PHOTO

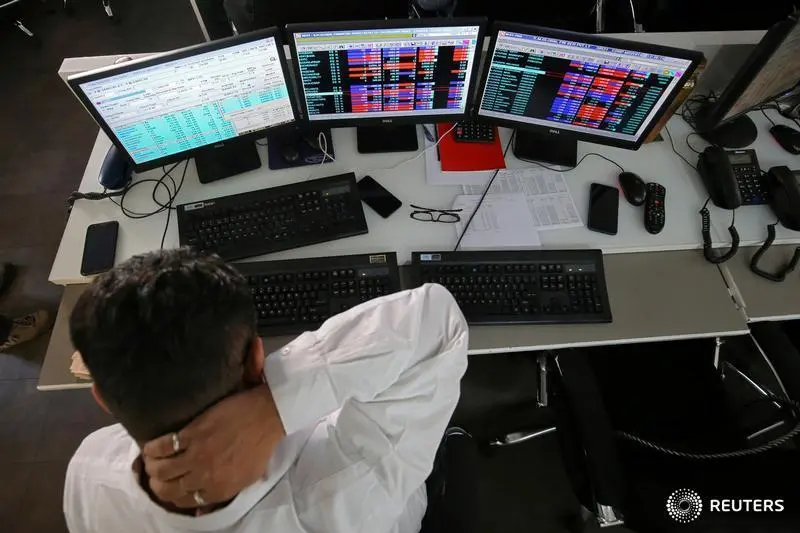

SINGAPORE - Emerging Asia is primed for volatility. The new year has brought hints of recovery, thanks to weaker oil prices and hopes of a more dovish U.S. Federal Reserve. But cooler growth, U.S.-China trade tensions and elections in India, Indonesia and Thailand leave room for significant ructions in the region’s equity, credit and currency markets.

Contagion from collapses elsewhere meant 2018 was bruising for Southeast Asia and India. Indonesia, with a chunky current account deficit and hefty foreign holdings in its bond market, was one of the worst affected: the rupiah plunged to its weakest since the Asian crisis two decades ago. Now, Jakarta's bourse is back to where it was in April, and the currency is near 14,000 to the U.S. dollar, close to June levels.

But the deeper problems behind 2018's market woes remain. One is economic sluggishness. Indonesia was already struggling to accelerate; tighter fiscal policy and six rate hikes last year mean it may have expanded only 5.15 percent, by official estimates, short of the targeted 5.4 percent. In Malaysia, a post-election halt on big-ticket infrastructure, plus fiscal reform, will act as brakes.

And trade tensions endure. Despite talk of Southeast Asian winners from the U.S.-China skirmish, the reality is most of the export-oriented region suffers, while a slower moving People's Republic hurts everything from Thai tourism to Malaysian semiconductor exports.

Then there is the ballot box. In Indonesia, President Joko Widodo is the favourite and, come April, should find his hand strengthened for reform. Yet the number of undecided voters has hovered close to a fifth, according to some polls, and any sign the opposition is gaining ground will spook investors.

In Thailand, where a February vote could yet be postponed, it is political unrest that may prove costly. After outflows last year, foreign ownership of Thai stocks is already below where it was during the 2008 financial crisis, according to Citi. And India too carries risks: a bourse trading at nearly 17 times forward earnings is buoyed by domestic buyers, but is ripe for correction if Prime Minister Narendra Modi stumbles.

The potential for volatility should ease towards the second half, when China's expected economic stimulus measures kick in and election outcomes are clear. Until then, buckle up.

On Twitter https://twitter.com/claramarquesrtr

CONTEXT NEWS

- Bourses in South Korea, Taiwan, India, Thailand, Philippines, Indonesia and Vietnamese showed foreigners sold a net $33.6 billion worth of equities in 2018, which was the most significant outflow since at least 2012, according to data from the exchanges.

- Indonesia is due to hold presidential and parliamentary elections on April 17.

- Thailand is due to hold a long-awaited national election on Feb. 24, but the government said on Jan. 3 that it may clash with preparations for the coronation of King Maha Vajiralongkorn, set for early May. Dozens of activists protested on Jan. 6 against the delay, the first such gathering since the military government lifted a ban on political activity last year.

- India’s general election is due by May.

(Editing by Una Galani and Katrina Hamlin)

© Reuters News 2019