Friday tariffs on $34 billion worth of Chinese goods and were immediately countered by measures from China

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Middle East markets

Stock markets in the Middle East were mixed on Thursday.

Dubai’s index rose 0.7 percent, with developers Dubai Investments, Emaar Properties and DAMAC Properties gaining 2.1 percent, 0.6 percent and 1.4 percent respectively.

The Saudi index lost 0.9 percent. National Commercial Bank (NCB) dropped 1.6 percent and al-Rajhi Bank lost 1.4 percent.

Shares in retailer Fawaz Abdulaziz Alhokair Co continued to plunge, shedding another 9.2 percent after reporting a heavy annual profit fall last week and announced that it would close 75 stores.

Abu Dhabi’s index added 0.2 percent with Abu Dhabi National Energy Co dropping 0.9 percent, while Dana Gas rose by 1 percent.

Qatar’s index added 0.3 percent. banks QNB and Masraf al-Rayan rose 0.65 percent and 0.82 percent respectively. Qatar Electricity & Water, the third-biggest gainer, closed 1.2 percent up.

Egypt's index fell 1.1 percent, Bahrain's index rose 0.6 percent, while Kuwait's index rose 1.0 percent and Oman's index was flat.

Oil prices

Oil prices were mixed on Friday.

U.S. crude futures gained 86 cents, or 1.2 percent, to settle at $73.80 a barrel. Canadian supply outage supported U.S. crude prices.

Global benchmark Brent slipped 28 cents to settle at $77.11 a barrel as an increase in production from OPEC’s biggest exporter Saudi Arabia pushed Brent lower.

“We’re continuing to see - and I expect the trend will continue - lower inventories in Cushing in July, resulting in a very tight light sweet crude market,” Andrew Lipow, president of Lipow Associates, told Reuters.

“That has been exacerbated by the Canadian Syncrude outage...which has resulted in a scramble for supplies in the Midwest. I do expect that at least over the next few weeks, the Brent-WTI spread is going to narrow.”

Currencies

The dollar dropped on Friday on higher than expected jobs in the U.S. in June.

U.S. non-farm payrolls advanced by 213,000 jobs in June, the Labor Department said. Data for April and May was revised to show 37,000 more jobs created than previously reported.

Against the yen, the dollar slid 0.2 percent to 110.42 yen , while the euro rose 0.5 percent to $1.1742 .

Precious metals

Gold prices finished lower on Friday but bounced back from session lows as the dollar weakened.

Spot gold was down 0.2 percent at $1,254.45 oz by 1:35 p.m. 1735 GMT, off the session low of $1,252.15 and headed for its first weekly gain in four weeks.

U.S. gold futures for August delivery settled down $3, or 0.2 percent, at $1,255.80 per ounce.

(Writing Gerard Aoun; Editing by Mily Chakrabarty)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018