PHOTO

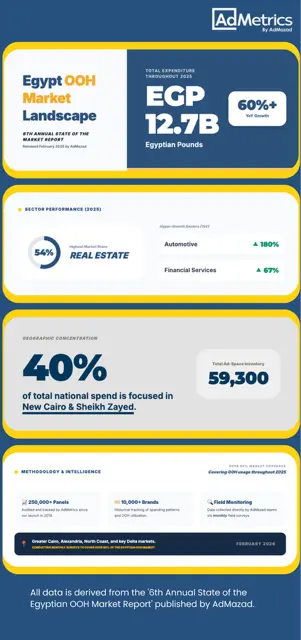

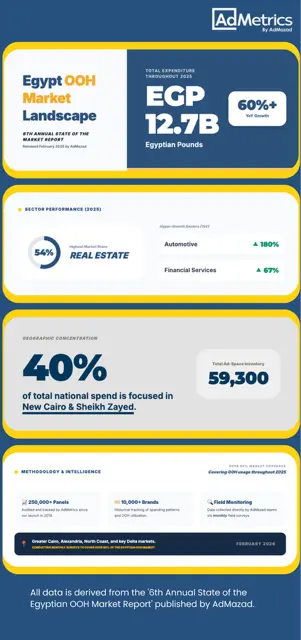

CAIRO, EGYPT — Egypt’s Out-of-Home (OOH) advertising expenditure surged by 60 percent in 2025 to reach EGP 12.7 billion, according to AdMazad’s sixth Annual State of the Outdoor Advertising Market Report. Findings from AdMetrics, Egypt’s leading platform for measuring and analyzing outdoor advertising performance, reveal a clear shift in market leadership from real estate dominance toward what is described as a “brand economy,” driven by a strategic partnership between high-ticket manufacturers and the financial services sector.

Investment from Financial Services in OOH grew by 67%, with banks and fintech firms pivoting messaging from institutional branding toward promoting accessibility and flexible payment solutions. This approach enabled manufacturers to sustain sales momentum by emphasizing “ease of payment.”

This trend reflects a significant diversification of the market’s capital base. While the real estate sector remains a dominant force, the growing strategic integration between high-ticket manufacturers, particularly across the automotive, consumer electronics, and home appliances sectors, and the financial services sector is contributing to the development of a more balanced and resilient Out-of-Home advertising ecosystem.

In this context, new brands accounted for 41% of total active entities in 2025, with more than 700 brands entering the Out-of-Home advertising market for the first time, seeking to establish the physical presence necessary to build trust in an increasingly credit-driven economy.

"We observed signs of cooling in Q4 2025, with real estate expenditure beginning to stabilize and even decline in certain geographic areas," said Assem Memon, Founder and Managing Director of AdMazad. "This decline highlights a 'Sustainability Gap.' While real estate developers have historically absorbed high premium rates for advertising, the Brand Economy operates according to much stricter ROI standards. If the real estate sector continues to slow, Out-of-Home advertising rates are expected to face a strong decline, in order to adjust to lower occupancy levels and ensure that pricing in the future aligns with performance data and customer base expansion costs."

Representing the shift toward financial service-led growth, Ahmed El Mandouh, Head of Marketing at Lime Consumer Finance, noted: “We strategically leveraged outdoor advertising as a central part of our awareness campaigns because it becomes part of daily routines, enhancing brand recall in a way that cannot be ‘skipped’ like online media. By placing transit displays and other OOH media in high-traffic locations, we engaged communities directly to make financial literacy visible. This physical presence is essential for sparking conversations around smart financial choices in everyday environments.”

Another significant shift is underway in Egypt’s outdoor advertising landscape, as the number of digital Out-of-Home screens increased by 50% in 2025. This expansion highlights the medium’s strong revenue-generating potential, with just 5 percent of total inventory accounting for 19% of market spend. The report notes, however, that the sector is approaching maturity, and future growth will rely on transitioning from static rotations to smarter operating models that leverage data and algorithms to enhance efficiency.

Key Market Metrics (2025)

- Total Market Spend: EGP 12.7 billion (+60% YoY)

- Sector Growth Leaders: Automotive (+180%), Banking and Fintech (+67%), Fast-Moving Consumer Goods (+40%)

- Real Estate Dependence: 72% growth in spend, yet accounting for 81% of inventory in new urban developments, such as New Cairo and Sheikh Zayed

- Digital Efficiency: The digital portfolio generated revenues four times its size compared to physical inventory (19% of revenue vs. 5% of inventory)

- New Advertiser Influx: More than 700 brands entered the Out-of-Home market for the first time in 2025

The report draws from a dataset of over 60,000 physical billboard audits conducted via AdMazad’s proprietary AdMetrics suite. The analysis covers Greater Cairo, Alexandria, and the North Coast/Delta, tracking utilization, expenditure, and asset distribution throughout the 2025 calendar year.

About AdMazad

Founded in 2015, AdMazad is Egypt’s leading AdTech firm and the creator of AdMetrics, the country’s primary OOH measurement suite. By tracking over 6,000 billboards across Egypt and 4,000 brands, AdMazad’s data-first approach provides CMOs with the insights required to turn billboards into actionable data points, maximizing returns and optimizing outdoor advertising spend.

For media inquiries, please contact:

AbdelAziz Khalaf

abdelaziz.khalaf@publicistinc.com