PHOTO

Credit rating agency Moody’s announced on Monday that it changed its outlook for the country to stable from negative, while maintaining its sovereign issuer rating at B2.

The cost of insuring the country's sovereign bonds soared in May and June this year as markets became concerned about the country's ability to pay down debt given a recent run of budget deficits (Read more here), but these fears were calmed in early October when Saudi Arabia, the United Arab Emirates and Kuwait announced that they would extend an aid package to Bahrain worth $10 billion, which is tied to fiscal reforms. (Read more here).

“The reason for the change in outlook stems from the extension of the US$10bn GCC (Gulf Cooperation Council) aid package, which has significantly reduced external financing risks,” Jean-Paul Pigat, head of research at Lighthouse Research said in a note seen by Zawya on Tuesday.

“This is not to suggest the near-term growth outlook has necessarily improved, as much will depend on the extent of fiscal consolidation measures that are implemented over the coming months,” Pigat added. “Nevertheless, the importance of the aid package can’t be overstated, both for Bahrain and the wider GCC," he said.

Bahrain released a 33-page fiscal plan after signing the Gulf aid agreement to fix its finances and essentially abolish its budget deficit by 2022.

The Bahraini House of representatives approved in October a draft law to introduce VAT, with the Kingdom set to join the United Arab Emirates and Saudi Arabia in implementing the rollout of the tax starting on January 1, 2019. (Read more here).

“Even though Bahrain is the smallest economy in the region, macro and market stability still has implications for the wider GCC, and it is to the entire region’s benefit that this one source of uncertainty has been eliminated,” Lighthouse Research’s Pigat said.

“Bahrain’s breakeven oil prices are still well outside most estimates for short and long-term global oil prices, suggesting the economy will continue to run large current and fiscal account deficits in the years ahead,” he added.

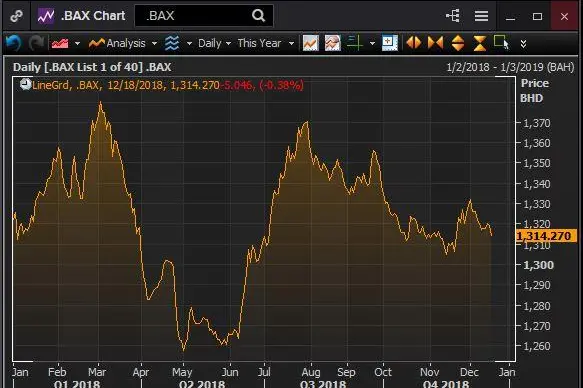

Bahrain has been struggling with its finances since the oil prices drop in 2014 and the Bahraini stock market has dropped 1.31 percent during the year 2018 and closed 0.38 percent lower on Tuesday, despite Moody’s announcement.

In its May regional outlook for the region, the International Monetary Fund (IMF) calculated the breakeven point for Bahrain at $113 per barrel. Data from Eikon showed that Brent oil prices were trading at $57.86 per barrel on Tuesday at 13:29 GST.

Nishit Lakhotia, head of research at Bahrain-based SICO told Zawya by email that the outlook upgrade to stable by Moody’s is not surprising, given the recent $10 billion support by some of Bahrain’s GCC neighbors and the ongoing reforms being done in the Kingdom.

“The risk of course remains on the oil revenues from recent correction, while successful implementation of these reforms will be positive for Bahrain Government’s fiscal outlook,” Lakhotia added.

Moody's note had said that "financial support and the fiscal consolidation measures that are set to accompany it will support investors' confidence and help to reduce the government's financing needs".

Elsewhere in the region, Dubai’s index dropped 2.05 percent on Tuesday, Abu Dhabi’s stock market fell in value by 0.76 percent, Qatar’s index was mainly flat, while Kuwait’s Premium Market index dropped 0.82 percent and Oman's MSM30 Index fell 0.65 percent.

By 14:49 GST, Saudi Arabia’s index was trading 0.31 percent lower and Egypt’s blue-chip index EGX30 was down 0.45 percent.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018