Fitch Ratings-Dubai/London: Changes in international sukuk documentation linked to the Central Bank of the UAE’s adoption of the Accounting and Auditing Organization for Islamic Financial Institutions’ (AAOIFI) sharia standards have become standardised to some extent, Fitch Ratings says. However, it is uncertain if additional changes will be seen in the near term and issuers have exhibited varying degrees of adaptation, while the practical effect of the new documentation has yet to be tested.

A majority of Fitch-rated sukuk issued in 2021-9M22 have new clauses embedded in the documents, including defined tangibility events and the associated put options. The changes have been seen across sovereigns, financial institutions and corporate issuers. Non-compliance with AAOIFI sharia standards and Higher Sharia Authority (HSA) guidelines could reduce sukuk demand, as a sizeable share of global sukuk investors, arrangers and issuers are based in the UAE and fall under the Central Bank of the UAE’s remit. In June 2022, Fitch updated its Sukuk Rating Criteria to take account of these developments.

Fitch commented on the potential impact of the adoption of AAOIFI standards when new clauses and revised terms began to appear in documentation last year (see: Sukuk Risk Profiles Could Be Altered by AAOIFI-Compliance Push). These included stricter tangibility ratio requirements with new dissolution triggers. While gaps remain, some standardisation has been achieved in language relating to tangibility events, delisting events, indemnity payments and partial-loss events.

Several Fitch-rated sukuk across sectors issued in 2021-9M22 have sufficient unencumbered sharia-compliant assets to provide headroom against tangibility events. However, the risk of tangibility event is present for sukuk issuers (mainly non-sovereigns) with limited tangible assets and low headroom. This could expose issuers to rising liquidity risk upon exercise of put options by investors, which could have implications for their Issuer Default Ratings.

The amount that can be raised through sukuk issuance could also be capped by the value of an obligor’s tangible assets. This built-in cap on leverage could be credit positive, but may be neutral or negative for issuers with limited tangible assets, asset-light firms and highly indebted issuers, for whom it could restrict access to funding.

Sukuk investors may have an advantage over conventional bond investors in their contractual right to exercise a put option following a tangibility event and accelerate repayment prior to maturity. However, this remains untested in practice since no dissolution triggers have been hit, or puts exercised. This compounds uncertainty over potential differences in sukuk and bondholder treatment in many Islamic finance markets. Most Fitch-rated sukuk are senior unsecured obligations of the issuer and rank pari passu with other senior unsecured obligations, including bonds.

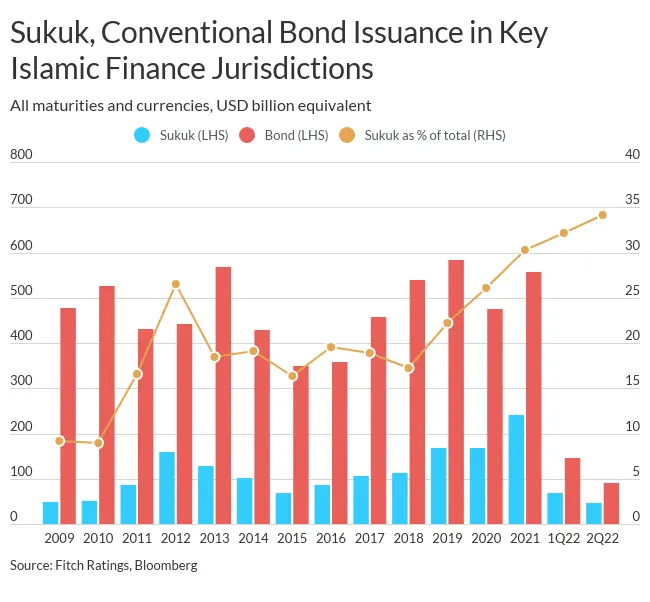

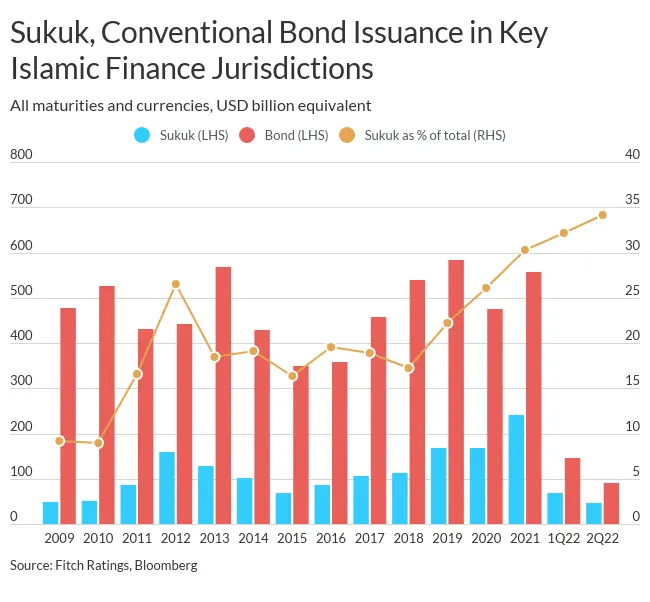

Global sukuk issuance slowed in 1Q21, due to complexities relating to AAOIFI, before normalising. Annual global growth in 2021 was 42.3%, driven by sizeable issuances by sovereigns, Islamic banks and large corporates. However, the impact was greater in the UAE, where sukuk volumes fell by 54.1% in 2021, while issuance of conventional bonds, which are simpler, more standardised and unaffected by AAOIFI standards, jumped by 239.3%. This shift from sukuk to bonds partly retraced in 1H22, when sukuk issued by UAE-based entities rose by 88.4% compared to 2H21, while bond issuance increased by 9.2%.

ssuance for the remainder of 2022 will depend on various factors, including how far high oil prices reduce oil-exporting sovereigns’ funding needs and global investor appetite for emerging market debt as well as sharia complexities. However, intact Islamic investor appetite, upcoming debt maturities, Islamic-finance development plans from several governments, and issuers’ funding diversification strategies should support issuance over the longer term.

Secondary market liquidity remains limited for sukuk as the market is dominated by buy-and-hold investors. UAE-based Islamic banks may face regulatory restrictions on investing in sukuk issued before 2021 that do not comply with AAOIFI sharia standards and HSA guidelines, further reducing secondary market liquidity.

A lack of standardisation is a long-standing challenge for sukuk, including in product structuring, documentation, sharia-interpretation and dispute resolution.

-Ends-

Media Relations: Matthew Pearson, London, Tel: +44 20 3530 2682, Email: matthew.pearson@thefitchgroup.com

The above article originally appeared as a post on the Fitch Wire credit market commentary page. The original article can be accessed at www.fitchratings.com. All opinions expressed are those of Fitch Ratings.

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch's rating definitions for each rating scale and rating categories, including definitions relating to default. Published ratings, criteria, and methodologies are available from this site at all times. Fitch's code of conduct, confidentiality, conflicts of interest, affiliate firewall, compliance, and other relevant policies and procedures are also available from the Code of Conduct section of this site. Directors and shareholders’ relevant interests are available at https://www.fitchratings.com/site/regulatory. Fitch may have provided another permissible or ancillary service to the rated entity or its related third parties. Details of permissible or ancillary service(s) for which the lead analyst is based in an ESMA- or FCA-registered Fitch Ratings company (or branch of such a company) can be found on the entity summary page for this issuer on the Fitch Ratings website.

In issuing and maintaining its ratings and in making other reports (including forecast information), Fitch relies on factual information it receives from issuers and underwriters and from other sources Fitch believes to be credible. Fitch conducts a reasonable investigation of the factual information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of Fitch's factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer, the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other reports provided by third parties, the availability of independent and competent third- party verification sources with respect to the particular security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of Fitch's ratings and reports should understand that neither an enhanced factual investigation nor any third-party verification can ensure that all of the information Fitch relies on in connection with a rating or a report will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the information they provide to Fitch and to the market in offering documents and other reports. In issuing its ratings and its reports, Fitch must rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect to legal and tax matters. Further, ratings and forecasts of financial and other information are inherently forward-looking and embody assumptions and predictions about future events that by their nature cannot be verified as facts. As a result, despite any verification of current facts, ratings and forecasts can be affected by future events or conditions that were not anticipated at the time a rating or forecast was issued or affirmed.

The information in this report is provided 'as is' without any representation or warranty of any kind, and Fitch does not represent or warrant that the report or any of its contents will meet any of the requirements of a recipient of the report. A Fitch rating is an opinion as to the creditworthiness of a security. This opinion and reports made by Fitch are based on established criteria and methodologies that Fitch is continuously evaluating and updating. Therefore, ratings and reports are the collective work product of Fitch and no individual, or group of individuals, is solely responsible for a rating or a report. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is specifically mentioned. Fitch is not engaged in the offer or sale of any security. All Fitch reports have shared authorship. Individuals identified in a Fitch report were involved in, but are not solely responsible for, the opinions stated therein. The individuals are named for contact purposes only. A report providing a Fitch rating is neither a prospectus nor a substitute for the information assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be changed or withdrawn at any time for any reason in the sole discretion of Fitch. Fitch does not provide investment advice of any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. Fitch receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. Such fees generally vary from US$1,000 to US$750,000 (or the applicable currency equivalent) per issue. In certain cases, Fitch will rate all or a number of issues issued by a particular issuer, or insured or guaranteed by a particular insurer or guarantor, for a single annual fee. Such fees are expected to vary from US$10,000 to US$1,500,000 (or the applicable currency equivalent). The assignment, publication, or dissemination of a rating by Fitch shall not constitute a consent by Fitch to use its name as an expert in connection with any registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of the United Kingdom, or the securities laws of any particular jurisdiction. Due to the relative efficiency of electronic publishing and distribution, Fitch research may be available to electronic subscribers up to three days earlier than to print subscribers.

For Australia, New Zealand, Taiwan and South Korea only: Fitch Australia Pty Ltd holds an Australian financial services license (AFS license no. 337123) which authorizes it to provide credit ratings to wholesale clients only. Credit ratings information published by Fitch is not intended to be used by persons who are retail clients within the meaning of the Corporations Act 2001.

Fitch Ratings, Inc. is registered with the U.S. Securities and Exchange Commission as a Nationally Recognized Statistical Rating Organization (the 'NRSRO'). While certain of the NRSRO's credit rating subsidiaries are listed on Item 3 of Form NRSRO and as such are authorized to issue credit ratings on behalf of the NRSRO (see https://www.fitchratings.com/site/regulatory), other credit rating subsidiaries are not listed on Form NRSRO (the 'non-NRSROs') and therefore credit ratings issued by those subsidiaries are not issued on behalf of the NRSRO. However, non-NRSRO personnel may participate in determining credit ratings issued by or on behalf of the NRSRO.

Copyright © 2022 by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved.