PHOTO

Global markets dropped on Friday on trade concerns between the United States and China, as MSCI’s gauge of stocks across the globe dropped 0.26 percent.

On Wall Street, the Dow Jones Industrial Average rose 1.11 points to 24,715.09, the S&P 500 lost 7.16 points, or 0.26 percent, to 2,712.97 and the Nasdaq Composite dropped 28.13 points, or 0.38 percent, to 7,354.34.

“The driver is continued concerns about trade and the seeming lack of progress on both NAFTA and the negotiations with China,” Kate Warne, investment strategist with Edward Jones in St. Louis, told Reuters.

“I think that’s why you are getting markets that are caught and not moving much because no one is certain about which way any of these will go, and whether there’s good news or whether they need to worry more about what happens next.”

The pan-European FTSEurofirst 300 index lost 0.29 percent, but posted gains for an eighth straight week.

Middle East markets

Most stock markets in the Middle East fell on Thursday on geopolitical tensions but Saudi Arabia’s index added gains as rising oil prices boosted the index.

The Saudi index gained 0.7 percent as shares in the energy and petrochemical sectors rose. Saudi Basic Industries (SABIC) gained 1.3 percent while Saudi Kayan Petrochemical Company rose 1.2 percent and National Petrochemical Co was up 1.5 percent.

National Commercial Bank gained 4.2 percent and Saudi British Bank fell by 3.3 percent, while Alinma Bank added 1.1 percent.

Abu Dhabi's index lost 0.8 percent, with Aldar dropping 0.9 percent.

Dubai’s index was down 0.6 percent, dragged lower by Emaar Properties and subsidiary Emaar Development, down 1.2 percent and 0.7 percent respectively. GFH Financial helped reduce the market losses and rose 2.1 percent.

In Qatar, the index fell 0.7 percent as Masraf al Rayan and telecommunications group Ooredoo were down 2.3 percent and 1.3 percent respectively.

Egypt’s index fell 0.7 percent, Oman’s index lost 0.8 percent, while Kuwait’s index edged down 0.2 percent and Bahrain’s index was flat.

Oil prices

Brent prices remained near $80 on Friday due to supply concerns, but prices retreated from high levels on profit-taking.

Brent crude futures fell 79 cents, or 1 percent, to settle at $78.51 a barrel. The global benchmark on Thursday broke through $80 a barrel for the first time since November 2014.

Brent, which has gained about 17.5 percent since the start of the year, rose about 1.9 percent for the week.

West Texas Intermediate (WTI) crude futures fell 21 cents to settle at $71.28 a barrel, a 0.29 percent loss. The contract rose about 0.9 percent for the week, its third straight week of gains.

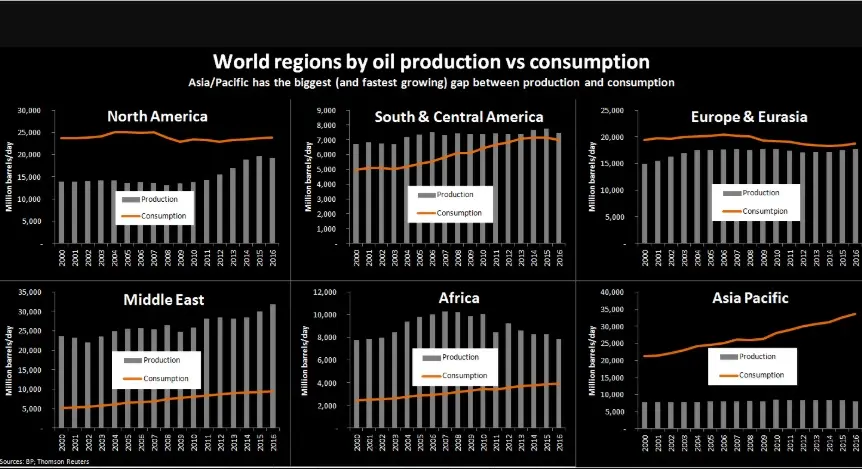

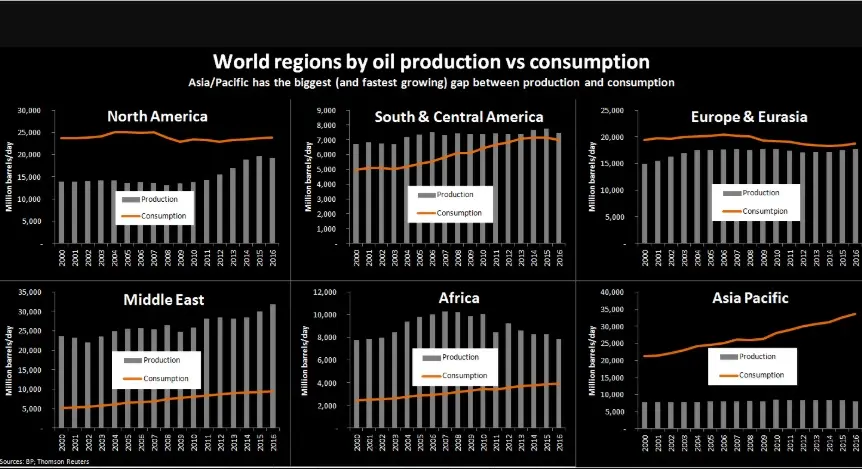

Commentary: Asia’s oil bill is now in the region of $1 trillion as oil prices hover near 80$ a barrel.

Please click here to gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Currencies

The U.S. dollar rose for a fifth straight session against a basket of currencies on Friday, adding 0.22 percent.

Precious metals

Spot gold gained 0.2 percent at $1,292.12 per ounce by 1733 GMT, after hitting its lowest since December 27 in the previous session at $1,285.41.

In other news…

Egypt's central bank said in a statement that it kept its main interest rates unchanged on Thursday, with its deposit rate at 16.75 percent and the overnight lending rate at 17.75 percent.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018