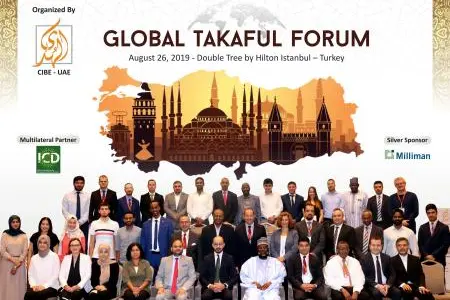

PHOTO

Dubai: Global Takaful Forum (GTF) was successfully concluded at Double Tree by Hilton Hotel, Istanbul, Turkey. The forum was inaugurated by Chief Guest H.E. Husnu Tekin, Division Director from Presidency Finance Office – Turkey. The objective of the event was to provide adequate knowledge and benefits of Takaful industry to the relevant market. It is also pertinent to mention that the forum was handful to promote, strengthen and unite the organizations of Islamic Insurance (Takaful) with the theme of product outreach strategies and innovations. The platform helped to analyze the problems hindering rapid development of Takaful globally that would surely help to increase financial inclusion. Prominent Speakers and industry professionals from well serving organizations related to Takaful, Insurance and Islamic Finance participated in the event. They discussed the outreach strategies and Innovative products development with stakeholders under one roof. The forum was organized by AlHuda Centre of Islamic Banking and Economics in partnership with multilateral organization Islamic Corporation for Development of Private Sector (ICD) - Saudi Arabia and Milliman LLP - UK.

Muhammad Zubair Mughal, CEO, AlHuda Centre of Islamic Banking and Economics (CIBE) said that Takful is neglected area of the Islamic finance industry with merely 2% contribution. Takaful industry in dire need to develop new and innovative products to penetrate in the market. Alongside with the innovative product development the distribution mechanism should be addressed by focusing its outreach through banca-Takaful and Micro-Takaful etc. Moreover, re-Takaful products should be developed to strengthen the Takaful industry in global financial markets.

He further said that Takaful product of one country/region should not be implemented in another country/region. The bases and indicators of one country would be different in term of GDP, religious sensitivity, regulation framework etc. with the other country while the development of Takaful products. The social, economic and religion dynamics could also be different. So, Takaful products should be designed keeping in view the country/region dynamics and indicators mentioned above for the successful implementation.

He was also delighted to highly distinguished speakers and policy advisors to bring forth exceptionally handful of ideas to implement Takaful as a substitute to conventional insurance for the poverty alleviation especially for under developing countries. He further welcomed all insurance industry including commissions, regulators, central banks, banking sectors, Takaful, composite, general, life, re-Takaful, reinsurance, brokers and actuaries to come up in order to offer a resolution for the sake of sustainable financial solution.

He further motivated the industry players to play their role in the development of Takaful industry. As Takaful is the only solution to the poverty of the world. The Takaful industry is an emerging trend in the emerging financial world and there is a great room for numerous Takaful, re-Takaful, actuaries, brokers and IT solution providers and many others to explore the untapped market under one umbrella.

AlHuda CIBE arranged an impressive lineup of speakers from various nationalities with the revealing sessions on Takaful and Role of Takaful, Strategies to Tap the Untapped Takaful Market, Takaful Potential and Opportunities and Takaful Global Future Development to explore more options for Takaful industry. The speakers include Dr. Hakan Berooglu, Mr. Mahmood Al Reefy, Mr. Muhammad Albaha, Mr. Mohamed Saeed Elmutasim, Mr. Enver Avdic, Dr. Levent Sumer, Mr. Mehmet Siddik Yurtcicek, Mr. Halil Kolbasi, Mr. Yusuf Dinc and few others. In the forum, delegates from Presidency Finance Office - Turkey, Milliman LLP - Turkey, Banaa' Productive Families – JANA - Saudi Arabia, Hayat Microfinance Fund - Turkey, National Reinsurance Company - Sudan, Investrade Portfolio Management Insurance, ESOF Limited, SMR Strategy - Turkey, Ba-Fin Consultancy - Turkey, Istanbul Sabahattin Zaim University and many other delegates participated in it. The Forum is followed by Two Days Post Event Workshops on “Operational Aspects of Takaful, Micro-Takaful & Re-Takaful” and “Takaful for Regulators” dated for August 27-28, 2019. These Workshops will cover a variety of allied topics.

The guest of honor Mr. İhsan ÖVÜT from SMIIC-OIC at the closing ceremony said that SMIIC-OIC always support product development in the Islamic financial markets at any stage. Moreover, he mentioned that AlHuda CIBE role to promote Islamic Banking and Finance in vital globally. AlHuda CIBE is working dedicatedly for the promotion and implementation of Islamic finance products and solutions. AlHuda CIBE also paying attention to strengthen the awareness and knowledge of Islamic banking and finance and its products in more than 40 countries.

About AlHuda CIBE: AlHuda Center of Islamic Banking and Economics (CIBE) is a well-recognized name in Islamic banking and finance industry for research and provide state-of-the-art Advisory Consultancy and Education through various well-recognized modes viz. Islamic Financial Product Development, Shariah Advisory, Trainings Workshops, and Islamic Microfinance and Takaful Consultancies etc. side by side through our distinguished, generally acceptable and known Publications in Islamic Banking and Finance.

We are dedicated to serving the community as a unique institution, advisory and capacity building for the last twelve years. The prime goal has always been to remain stick to the commitments providing Services not only in UAE/Pakistan but all over the world. We have so far served in more than 35 Countries for the development of Islamic Banking and Finance industry. For further Details about AlHuda CIBE, please visit: www.alhudacibe.com

For Media Contact:

Ms. Shaguftta Perveen

Manager Communications,

info@alhudacibe.com

Call: +92 42 35913096 - 98

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.