PHOTO

Board proposed a cash dividend of QAR 0.75 per share, up 15%

Doha, Qatar: Ooredoo Q.P.S.C. (“Ooredoo”) – Ticker: ORDS today announced its financial results for the year ended 31 December 2025.

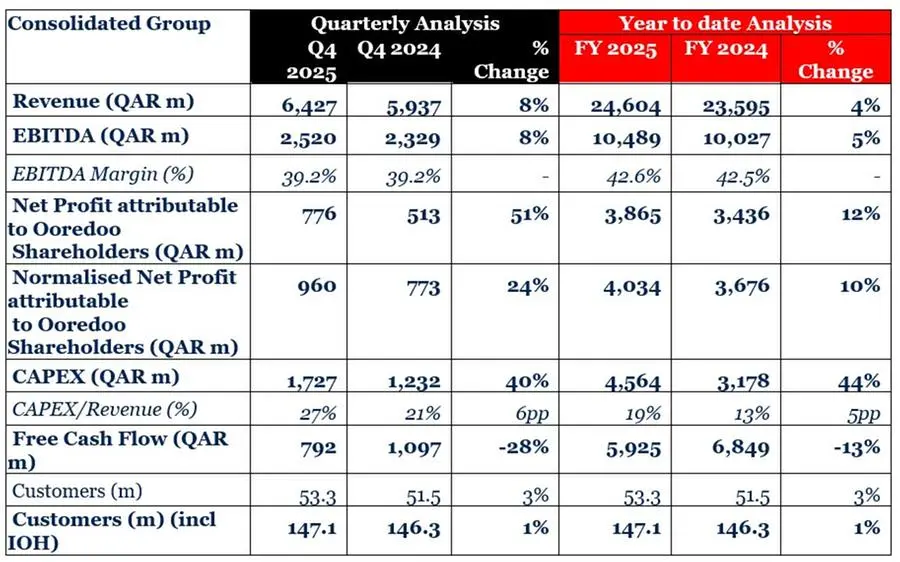

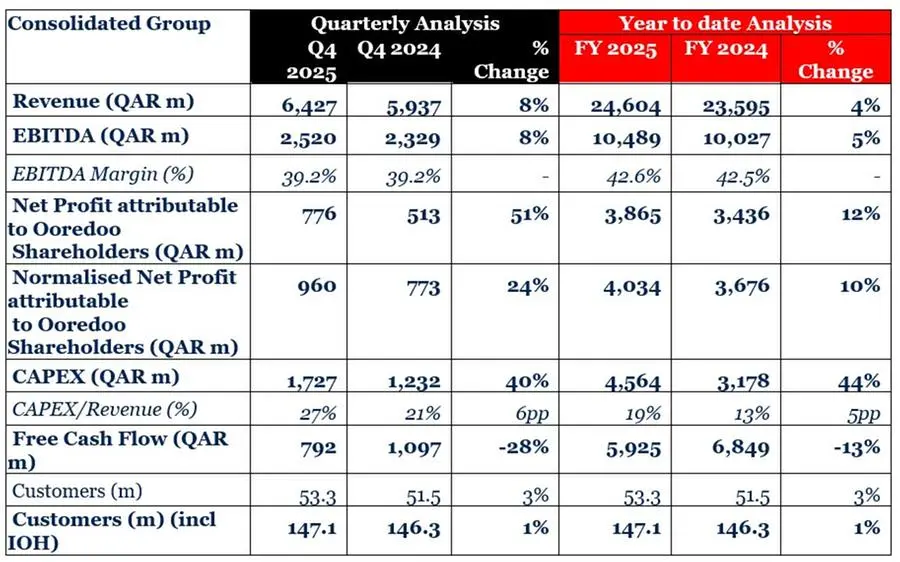

Full year 2025 (FY 2025) Highlights:

- Revenue increased by 4% (up by 6%, excluding the impact of Myanmar exit) at QAR 24.6 billion

- EBITDA up by 5% (Normalised up by 7%^) at QAR 10.5 billion

- EBITDA margin at 42.6%

- Double-digit reported Net profit growth of 12% to QAR 3.9 billion

- Capital expenditure (CAPEX) spend of QAR 4.6 billion

- Free Cash Flow at QAR 5.9 billion, decreased by 13%

- Customer base of 147.1 million (including IOH)

- Board proposed a cash dividend of QAR 0.75 per share, up by 15%

The disposal of the Ooredoo Myanmar operation was completed on 31 May 2024, and Ooredoo Group's financial results for FY 2024 include results for Ooredoo Myanmar up 31 May 2024 unless otherwise stated. ^Normalised for one-off restructuring cost in Oman in 2025 and impact of Myanmar exit in 2024

Commenting on the results, HE Sheikh Faisal Bin Thani Al Thani, Chairman of Ooredoo, said:

"Ooredoo Group continues to redefine the digital infrastructure landscape of MENA. Our full-year performance, marked by a 6% YoY Revenue growth, excluding the impact of Myanmar exit, to QAR 24.6 billion and a double-digit Net Profit growth of 12% YoY to QAR 3.9 billion, demonstrates the accelerating momentum of our infrastructure‑led transformation.

A major milestone this year was the successful completion of a secondary fully marketed global offering, which significantly increased our free float and enhanced market liquidity and index inclusion. This transaction highlights investor confidence in our strategy and expands our shareholder base to include a broader and more international mix of investors.

I am also pleased to confirm that the Board of Directors will recommend a cash dividend distribution of QAR 0.75 per share at the Annual General Meeting in March. This is aligned with our recently updated progressive dividend policy, which reflects a new target payout ratio range of 50%-70% of normalised net profit, up from the previous 40%-60%. This revision underscores the Group's strong financial position, consistent cash generation, and our ongoing commitment to delivering greater value to shareholders.

Our operational performance continues to validate our strategic direction. We are delivering strong results while expanding our capabilities and reinforcing our competitive position. Our disciplined focus on profitable growth, supported by ongoing operational transformation, continues to enhance our advantage across the region.

With solid fundamentals and consistent execution of our infrastructure‑led model, Ooredoo is well positioned to deliver on its strategic priorities and create sustainable, long‑term value for all stakeholders.”

Also commenting on the results, Aziz Aluthman Fakhroo, CEO of Ooredoo Group, said:

“Our full-year 2025 performance reflects the strength of our strategy and consistent execution across our markets. Excluding the impact of Myanmar exit, Revenue grew by 6% YoY to reach QAR 24.6 billion with Normalised EBITDA increasing by 7% YoY. We also delivered a solid EBITDA margin of 42.6%.

Most notably, reported Net Profit grew at double‑digit levels for the fourth consecutive year, reaching another all‑time high. This reflects our disciplined commitment to maintaining healthy profitability across the portfolio and delivering record results year after year.

These results are a testament to the dedication and hard work of our talented employees.

The Group delivered broad‑based growth across our core operations, with particularly strong performances in Algeria, Iraq, Tunisia, Kuwait and Qatar. Our continued investments in network infrastructure and our commitment to excellence in customer experience strengthened commercial performance and lifted both top‑line and bottom‑line results.

We are accelerating our infrastructure strategy to unlock long‑term value. After year‑end, Syntys acquired Q Data, adding 5MW of live capacity and 7.5MW under development. This increases Qatar’s capacity to 26 MW and total Syntys capacity to 30MW, providing immediate revenue and EBITDA contribution while scaling toward our 120MW ambition.

Building on the successful delivery of our five-pillar strategy, we launched RISE, a clear, forward-looking framework to drive long-term, sustainable value. Under RISE, we will expand and diversify into new revenue streams through digital infrastructure and adjacent platforms, which are expected to contribute around 15% of Group revenue by 2030.

In a milestone moment for the market, we played a key role in Qatar’s first-ever secondary global offering, supporting ADIA’s sale of Ooredoo shares. The offering was multiple times oversubscribed, expanded our free float to 27% on the Qatar Stock Exchange, and reaffirmed strong investor confidence in our evolved business strategy as presented to investors prior to the offering at our Capital Markets Day.

Looking ahead, Ooredoo will continue to build on its strong foundations to become the region’s leading telecom and digital‑infrastructure provider. By executing our strategy, diversifying revenue streams, and maintaining a disciplined financial position, we remain focused on unlocking sustainable, long‑term value for all our stakeholders while capturing the emerging digital‑infrastructure opportunities in 2026.”