PHOTO

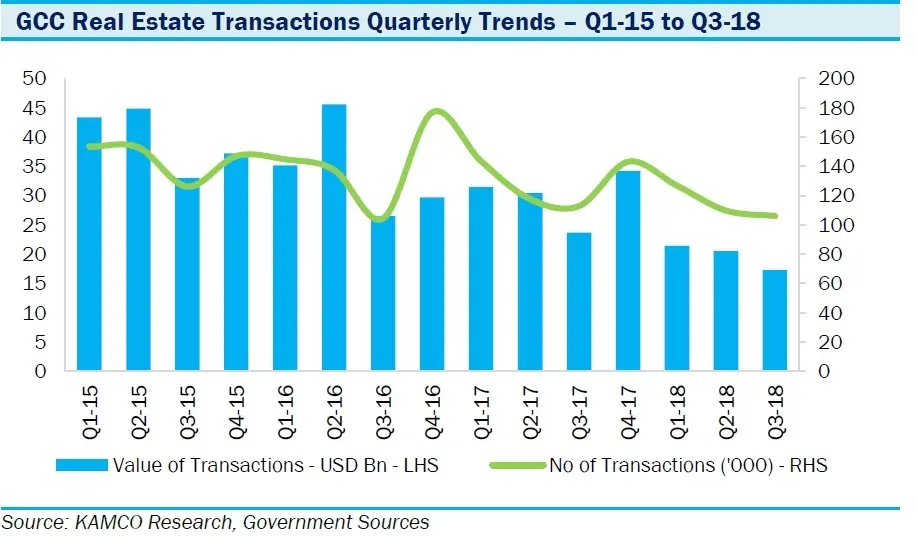

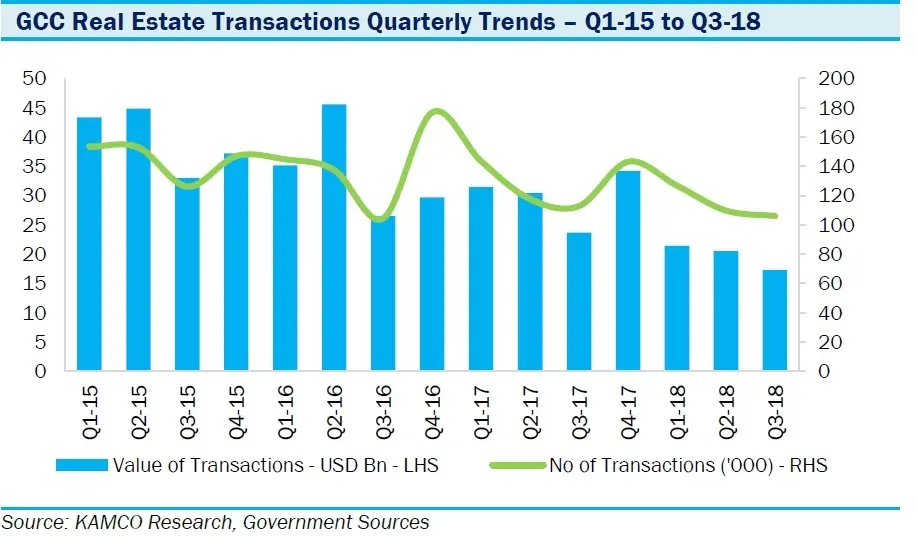

The number of real estate transactions carried out across the Gulf Arab states (excluding Bahrain) declined by 30.7 percent during the first nine months of 2018, and the value of listed property firms also took a hit, a new report has shown.

The report by KAMCO Research, a division of Kuwait's KAMCO Asset Management, found that most real estate firms listed on stock markets in Saudi Arabia and the United Arab Emirates have declined in value during the first 11 months of the year.

By end of November, Saudi Arabia’s Jabal Omar Development dropped the most among the Saudi real estate companies, down 40.36 percent and Emaar The Economic City (which is developing King Abdullah Economic City) dropped 39.07 percent. On the Dubai market, two of the UAE's biggest developers, Emaar Properties and Damac Properties, dropped 25.13 percent and 40.07 percent respectively, while in Abu Dhabi Aldar Properties' share price dropped by 23.18 percent, according to the report.

The region has continued to suffer from an economic slowdown that began around two years ago following a sharp fall in oil prices in 2014 and 2015. The economic situation led the governments of Saudi Arabia and the UAE, the Arab world’s two biggest economies, to cut spending and introduce new taxes such as a five percent value-added tax on most of consumer products and services.

According to KAMCO’s report the transactions made for properties’ sales dropped by a combined 30.7 percent in the first nine months of the year in five Gulf Arab markets: Saudi Arabia, the UAE, Qatar, Oman and Kuwait - mainly as a result of declines in Saudi Arabia and Dubai.

The total amount of real estate sale transactions in the five states fell to $59.3 billion in the first nine months, from $85.6 billion in the same period last year, the report said.

The report said the transacted values in Dubai, the Arab region’s real estate hub, dropped by 36.1 percent year-on-year for the first nine month of 2018, while transacted values in Saudi Arabia fell by 33.8 percent over the same period.

However, Kuwait was the best-performing real estate market among the five countries as the value of real estate deals actually increased by 34 percent, driven by a rise in the sale of apartments, it added. Demand for Kuwait’s office space was also strong, particularly for premium office spaces.

The report said that residential rents were under pressure in most of the surveyed markets this year and “incremental office space demand continues to remain soft” due to job cuts.

The average value per transaction in the five countries declined by over 24 percent to around $173,000 in the first nine months of 2018, from $228,700 in the same period last year, the report said.

Dubai dragged down

The region’s real estate hub witnessed a decline in both transaction values and volumes during the first nine months of the year, the report said, quoting data from Dubai Land Department (DLD). The number of transactions fell by 32 percent year-on-year, with 25,476 transactions made during the nine-month period, down from 37,632 transactions in the first nine months of last year. The value of the transactions also dropped 36.1 percent to 56.4 billion dirhams ($15.4 billion) in the first nine months, from 88.2 billion dirhams in the same period last year.

Rents declined across the board but fell fastest during the third quarter in the mid-tier, 2-bedroom segment. They dropped in value by 4.9 percent quarter-on-quarter, while mid-to-high end apartments dropped 3 percent quarter-on-quarter and high-to-luxury end apartments dropped 2.9 percent. The villa segment in Dubai also saw declines, with four-bedroom villa rents dropping 2.4 percent quarter-on-quarter.

As for Dubai’s office market, the report said: “Landlord(s) continued to offer more discounted rents and attractive terms such as rent-free period, fit-out contributions and other concessions. As a result, rents in Q3-18 plunged by double digits across office districts from the start of the year, especially in DIFC and Sheikh Zayed Road, as per data from Asteco.” Asteco is a Dubai-based property management company.

In the retail segment, vacancy rates in Dubai increased to 16 percent in the third quarter of 2018, from 14 percent in the previous quarter, KAMCO said, quoting data from property consultancy JLL.

(Compiled by Yasmine Saleh; Editing by Michael Fahy)

Further reading:

- 2019: What to expect for Dubai real estate

- DAMAC Properties calls bottom for weakened Dubai real estate

Luxury watches, fast cars and hard cash: The incentives offered to brokers at Cityscape Global to help developers shift unsold stock

Entertainment and tourism sectors to stir up Saudi real estate industry in ’19: Study - Jeddah hotels hit by supply growth in November: report

- Bahrain seeks tenders for building over 300 new villas

(Compiled by Yasmine Saleh; Editing by Michael Fahy)

(yasmine.saleh@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018