PHOTO

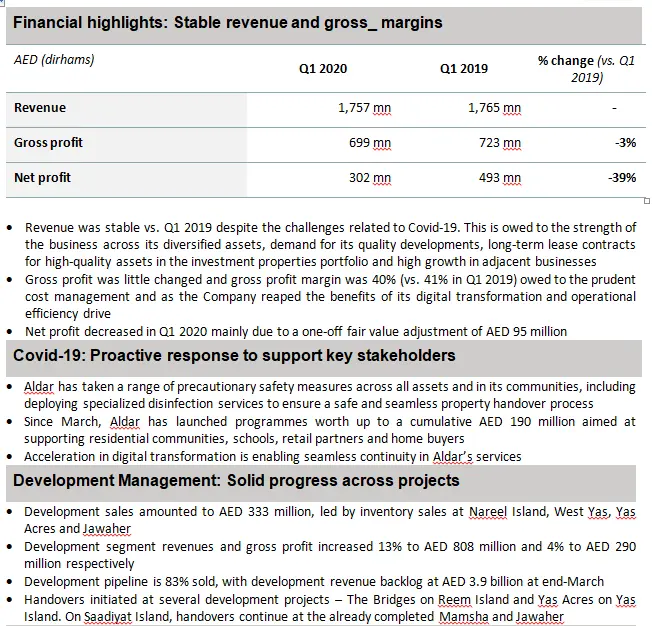

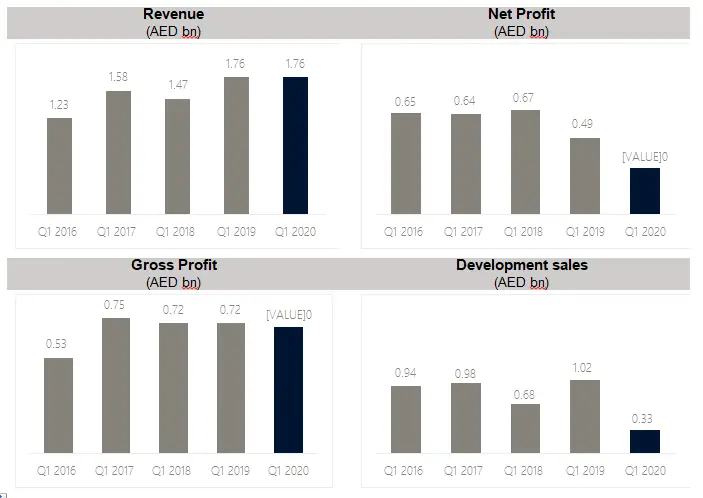

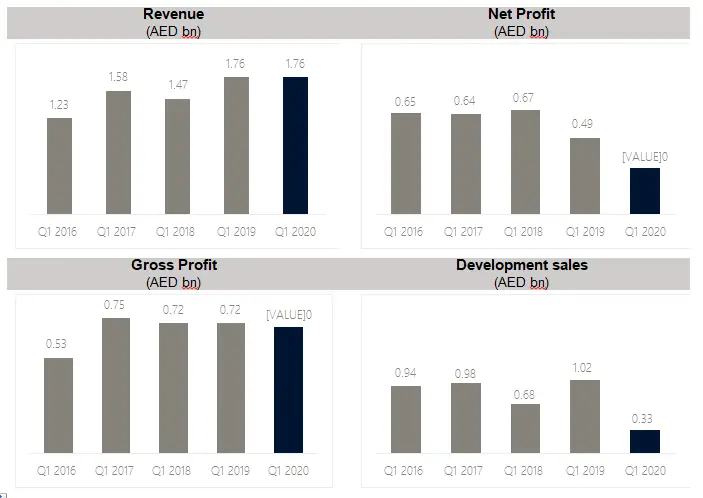

- Gross profit of AED 699 million (gross profit margin stable at 40%), net profit of AED 302 million, driven by diversified, multi-asset class portfolio

- Strong balance sheet and liquidity, with AED 6.8 billion of free cash and undrawn credit facilities

Abu Dhabi: Aldar Properties PSJC (“Aldar”) today reported revenue of AED 1.76 billion in the first quarter of 2020, unchanged from the same period a year ago, demonstrating the fundamental strength of its diversified Development Management and Asset Management businesses.

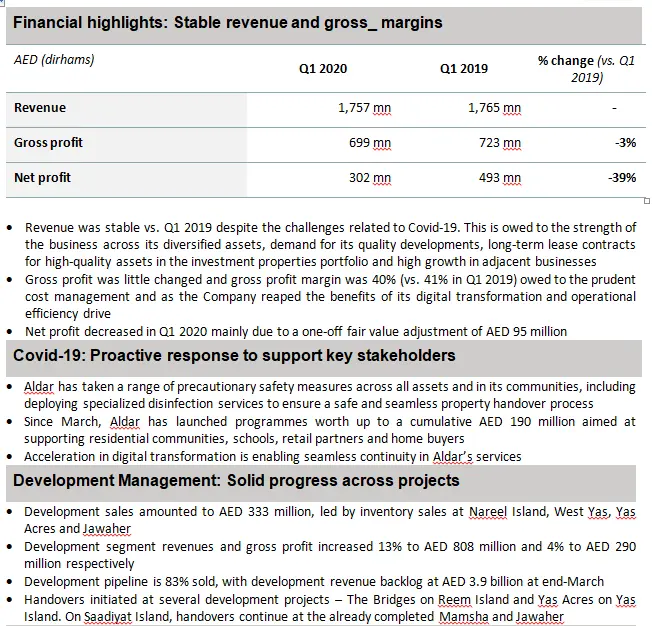

From the onset of the global Covid-19 health crisis, Aldar’s has prioritised safeguarding the health and wellbeing of its employees, customers, contractors and communities. Adhering to UAE health authorities’ regulations and guidance, the Company swiftly implemented strict hygiene and sanitation measures across all its assets.

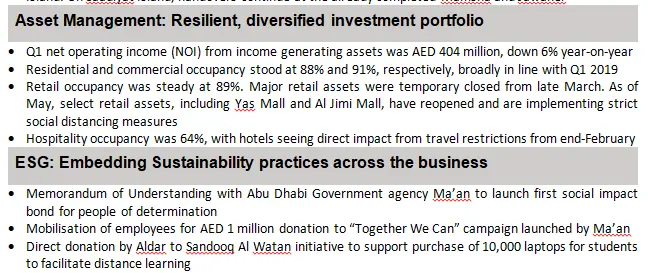

Furthermore, in line with Abu Dhabi’s wide-ranging initiatives to alleviate the economic impact of Covid-19, Aldar rolled out in March support programmes worth up to AED 190 million to assist tenants, homebuyers, students and business partners. These include introducing rental and school fee payment plans and support for SMEs.

H.E. Mohamed Khalifa Al Mubarak, Chairman of Aldar, said “Abu Dhabi’s leadership has been proactive and resolute in safeguarding the health of its residents and the economy. The comprehensive response by the Government and Central Bank is supporting confidence and positioning the Abu Dhabi market for an effective recovery. As an industry leader, Aldar will continue to play a transparent and responsible role towards a more sustainable future. We are proud of the collaborative community spirit which reinforces Abu Dhabi‘s sense of home for citizens and residents alike.”

Talal Al Dhiyebi, CEO of Aldar said, “As a leading Abu Dhabi company, we acted decisively to safeguard the health and safety of our people and customers and engaged responsibly by launching a comprehensive support package for our business partners and communities. We were able to tackle rapidly evolving conditions, while remaining steadfast in paying a 2019 dividend of AED 1.14 billion and delivering a strong first-quarter performance.

The Company’s strength lies in a well-balanced, diversified business model and a robust balance sheet. We benefit from the financial firepower to weather the current global crisis, and to take advantage of attractive opportunities to expand our investment portfolio. Aldar continues to prudently manage its business to mitigate the impact of the global crisis and enhance long-term value for our stakeholders.”

Business and financial update

During the first quarter, Aldar’s Development Management business made significant progress across its projects and reported development revenue of AED 808 million, a 13% year-on-year increase, driven by progress on recently awarded development management government projects valued at AED 5 billion, including the new twofour54 campus on Yas Island.

Development sales totalled AED 333 million, led by inventory sales. This meant that, as of end of Q1 2020, 83% had been sold across its development pipeline. Aldar has leveraged its digital transformation programme to facilitate sales amid government-mandated or recommended guidelines including social-distancing and curfew and has introduced virtual tours for all available units. Moreover, the Company has deployed its market leadership position to partner with Abu Dhabi banks to provide attractive financing packages for homebuyers, complementing government and UAE Central Bank incentives to support the real estate sector.

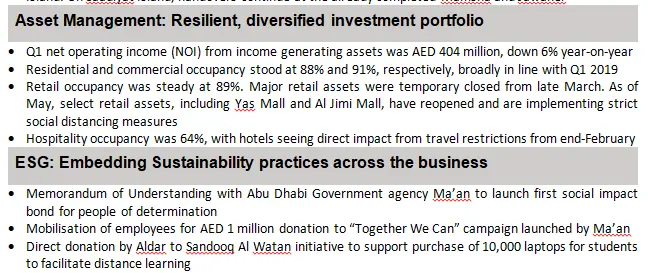

The Asset Management business has displayed resilience, with a particularly solid performance in the first two months of the quarter. In Q1 2020, occupancy remained steady at 89% across the Investment Properties portfolio, which includes retail, residential and commercial assets, due to long-term, committed lease contracts and a high-quality, diversified portfolio.

The adjacent businesses segment, which includes Aldar Education, property management firm Provis, facilities management company Khidmah and Aldar’s district cooling assets on Saadiyat Island, continued to contribute positively to Aldar’s financial performance during the period. Their combined gross profit increased 40% to AED 52 million.

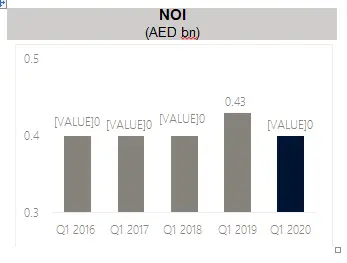

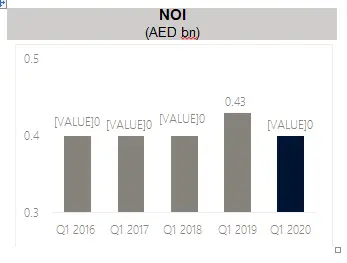

As travel restrictions and temporary mall closures took effect in the end of February, the Covid-19 situation mainly affected Aldar’s hospitality and retail assets. However, the diversified asset management portfolio delivered a net operating income (NOI) of AED 404 million in Q1 2020. Select retail assets, including Yas Mall and Al Jimi Mall, reopened in May and are implementing strict social distancing measures.

While Covid-19 will impact the operating environment in 2020, Aldar benefits from a robust balance sheet, with debt maintained well within its established debt policies across the development and asset management businesses.

As at 31 March 2020, Aldar held AED 6.8 billion of free cash and undrawn credit facilities. This includes a new AED 500 million credit facility agreed in the first quarter at the attractive rate of Eibor + 1%. Aldar Investment Properties, the 100% owned subsidiary that owns a majority of Aldar’s recurring revenue generating assets, is the only corporate in the region with a Baa1 credit rating and stable outlook.

-Ends-

For further information, please contact:

Media/ IR

Nick Farmer / Chris Wilson

Aldar Properties

+971 2 810 5555

Joudi Issa

Brunswick Group

+971 2 234 4600

ALDAR@brunswickgroup.com

About Aldar

Aldar Properties PJSC is the leading real estate developer in Abu Dhabi, and through its iconic developments, it is one of the most well known in the United Arab Emirates, and wider Middle East region.

From its beginnings in 2005 through to today, Aldar continues to shape and enhance the urban fabric of the UAE’s Capital City in addition to other key areas of the Emirate.

Aldar develops exciting and innovative projects, such as the internationally recognized HQ building situated in the Al Raha Beach development, the Gate Towers in Shams Abu Dhabi on Al Reem Island, in addition to Yas Island’s F1 circuit.

Aldar’s shares are traded on the Abu Dhabi Securities Exchange (Stock quote: ALDAR:UH), and is a profitable, cash generative business that provides recurring revenues, and benefits from a diverse and supportive shareholder base. Aldar operates according to high standards of corporate governance and is committed to operating a long term and sustainable business in order to provide ongoing value for its shareholders.

Aldar seeks to create quality, comfortable, desirable destinations that enrich the lives of Abu Dhabi residents as well as tourists within the Emirate. Aldar is playing a leading role in the development and provision of world class retail - Yas Mall, international standard education through Aldar Academies, iconic entertainment venues such as the Yas Marina Circuit, and community amenities across its entire portfolio.

Aldar is driven by a vision to be the most trusted and recognized real estate lifestyle developer in Abu Dhabi and beyond.

For more information on Aldar please visit www.aldar.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.