PHOTO

Dubai-based developer Binghatti Properties’ newly launched Mercedes-Benz-branded residential mega project near Meydan in Nad Al Sheba underscores the growing appeal of branded residences as a premium asset class in the emirate’s property market, according to its Chairman.

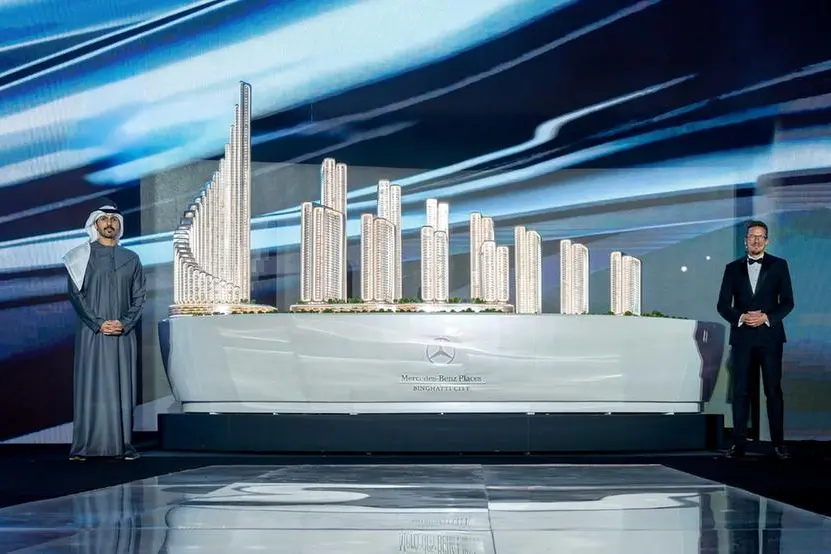

The 30-billion-UAE-dirham ($8.2 billion) Mercedes-Benz Places Binghatti City will comprise 12 residential towers, spanning around 10 million square feet ( sq. ft.) of built-up area and delivering more than 13,000 homes. The project is expected to be completed in three and a half years and targets both end-users and investors.

Binghatti said branded projects offer a whole new plethora of opportunities and experience from the brand itself, in terms of design and lifestyle curation.

Justifying the choice of the Mercedes Benz brand for the new project, he said the automotive industry is way ahead of the real estate industry in terms of technology and design.

“Brand collaboration, specifically with automotive, brings this value to real estate, then ultimately that value reflects from a brand perspective and product perspective….it reflects on the price,” he said.

Branded homes typically command a 30–40 percent price premium over non-branded luxury properties, Binghatti added.

He also noted that there is growing scarcity of prime, centrally located land in Dubai for developers.

“That’s why there is more value to real estate in general in Dubai. It’s a very mature market now and so very good land does not come cheap.”

The developer has collaborated with luxury automotive brand Bugatti, whose Dubai residential tower has attracted global celebrities among its buyers. Last month, Binghatti had closed the sale of a 47,200 sq.ft. penthouse in the 43-storey luxury tower for $150 million.

The Mercedes-Benz development will offer studios, one- to four-bedroom apartments and five-bedroom penthouses, with prices starting at AED 1.6 million for studios, AED 2.6 million for one-bedroom units, AED 3 million for two-bedroom homes and around AED 5 million for three-bedroom units.

Non-branded projects

While branded developments sit at the premium end of its portfolio, Binghatti said demand for its non-branded projects continue to remain strong.

“When we look at it from an investment perspective, our non-branded products provide the investment fuel for the group, and the branded product is almost like the premium or the cherry on the top,” he said. He cited Binghatti Skyblade Downtown, a non-branded development that achieved nearly AED 5,000 dirhams per square foot.

“Our non-branded products now set a new market benchmark, while branded projects serve as a premium offering,” he noted.

Binghatti said international demand remains robust, with investors from India and the United Kingdom among the most active buyer groups in recent launches.

The company aims to surpass 2025's sales worth AED 26 billion amid launches and continued demand for property.

Knight Frank’s The Residence Report - 2025/26 launched last year noted the Middle East – especially Dubai and Saudi Arabia – is driving branded residential growth, with the region’s share of pipeline developments (26.7 percent) well ahead of its share of live projects (15.9 percent).

In a May 2025 report, Savills said Dubai is projected to account for 40 percent of all development in the Middle East and Africa region by 2031.

(Reporting by Bhaskar Raj; Editing by Anoop Menon)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.