DUBAI: An overall analysis of the Dubai residential market in 2018 revealed that over 5,454 villas and 25,595 apartments were transacted within 2018 in the overall residential market. Volume of transactions in the secondary market was AED 74.7 billion, compared to AED 82.6 billion in 2017 (a 10% drop), according to analysis by Luxhabitat based on data by Property Monitor.

OFF-PLAN MARKET

Off-plan transaction volumes dropped 34% from the previous year to AED 23 billion. Opening the off-plan market in Jumeirah was a much needed bolster for the real estate market as it emerged as the top performing area in 2018. World islands, City walk, Port de la Mer, Jumeira Bay and Madinat Jumeirah all have contributed to sales in the area. Brigitte Tenbergen, Associate Director at Luxhabitat reiterates that the Jumeirah area has received an overwhelming amount of interest.

PRIME RESIDENTIAL MARKET

According to Luxhabitat’s analysis, the prime residential market in 2018 totalled AED 39 billion, which is approximately 11% lesser than the previous year. Luxhabitat defines the prime residential market as a residential market composed of properties that lie on the high-end spectrum of the Dubai residential market. Luxhabitat recognises 15 key areas that form part of this classification; the areas are Al Barari, Arabian Ranches, Downtown Dubai, Dubai Marina, Dubai Creek Harbour, Business Bay,Emirates Hills, Jumeirah, Jumeirah Beach Residence, Mohammed bin Rashid city, Jumeirah Golf Estates, Jumeirah Islands, Jumeirah Lakes Towers, Palm Jumeirah, The Lakes, Meadows, & Victory Heights.

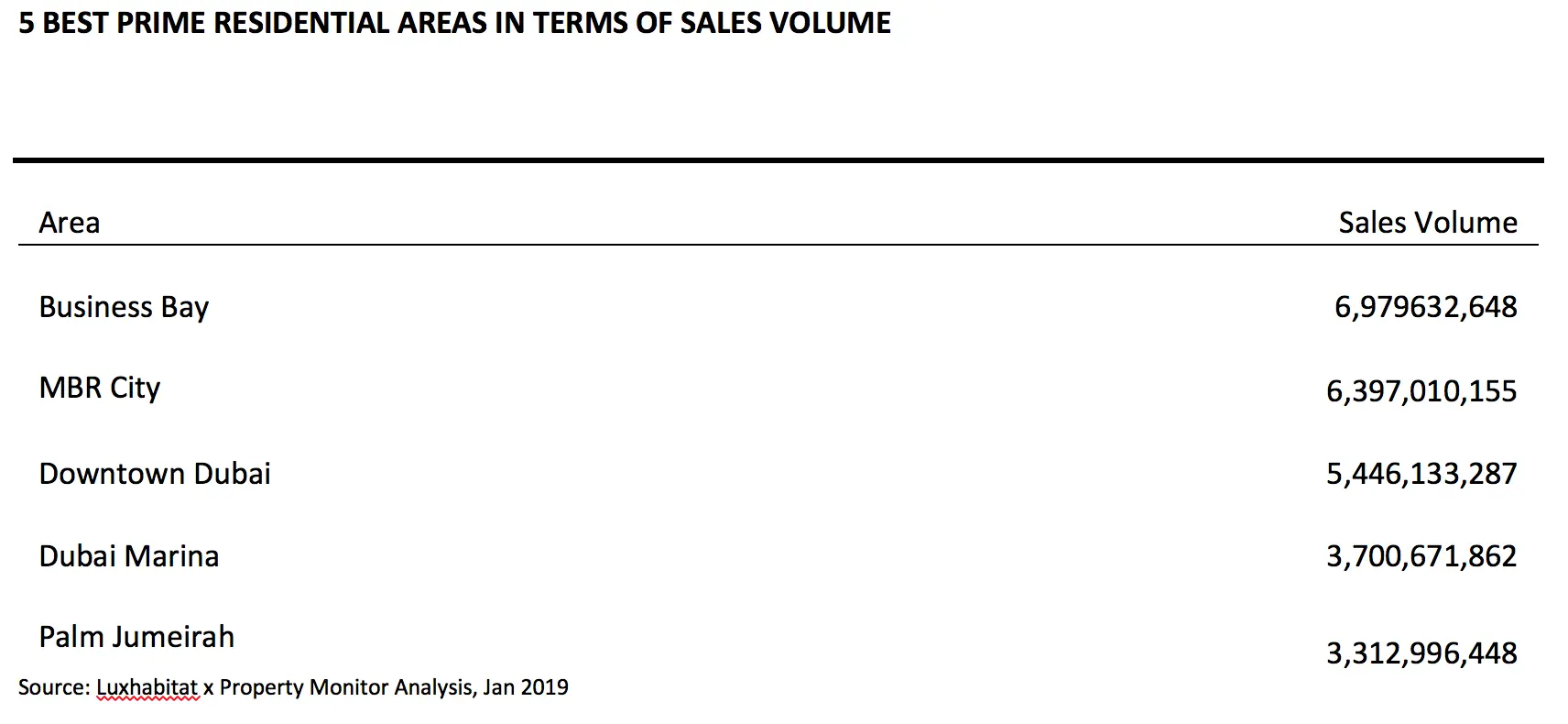

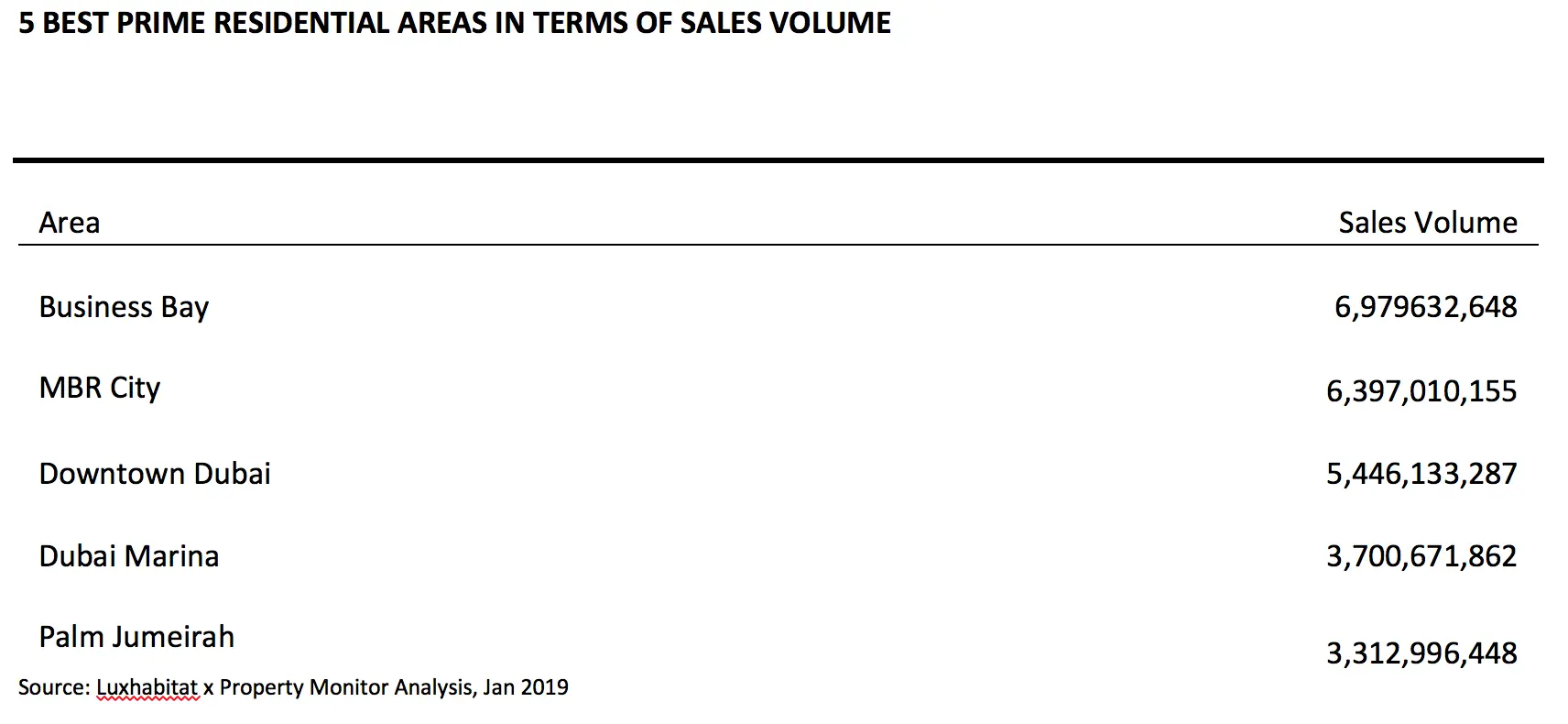

The top 3 areas in terms of sales volume were Business Bay (AED 6.9 billion), MBR City (AED 6.3 billion) and Downtown (AED 5.4 billion).

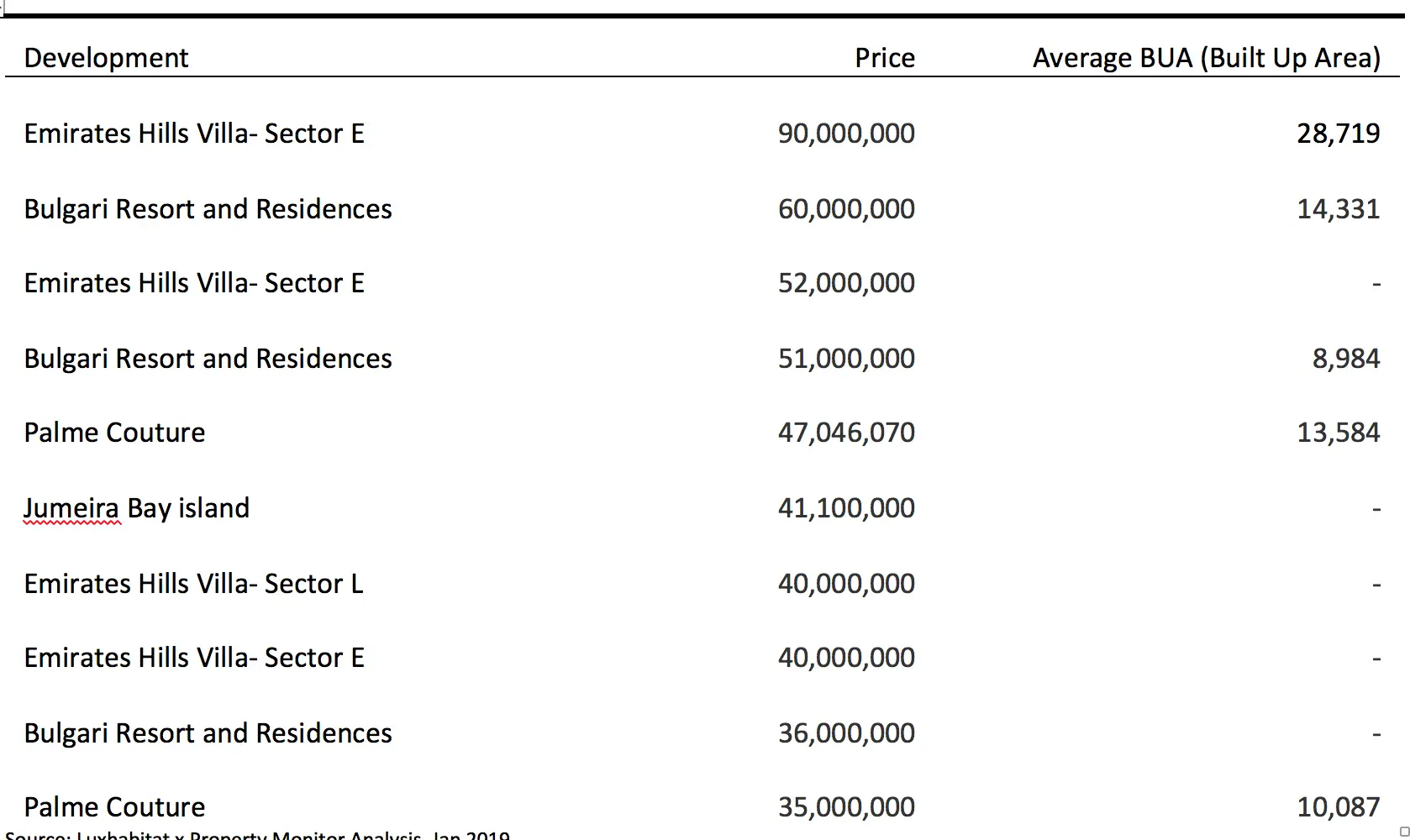

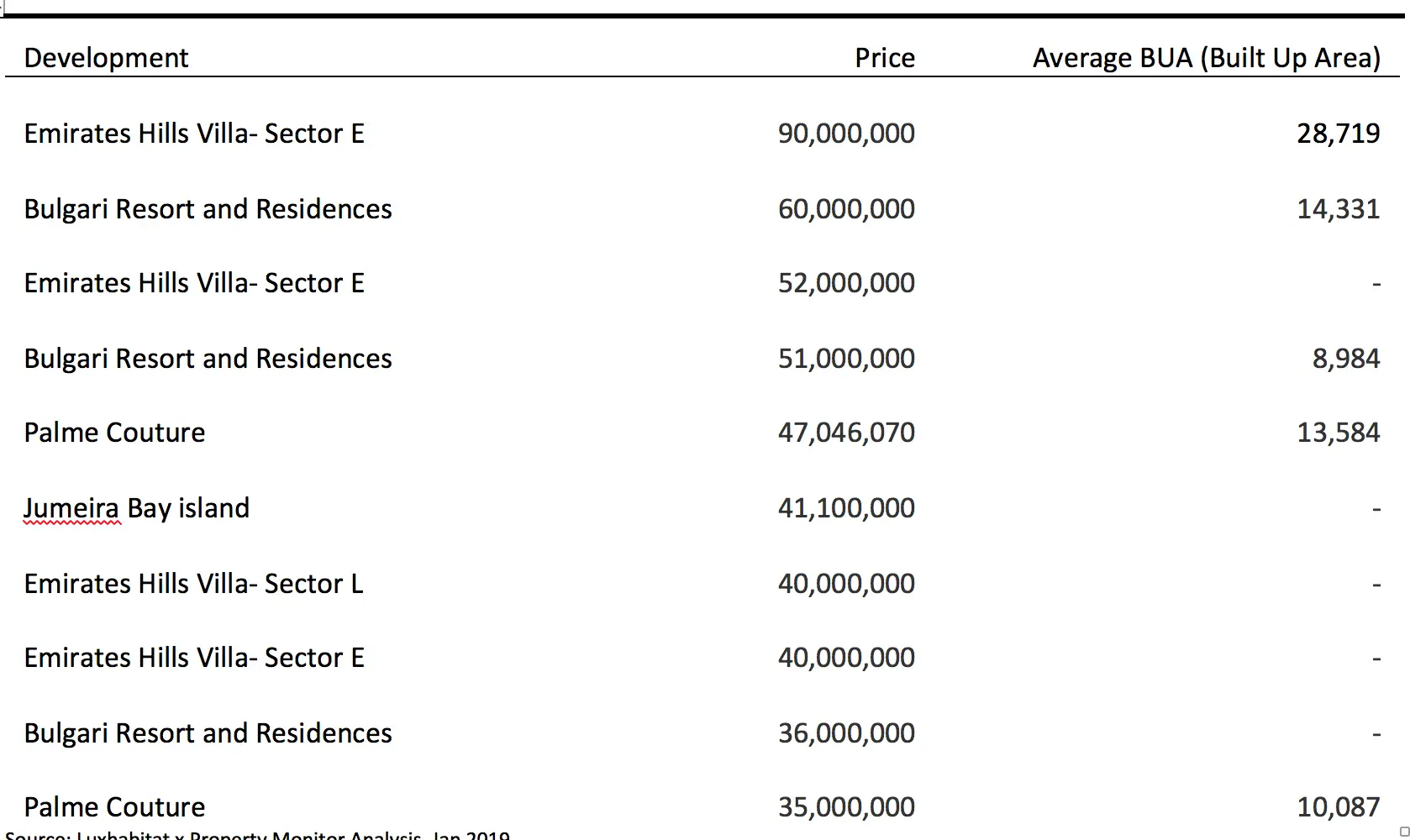

TOP 10 RESIDENTIAL TRANSACTIONS

KEY OBSERVATIONS

- The average price/ square foot for villas that transacted has increased, indicating interest for higher end and better quality units.

- Demand for ready to move in secondary market villas has doubled as resident families look to move into villa communities. Arabian Ranches 2 seems to be a popular area, with a 47% increase in sales from the previous year, presumably owing to more launches in 2018.

- Off-plan investments in apartments remained steady.

- The data also indicates that it also more expensive to buy off-plan properties than in previous years, a 8.4% increase. However, it is deduced that the average size of off-plan units transacted has also reduced from an average BUA of 1,100 sqft to 917 sqft (6.2%). The gaps between the pricing of off-plan properties and secondary market properties is minimal. Developers will need to offer more incentives than at their current levels. As the supply increases, there is a larger pool of investments to choose from. 2019 looks to be a buyer’s market, with further price stabilisation.

LOOKING FORWARD TO 2019

Sales Director, Andrew Cleator said, “In my opinion 2019 will continue to be a buyer’s market with great opportunities for both investors and end users alike. Saying that price reductions have already started to wane with some areas showing signs of stabilising.

For sure this year we will see even more bullish developer sales incentives being offered. Last year we witnessed developers offering DLD fee waivers, free initial period service charges and very attractive post completion payment plans. The latter was partly due to the UAE central banks reluctance to increase the mortgage loan to value ratio, but I strongly believe this will be addressed in the coming months as part of the current government stimulus plan.

Other key drivers to positively affect the market in 2019 include the current interest from international buyers and institutional investors especially from China. In addition, the government has recently been strengthening diplomatic and international business ties with many countries to bolster both tourist and population numbers which is a must. This for sure helped the Emirati passport recently became the most powerful in the world.”

We at Luxhabitat have curated a list of 12 real estate experts to predict the UAE real estate market in 2019. View our article here.

About LUXHABITAT

LUXHABITAT is Dubai’s only high-end real estate company focused on marketing, selling and designing the most important real estate properties in the region. The company is focused on properties above AED5M and in 2017 had an average property transaction of AED5.7M. We are focused in sourcing the best quality properties in premium residential areas such as Emirates Hills, Palm Jumeirah, Al Barari, Jumeirah Islands, Jumeirah Golf Estates, Meadows, Lakes and Arabian Ranches; and also, the best apartments and penthouses in upscale buildings such as Le Reve, Index Tower, Six Towers, Burj Khalifa, The Address Hotels, among others. For more information, visit its award-winning website at www.luxhabitat.ae

For further press information, images or to arrange interviews please contact

Aneesha Rai

E: ar@luxhabitat.ae |

M +971 50 42 60 432 |

T +971 4 432 79 72

© Press Release 2019

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.