Doha, Qatar: Ooredoo Q.P.S.C. (“Ooredoo”) - Ticker: ORDS today announced results for the half year ended 30 June 2019.

Financial Highlights:

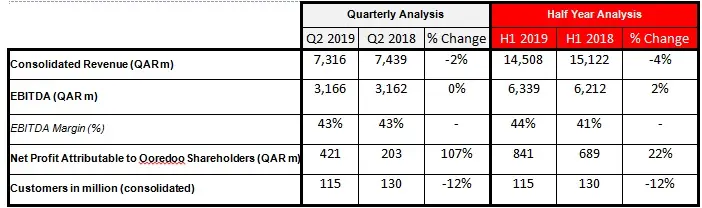

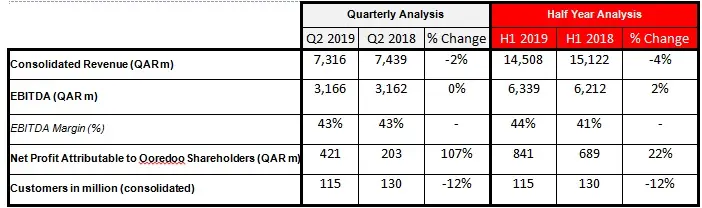

- Group EBITDA for H1 2019 increased by 2 percent year-on-year to QAR 6.3 billion with a corresponding EBITDA margin of 44% supported by a positive impact from the new IFRS 16 accounting standards

- H1 2019 Revenue stood at QAR 14.5 billion, a decline of 4% compared to the same period last year, impacted by an industry wide shift from voice services to data services, as well as macroeconomic and currency weakness in some of our markets

- Group Net Profit attributable to Ooredoo shareholders increased by 22% compared to the same period last year and reached QAR 841 million, partially aided by a favorable FX environment and offset by a negative IFRS16 impact on Net Profit in 1H 2019

- Increased monetization of data business, with significant data growth coming from consumer and enterprise customers: saw data revenue increase to 52% of Group revenue. Revenue from data contributed QAR 7.5 billion

- Post period on July 3, the Qatar Exchange implemented a successful 10 for 1 stock split for ORDS. This was mandatory for all QE listed companies

Operational highlights:

- The Group customer base stood at 115 million and increased sequentially by 2.7 million as Indosat Ooredoo reversed its trend and attracted new customers

- Ooredoo continues to lead in 5G adoption. At the 2019 Emir Cup final, Ooredoo Qatar showcased its 5G capabilities, achieving data speeds of up to 1.2 Gbps on 5G handsets and delivered more than 6 TB of mobile traffic during the event. Whilst Ooredoo Kuwait launched 5G commercially with a host of new 5G internet plans.

- Network expansion and improvements remain a key driver of growth, Ooredoo Qatar maintained its fibre rollout programme which now covers 423 thousand homes in Qatar and Ooredoo Algeria extended its 4G network to cover 58% of the population, more than doubling the year on year data usage. Ooredoo Oman extended its 4G Supernet network to 25 new areas.

- The launch of new digital initiatives continues to support customer acquisition and loyalty. Ooredoo Qatar launched ‘Ooredoo Sports’ - a conversational AI (artificial intelligence) platform that brings a new level of engagement to sports fans. Ooredoo Oman launched new features in its app through its AI powered Chatbot.

- Ooredoo continues to be a data leader in its markets with 4G networks now available in 8 of Ooredoo’s 10 markets, while 5G is available in Qatar and Kuwait

Commenting on the results, H.E. Sheikh Abdulla Bin Mohammed Bin Saud Al-Thani, Chairman of Ooredoo, said:

“We are making excellent progress with our digital strategy, whilst effectively managing our costs and overheads to support the growth of our business and long-term shareholder value generation.

Ooredoo Group reported a solid set of results for the first half of the year with Revenue of QAR 14.5 billion and a 22% increase in Net Profit despite the pressure in the operating environment in our markets and industry challenges associated with the decline in voice revenues.

We remain focused on providing reliable connectivity and innovative products to our customers and are proud to be at the forefront of the global 5G revolution. In our home market in Qatar, we now have around 100 live 5G sites as we prepare our network to cater to the future needs of our customers. We are proud to play our role in facilitating a tremendous opportunity that 5G will bring to people and business and have now launched a commercial 5G network in Kuwait as well.”

Also commenting on the results, Sheikh Saud bin Nasser Al Thani, Group Chief Executive Officer of Ooredoo said:

“During the period we invested further into our networks while at the same time improving the profitability of the company.

Indosat Ooredoo, our second biggest market in terms of contribution to revenues, continues to turn around its business delivering robust growth across the board. This was underpinned by our strategic refresh designed to create a more loyal customer base with lower churn rates, following the implementation of regulation for SIM card registration. As a result Indosat Ooredoo reversed the trend and started to add new customers again.

In Oman we grew our customer base by 5% as we launched exciting new features through our AI powered chatbot, whilst in Myanmar our customer base surged 19% despite increased competition from a fourth telecommunications operator. In Kuwait we launched 5G and we substantially grew our EBITDA supported by careful execution of our cost optimisation initiatives and enhanced operational efficiency. In Algeria, our data traffic more than doubled year on year, as we extended our 4G coverage to 58% of the population.

Looking ahead we remain optimistic about the opportunities available to Ooredoo Group, as the telecommunications industry transitions towards a more digital model. We believe that we have made the right investments and strategy to ensure long term value for our shareholders, customers and countries we operate in.”

Operational Review

Middle East

Ooredoo Qatar

Ooredoo Qatar continued to hold a strong leadership position at the end of the first half of 2019, with both fixed line and mobile networks ranking among the fastest globally. Reported revenue was slightly lower at QAR 3.7 billion (H1 2018: QAR 3.9 billion), due to a fall in handset sales while EBITDA increased to QAR 2.1 billion (H1 2018: QAR 2.0 billion). Customer numbers remained stable at 3.3 million.

EBITDA margin showed a healthy improvement year-on-year, rising to 57% (H1 2018: 51%). EBTIDA improvements were driven by a successful and ongoing cost optimization program and a more favorable product mix and IFRS 16 impact.

Ooredoo Qatar leveraged its strong sporting heritage to extend its 5G leadership position during the period, conducting 5G trials with a ‘Virtual Stadium’ at Mall of Qatar and deploying a 5G-connected ambulance for the final of the Amir Cup in May. The company now has around 100 live 5G sites. Ooredoo Qatar launched Ooredoo Sports, an innovative conversational Artificial Intelligence (AI) platform for sports fans that leverages AI and Augmented Reality technologies, and announced a two-year sponsorship of Qatar's national football team.

The company deployed a diverse range of Internet of Things (IoT) solutions during the period and enabled the digital transformation of several leading organisations through partnerships and the launch of a new portfolio of business internet services offering enhanced speeds, security and additional value. Ooredoo Qatar was also certified to the prestigious Business Continuity Standard (ISO22301:2012) by Bureau Veritas and was honoured by Microsoft with its ‘Digital Transformation Award’ at the annual Microsoft Digital Transformation Awards.

Ooredoo Oman

Ooredoo Oman continues to perform well maintaining revenues at QAR 1.3 billion during the first half of 2019. Business was driven by an increase in fixed line revenue which offset declines in mobile revenue. EBITDA increased 3% to QAR 733 million, and EBITDA margin was strong at 56%, up from 54% in H1 2018 mainly due to IFRS16.

Ooredoo Oman’s customer base increased 5% to 3.1 million during the first half of 2019 as compared to the same period last year. The expansion was aided by the continued positive reception of the “New Shababiah” all in one digital prepaid service and the “New Shahry” digital post-paid product as well as the launch of new features in Ooredoo Oman’s app through its AI powered Chatbot.

Ooredoo Kuwait

Ooredoo Kuwait maintained strong EBITDA growth, reporting a 47% increase during the first half of 2019 to QAR 432 million, compared to the same period last year. Cost optimisation initiatives as well as a more favorable product mix due lower handset sales and IFRS 16 impact supported margin expansion which increased to 32% in H1 2019 compared to 19% for the same period last year.

Year on year revenue was down 12% to QAR 1.4 billion for the first half of 2019 compared to the same period last year, primarily due to a reduction in handset sales. Quarter on quarter revenue increased by 3% in Q2 2019 compared to Q1 2019. Ooredoo Kuwait’s customer base increased to 2.5 million in H1 2019, up by 6% compared to H1 2018.

Asiacell - Iraq

Despite intensifying price competition, Asiacell maintained stable revenues of QAR 2.2 billion during the first half of 2019 as compared with the same period last year. EBITDA declined 9% to QAR 970 million, impacted by costs incurred for network upgrades and expansion as Asiacell continues to increase its reach and capacity in order to meet the data demand of its customers.

Asiacell’s customer base increased 6% during the first half of the year to 13.9 million, a result of network expansion and enhanced sales and marketing activities.

North Africa

Ooredoo Algeria

The telecommunications industry in Algeria continues to be characterised by intense price competition against a backdrop of weak consumer confidence, political uncertainty and economic instability. Ooredoo Algeria’s results were further impacted by the depreciation of the Algerian Dinar by 3% year on year, leading to a decrease in revenue to QAR 1.3 billion in the first half of 2019, compared to QAR 1.4 billion for the same period last year. EBITDA was QAR 459 million in H1 2019, down from QAR 557 million in H1 2018.

Ooredoo Algeria is making good progress towards a data centric future, extending its 4G coverage to 58% of the population across 48 wilayas, supporting the more than doubled data traffic and preparing its business to capture future growth.

Ooredoo Tunisia

Ooredoo Tunisia reported a robust set of results for the first half of 2019. EBITDA grew 10% to QAR 321 million, despite challenging market conditions and currency depreciation. EBITDA margin improved from 38% in H1 2018 to 47% in H1 2019 driven by improving operating efficiencies and careful cost management and IFRS 16. In local currency terms revenues increased 9% during the first half of 2019 as compared to the same period last year, mostly driven by an overall good performance. However, in Qatari Riyals revenues decreased 11% to QAR 689 million due to the 18% year on year depreciation of the Tunisian Dinar.

Ooredoo Tunisia’s customer base grew 5% to 8.8 million, affirming its position as the number 1 telecom player by customer market share.

Asia

Indosat Ooredoo

Growth in Indonesia continued to accelerate with Indosat Ooredoo reporting revenues of QAR 3.2 billion in H1 2019, an increase of 8% compared to the same period last year. The return to growth is a result of refreshed commercial strategies which attracted more than 3 million new customers in Q2 2019. EBITDA grew faster than revenues reaching QAR 1.3 billion, an increase of 24% compared to the same period last year, reflecting the success of cost optimisation initiatives and significantly improved network coverage and quality.

Indosat Ooredoo’s customer numbers stood at 56.7 million.

Ooredoo Myanmar

Myanmar remains a highly competitive market with the entrance of the fourth player putting pressure on revenues. As a result Ooredoo Myanmar revenue declined in local currency by 14% (24% to QAR 535 million in QAR terms) in the first half of 2019 compared to the same period last year. In spite of this Ooredoo Myanmar’s customer base increased 19% to 11.1 million. EBITDA increased 3% to QAR 134 million in H1 2019 compared to H1 2018, leading to an improvement in EBITDA margin to 25% for H1 compared to 18% for the same period last year. The improvement was mainly due to IFRS 16 impact.

Ooredoo’s Q2 2019 financial statements will be available on its website, accessible at: http://www.ooredoo.com

-Ends-

For further information: Email: IR@ooredoo.com

About Ooredoo

Ooredoo is an international communications company operating across the Middle East, North Africa and Southeast Asia. Serving consumers and businesses in 10 countries, Ooredoo delivers the leading data experience through a broad range of content and services via its advanced, data-centric mobile and fixed networks.

Ooredoo generated revenues of QAR 30 billion as of 31 December 2018. Its shares are listed on the Qatar Stock Exchange and the Abu Dhabi Securities Exchange.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.