Global commodity markets have seen their fair share of turmoil in recent weeks. The potential twin disruptive impact of trade war and upcoming recession helped sent energy and industrial metals sharply lower during May while continued weather-related disruptions to the planting season in the United States saw grain prices surge higher.

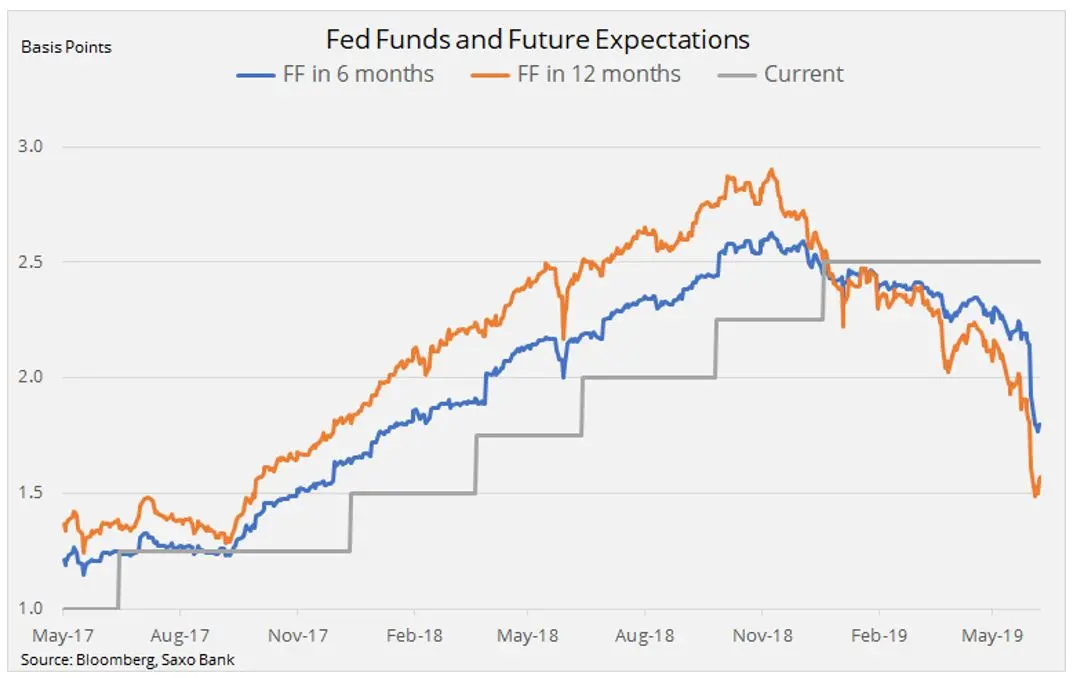

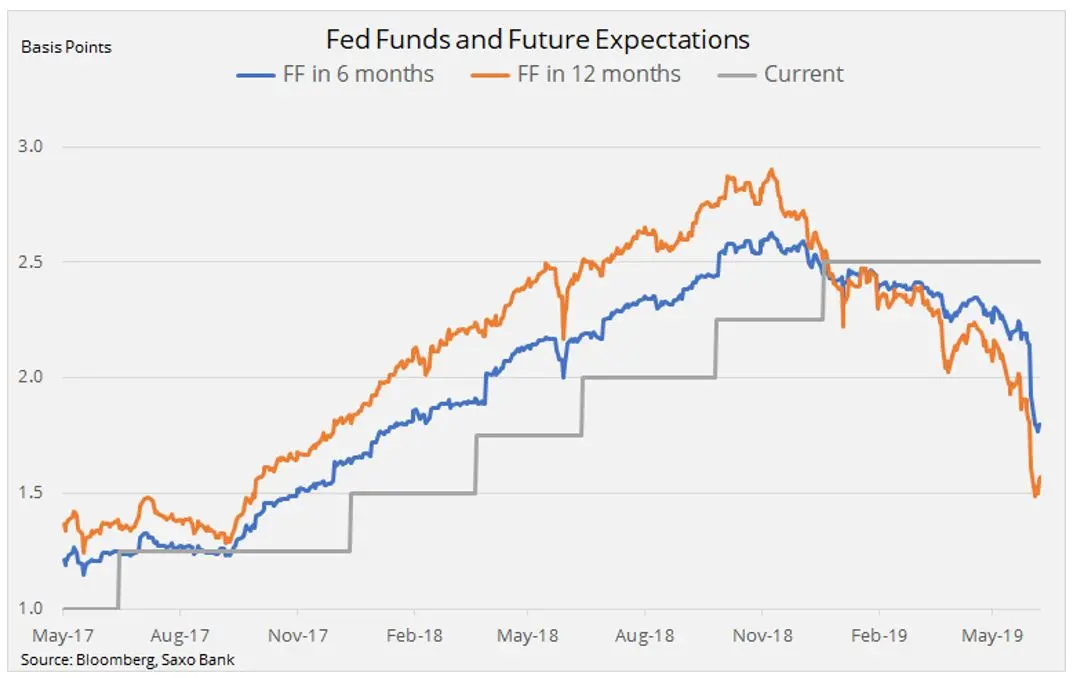

These developments, which hurt global stocks, eventually helped trigger a dramatic rally in U.S. bonds with the 10-year yield dropping to a 21-month low. The biggest and eventually market-supportive development has been the significant drop in the future U.S. Fed Funds expectations.

The rally in fed funds futures during May has seen rate cut expectations over the next 12 months double from 0.5-1 percent.

This development has been the main reason behind the latest recovery in gold and silver but also one that now poses its biggest short-term challenge should economic data improve. The Federal Open Market Committee led by chair Jerome Powell is not signalling a willingness to adopt the recent aggressive change in market expectations - at least for now.

Despite Europe having its own and potential bigger economic problems, the prospect of lower U.S. rates, something the ECB will struggle to do with rates already on the floor, has supported some profit taking and for commodities-supportive dollar weakness.

Precious metals traded higher for a second week before gold once again struggled ahead of the hitherto impenetrable area of resistance between $1,365 and $1,390 per oz. The monthly US job report provided an additional layer of support after missing all estimates, with U.S. employers adding the fewest workers in three months while wage gains cooled.

Crude oil began last week on the defensive, with a continued focus on the risk to global growth and demand, which drove the recent $10 slump. In addition, the weekly U.S. stock report proved challenging following another big jump in US crude oil stocks. In fact, the 22.5-million-barrel weekly rise in crude and product stocks was the biggest since records began in 1990.

A pickup in global equities as sentiment recovered together with technical and psychological support at $50 per barrel on WTI and $60 per barrel on Brent, however, proved strong enough to attract fresh buying.

The short-term focus will move to monthly oil market reports from the EIA on June 11, Opec on June 13 and the IEA on June 14. The market will scrutinise these reports for any change in the demand outlook from these major forecasters.

Short-term gains for gold

Two weeks of steep gains with the latest providing the best return in two months have left the yellow metal in need of consolidation, especially given its continued struggle to mount a challenge at the above-mentioned area of resistance between $1,365 and $1,390 per ounce.

We maintain the view that global growth momentum is slowing and likely to worsen further before renewed policy panic from global central banks will help to stabilise the outlook.

On that basis, we believe that gold will continue to act as a late-cycle hedge which eventually will see it challenge resistance. From a technical perspective, a breakout of the range that has prevailed since 2014 could initially trigger a $100 extension towards $1,480 per ounce, the 50 percent correction of the 2011-15 sell-off.

Silver’s recent rally following the breakout from its downward sloping wedge has so far met resistance at $15 per ounce In a recent update, we highlighted the potential for silver to outperform gold due to the risk of short-covering from funds holding a near record net-short in COMEX silver. On that basis, we maintain a focus on the XAUXAG ratio which has so far seen three failed attempts to break above 90 (ounces of silver to one ounce of gold), a move that would signal additional relative silver weakness.

High-grade copper continued to signal a challenging macro-economic outlook as it headed towards its eight consecutive weekly drop, with continued focus on the trend-line, currently at $2.60 per pound, dating back to early 2017. Technical traders see this support as being the neckline of a major head-and-shoulder formation which on a break could signal further losses.

Some support was found in response to the general improvement in risk sentiment and more specifically for copper the prospect of additional Chinese stimulus and comments from Codelco, the world’s largest producer that demand remains good. The chief commercial officer even warned that the latest price deterioration could deter much-needed investments and further negatively impact future supply outlook which is already tightening.

Oil faces opposing forces

The difficulty in navigating a market with several and major opposing forces was laid bare recently when, following a period of range-bound trading, Brent crude oil collapsed. The $10 per barrel slump towards key support at $60 per barrel was triggered by President Trump’s decision to add tariffs on Mexican imports in order to force a reduction in the flow of migrants from Central America. The temporary break below occurred this past week following the mentioned counter seasonal jump in U.S. crude stocks.

The recession themed sell-off has, in our opinion, potentially run its course for now after Brent crude found support around $60 per barrel. A sustained break below this level could signal a return to the December low, which current fundamentals just simply don’t support - at least not while the structure of the Brent forward curve continues to scream tightness. The prompt contract of August currently trades close to $3 per barrel above the price for delivery in six months’ time, a near five-year high.

Meanwhile, the fragile state of the coffee market was once again put on display last week when Arabica coffee futures in in New York dropped by 7.3 percent – its worst one-day drop since 2010. The sell-off came after the market had rallied by 19 percent since mid-May.

The initial rally last month was led by frost fears and a stronger Brazilian real; these developments helped trigger short covering from hedge funds while also attracting renewed buying from traders looking for the price of beans to bounce from a 14-year low.

The heightened volatility could indicate an emerging battle ground between buyers and short sellers who for many months have been benefitting from holding and rolling short futures positions. Currently, the one-year roll return on a short position is 14 percent - one of the highest rewards for holding a short commodity position.

The key area of support is 95 cents per pound, while the next area of resistance can be found just below 107 cents per pound.

Any opinions expressed here are the author’s own.

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.