The Central Bank of the UAE is enhancing its reporting of non-performing loans (NPL) for the UAE banking system to align its methodology with international best practices, in consultation with the International Monetary Fund.

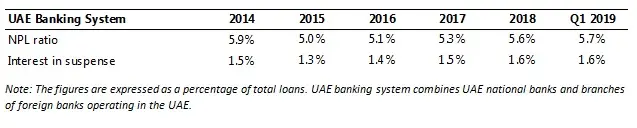

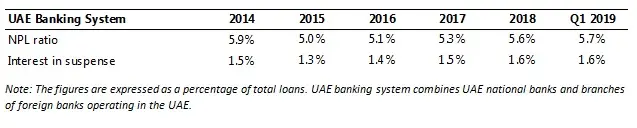

Under its previous reporting methodology the UAE banking sector’s NPL ratio was overstated compared to other jurisdictions, due to the inclusion of interest in suspense.[1]

Accordingly, under the new reporting standard the NPL ratio of the UAE banking system for the year-end 2018 stood at 5.6% (instead of 7.1% under the previous reporting methodology).

For comparative purposes, the Central Bank of the UAE is providing time series reflecting the enhanced NPL ratio methodology covering the last five years.

Specific Provision Coverage of Non-performing Loans

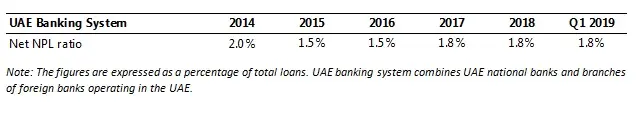

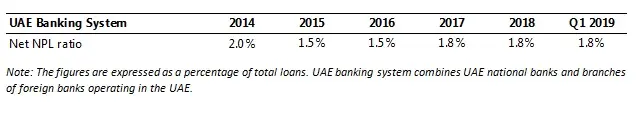

Furthermore, to provide increased transparency and comparability with other jurisdictions, the CBUAE is also publishing a Net NPL ratio.

The Net NPL ratio excludes specific provisions held by banks against non-performing loans. For the UAE banking system this ratio stood at 1.8% at year-end 2018.

The Net NPL ratio provides a comparison with other banking sectors considering the varying provisioning and write-off policies across different jurisdictions.

Effective Date

These changes will be reflected in the upcoming publications by the Central Bank of the UAE and communication with stakeholders as of the third quarter of 2019.

-Ends-

[1] The Central Bank of the UAE regulation requires suspending interest on loans, which are 90 days past due or have been provisioned. Suspended interest cannot be credited to the profit and loss accounts. As such, suspended interest is not considered as a part of non-performing loans.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.