PHOTO

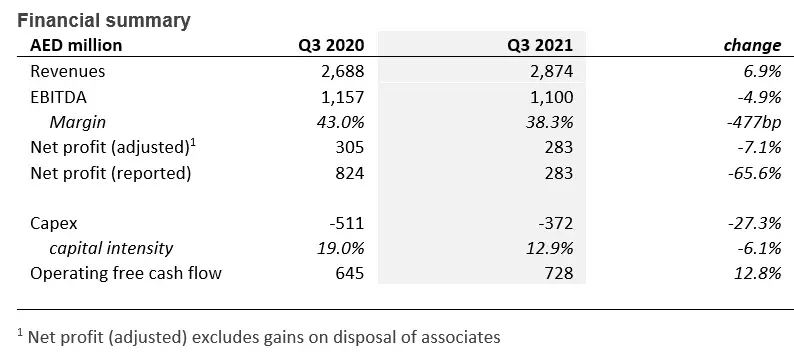

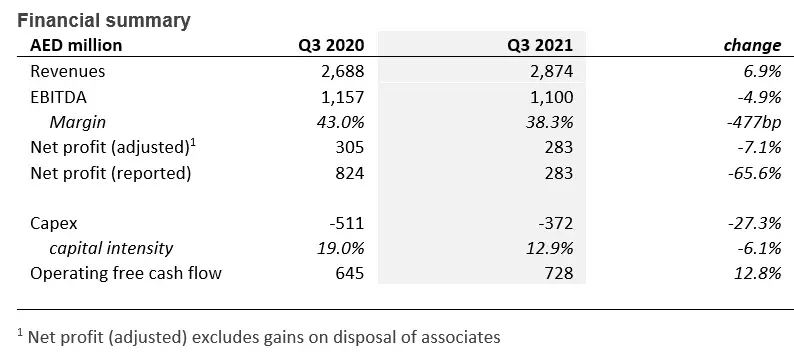

Dubai, UAE - Emirates Integrated Telecommunications Company PJSC (“EITC”) announced its financial results for the third quarter of 2021. Revenues grew 6.9% to AED 2,874 million on sustained demand for broadband services and 5G handsets. More importantly, mobile services continued its recovery thanks to a buoyant postpaid segment. EBITDA amounted to AED 1,100 million thanks to cost optimisation which helped contain margin pressure from direct costs. Net profit was AED 283 million in spite of higher depreciation and amortisation charges.

Operating highlights

- Mobile customer base reached 6.5 million. The postpaid segment remains resilient with net-adds of 13k. The postpaid customer base grew to 1.3 million as a result of an improved digital Customer Experience as well as enhancements to the Power Plans. The prepaid customer base declined to 5.2 million subscribers due to a combination of summer seasonality and flight restrictions brought by the Covid-19 Delta variant.

- Sustained commercial momentum in Fixed services across various product categories. The simplicity of our consumer offer helped accelerate net-adds to 52k. We ended the quarter with 331k broadband customers. Demand from the Enterprise segment is also returning.

- Capital deployment plan is bearing fruits. Following significant deployment, our 5G network covers 90% of the population. Independent tests confirmed our network was the fastest during the quarter. In addition, we inaugurated two data centres, KIZAD in Abu Dhabi and Dubai Silicon Oasis. These centres have an aggregate capacity of 2.7 MW.

Financial highlights

- Revenues grew 6.9% yoy to AED 2,874 million. Fixed revenues grew 14.7% to AED 731 million as the consumer and enterprise segments continue to perform well. “Other revenues” increased 16.6% to AED 839 million due to a doubling of handset sales and higher wholesale revenues. A resurgent postpaid segment ignited the recovery of mobile revenue to AED 1,304 million.

- EBITDA retreated by 4.9% yoy to AED 1,100 million. Our cost optimisation plan continues to yield results. We have rationalised marketing and G&A spend. We have improved our collections therefore reducing provisions on receivables. These various initiatives mitigated pressure from direct costs (product costs, interconnect costs).

- Net profit (adjusted)1 declined by 7.1% to AED 283 million. Depreciation and amortisation increased due to our ambitious investment programme. The disposal of Khazna Data Center in 2020 reduced the contribution from associates.

- Capex dropped 27.3% to AED 372 million due to phasing of expenditure. As a result, operating free cash flow increased to AED 728 million.

Fahad Al Hassawi, CEO said:

“I am very pleased that consumer and corporate confidence are on the mend. Our fixed services business delivered another solid quarter. Broadband net-adds accelerated to 52k thanks to an attractive service offering. In addition, we see corporate demand for fixed services returning. Our commercial initiatives in mobile services are bearing fruits. The refreshed prepaid mobile tariffs are pushing gross-adds on the prepaid segment towards pre-pandemic levels. Our enhanced postpaid tariff plan is stimulating usage and supports a pathway to ARPU growth. This quarter is an inflection point for mobile service revenues: we renewed with nominal growth (+0.7% quarter-on-quarter) after three consecutive quarters of decline.

Following two years of capital deployment, I am pleased to announce that our 5G network is now accessible to 90% of the population. The next milestone is to ultimately ensure seamless access for all residents. We remain committed to deliver value for our customers and will continue to be a market differentiator.”

-Ends-

About Emirates integrated Telecommunications Company PJSC

The Emirates Integrated Telecommunications Company PJSC (EITC) was founded in 2005. We are the UAE’s second licensed telecommunications operator. We operate under two brands: du (launched in 2007) and Virgin Mobile the region’s first digital service (started operations in September 2017).

We are listed on the Dubai Financial Market (DFM) and trade under the DU ticker (Bloomberg DU UH, Refinitiv Eikon DU.DU). Our core shareholders are government-related entities (Emirates Investment Authority 50.12%, Emirates International Telecommunications Company LLC 19.7%, Mamoura Diversified Global Holding PJSC 10.06%).

Media contact Investor contact

Noora AlMansoori Eric Chang

noora.almansoori@du.ae hong-yuan.chang@du.ae

+971 55 953 4713 +971 50 818 4258

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.