PHOTO

Abu Dhabi: As global carbon markets move from ambition to execution, a UAE-based climate finance and AI platform is positioning itself at the intersection of policy, capital and technology.

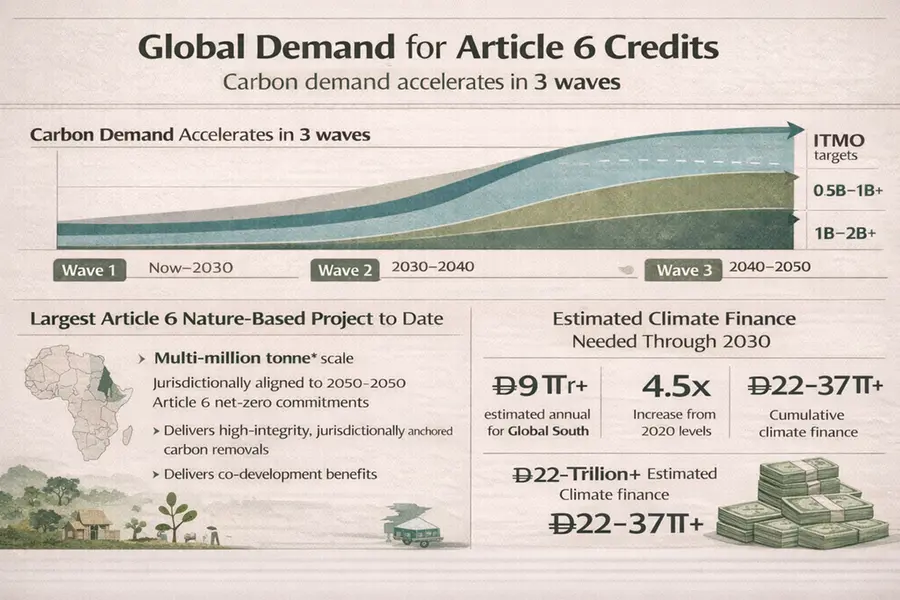

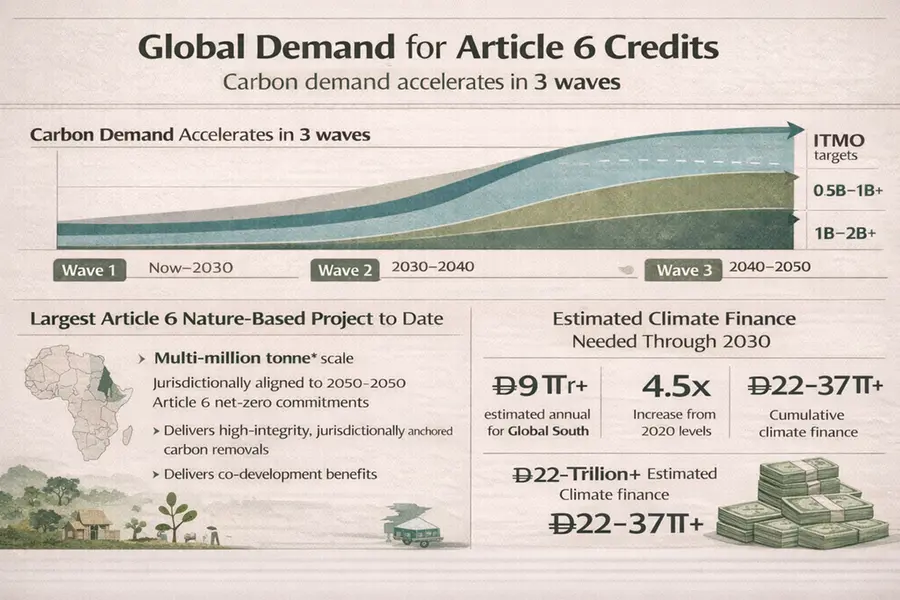

Green Economy Partnership (GEP) has announced the successful mobilisation of international institutional finance for its first transaction under Article 6 of the Paris Agreement—a milestone that signals the growing maturity of regulated carbon markets and the UAE’s expanding role within them. Demand for the credits is being driven by recently announced net-zero targets across the region, as set out in countries’ publicly listed Nationally Determined Contributions, as well as compliance requirements facing hard-to-abate sectors including steel, aluminium, cement and fertilisers

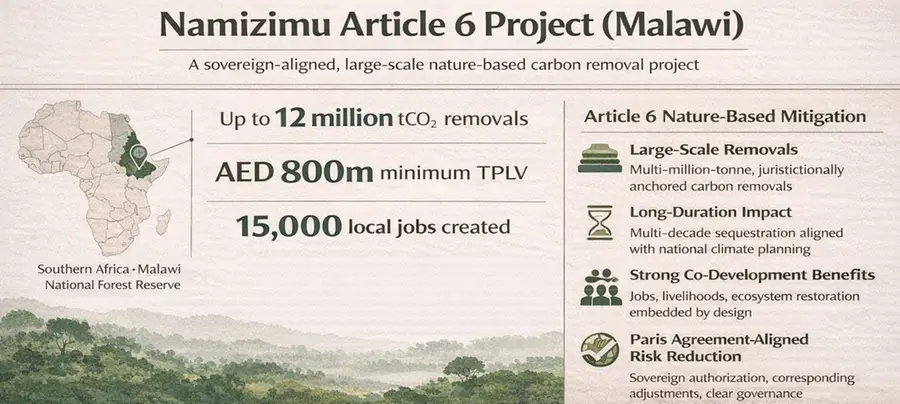

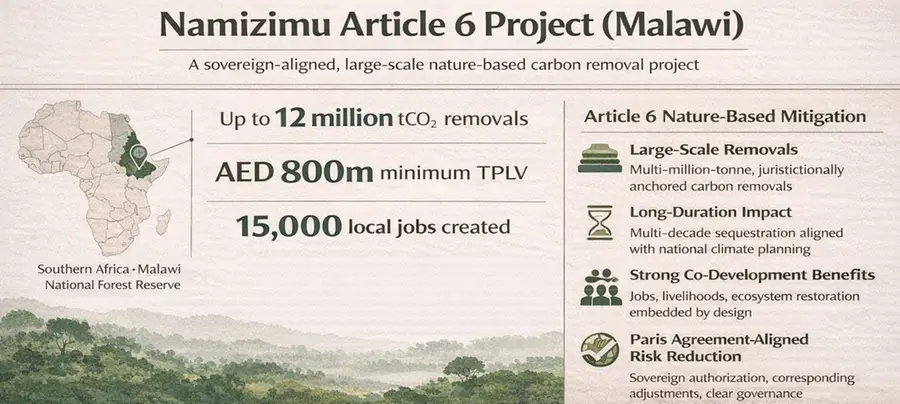

The transaction is anchored in a large-scale nature-based carbon reduction project in Malawi and is supported by Green Earth Group N.V. (Euronext: EARTH), a Netherlands-listed developer and financier of nature-based solutions. It represents one of the region’s first examples of a private-sector-led climate project being structured into a compliance-grade, financeable asset backed by a publicly traded international partner.

Unlike traditional carbon project developers, GEP operates as a climate finance and AI infrastructure platform. The company led the origination, structuring and implementation of the project, aligning it with national climate frameworks, Article 6 governance requirements and institutional standards for transparency and data integrity. The transaction leverages PAIP, GEP’s AI-enabled platform designed to support compliant carbon origination, monitoring and reporting, launched at COP30 late last year.

“Carbon markets ambition requires strong infrastructure in order to succeed,” said Ivano Iannelli, Chief Sustainability Officer and Managing Director of Green Economy Partnership. “Article 6 is now a functioning financial mechanism, but it only works when projects are structured with the same discipline, data integrity and governance expected in capital markets. That is the gap we are building leveraging the lessons learnt in the UAE.”

The Malawi-based Namizimu Project focuses on afforestation, reforestation and agroforestry within the Namizimu Forest Reserve and is expected to generate up to 12 million tonnes of high-integrity carbon removals over its lifetime, while creating more than 15,000 local jobs, estimated on hectare-to-labour ratios and international benchmarks.

For Green Earth Group, the transaction reflects a shift in investor appetite toward regulated, sovereign-aligned carbon assets. “This project combines environmental restoration with institutional governance and long-term value creation,” said Selwyn Duijvestijn, Chief Executive Officer of Green Earth Group. “That combination is increasingly what investors are looking for in climate finance.”

As governments and investors seek credible pathways to scale climate action, transactions like this offer a glimpse into how carbon markets may evolve—from fragmented voluntary initiatives into regulated, investable asset classes built on data, governance and trust.

About the Green Economy Partnership (GEP)

The Green Economy Partnership (GEP) is a ClimateTech, environmental finance and project originator dedicated to developing large-scale compliance emission reduction initiatives for global compliance carbon markets, particularly for the Global South. At the core of GEP’s strategy is innovation, combining data-centric platforms, clean technologies and Artificial Intelligence in support of the greater access to Paris Agreement Article 6, CORSIA, and emerging compliance frameworks including the IMO Net-Zero Framework. GEP is a project developer and system enabler, partnering with governments and institutions to identify, mature, and bring eligible projects to market at scale. Through its integrated AI and Blockchain platform, GEP aims to accelerate decarbonization across hard-to-abate sectors while ensuring transparency, auditability, and global interoperability.

Contact: media@greeneconomy.ae | +971504400162