PHOTO

Kuwait’s stock market has started the second half of the year on “a good note”, building on strong performance during the first six months of 2018 and continued positive growth for the country’s main listed banks in July, according to analysis published on Saturday.

A report by Markaz showed that Kuwait Finance House (KFH) and National Bank of Kuwait both performed strongly in July, gaining 8.2 percent and eight percent respectively.

The investment management and research company’s monthly markets report for July said “the second half of the year started on a good note for the stock markets of Kuwait”, with Kuwait’s All Share index rising 5.7 percent in July and up 9.6 percent so far this year.

Raghu Mandagolathur, executive vice president and head of published research at Markaz, said: “The positive performance of Kuwait Finance House (KFH) and National Bank of Kuwait (NBK) in the equity market could be attributed to their Q2 2018 earnings results. Profitability of banks in Kuwait during the period was boosted by rising interest rates and the uptick in economic activity resulting from the rise in oil prices.”

Responding to questions submitted by Zawya on Sunday, Mandogolathur said Kuwaiti banks’ performances were in line with their counterparts across the Gulf Cooperation Council (GCC), with investors bullish about banking stocks, as the majority of regional banks have exhibited growth during the second quarter of 2018. He believed the picture was likely to be positive for the remainder of 2018, thanks to rising oil prices.

“Rising oil prices will enable governments to move away from austerity and increase spending, which will support consumer and business confidence, and in turn have a positive impact on credit demand,” he said.

“As the United States Federal Reserve is likely to hike the interest rates twice in the remainder of the year, we expect the Gulf Cooperation Council countries to follow suit, presenting an opportunity for the local banks to widen their net interest margin. Hence, the performance of Kuwaiti banks is expected to remain positive for the remainder of 2018.”

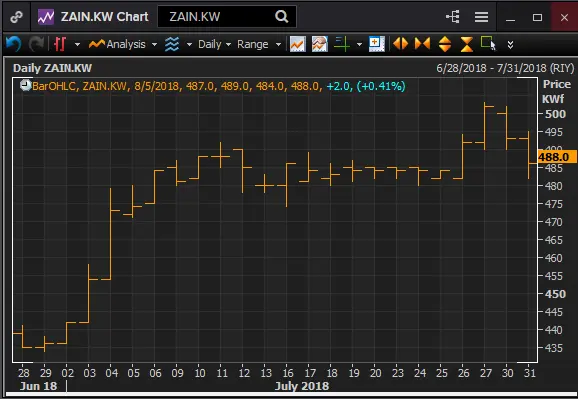

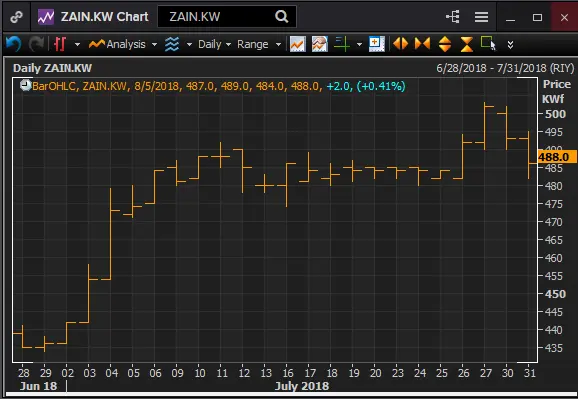

Kuwait-based telecoms operator Zain, which launched the country’s first 5G integrated network in June, performed even better, gaining 11.7 percent in July, which Mandogolathur said was primarily driven by positive investor sentiments surrounding Kuwait’s blue-chip stocks after the announcement in June that the MSCI may upgrade the country from frontier to emerging market in 2019.

“The sentiments spilled over into July, resulting in Zain’s stock price increasing by more than 10 percent within the first two weeks of the month and eventually posting a return of 11.7 percent for July,” he said.

Markaz’s report also stated that in Saudi Arabia, the country’s proactive initiatives to improve the business environment were likely to bring more foreign inflows into the country’s private sector.

Initiatives include the introduction of new draft law to regulate public and private partnerships, in addition to the earlier proposed bankruptcy law, which is expected to come into effect by August. The laws are expected to remove regulatory impediments for doing business.

(Reporting by Imogen Lillywhite; Edited by Shane McGinley)

(imogen.lillywhite@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018