PHOTO

- The 10-year Sukuk carries a profit rate of 4.721%, attracted strong investor demand exceeding USD 1.6 billion from regional and international investors.

- The total outstanding value of Sukuk listed on Nasdaq Dubai now exceeds USD 104.9 billion.

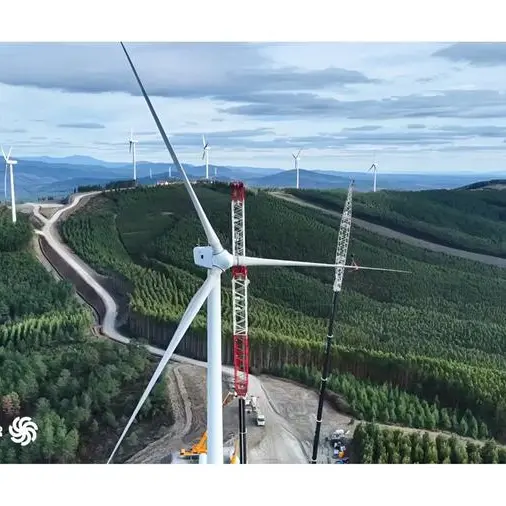

Dubai, UAE – Nasdaq Dubai welcomed the listing of a USD 500 million Sukuk issued by The Arab Energy Fund, a leading multilateral impact financial institution, marking its third issuance on the exchange.

Issued under the Trust Certificate Issuance Programme, the Sukuk comprises USD 500 million Trust Certificates with a profit rate of 4.721%. The senior unsecured Sukuk was issued at par and matures in 2036.

The Sukuk attracted strong investor demand, with an order book exceeding USD 1.6 billion, reflecting broad participation from regional and international investors. The Sukuk is rated Aa2 by Moody’s and AA+ by Fitch, in line with The Arab Energy Fund’s long-term credit ratings. This issuance marks The Arab Energy Fund’s first-ever 10-year Sukuk transaction, establishing a new longer-tenor pricing curve.

To mark the listing, Khalid Al-Ruwaigh, Chief Executive Officer, The Arab Energy Fund, rang the market-opening bell at Nasdaq Dubai, alongside Hamed Ali, Chief Executive Officer of Nasdaq Dubai and Dubai Financial Market (DFM), and senior representatives from both organisations.

Vicky Bhatia, Chief Financial Officer, The Arab Energy Fund, said: “This Sukuk issuance reflects strong investor confidence in The Arab Energy Fund’s credit strength and long-term mandate. Our return to Nasdaq Dubai underscores its role as a leading platform for Islamic finance and international capital markets."

Hamed Ali, CEO of Nasdaq Dubai and DFM, said: “We welcome The Arab Energy Fund’s Sukuk listing on Nasdaq Dubai, reflecting continued confidence among supranational issuers in our international debt capital markets. The listing contributes to the depth and diversity of our Sukuk market and highlights the role of Nasdaq Dubai in Islamic finance. We continue to support issuers in accessing capital and engaging a broad base of regional and international investors.”

Recently, The Arab Energy Fund also received regulatory approval to issue onshore Renminbi-denominated Panda Bonds in China, becoming the first multilateral financial institution in the MENA region to secure such approval, further strengthening its diversified funding strategy.

As of today, the total outstanding value of Sukuk listed on Nasdaq Dubai exceeds USD 104.9 billion, reinforcing the exchange’s position as one of the world’s leading venues for Islamic finance and international Sukuk listings, supported by a diversified issuer base and sustained issuance activity across sovereign, supranational and corporate segments.

About The Arab Energy Fund:

The Arab Energy Fund (The Fund) is a multilateral impact financial institution focused on the MENA energy and utility sectors, established in 1974 by ten Arab oil-exporting countries. The Fund’s mission is to support the energy ecosystem with debt and equity solutions to enable energy security and sustainability and to develop local value chains and services in the MENA region. The Arab Energy Fund creates impact by contributing to economic prosperity and enabling local communities via talent development and knowledge creation. The Fund offers a comprehensive range of funding solutions across the entire energy value chain to leading public and private sector business partners in over 35 markets. The Arab Energy Fund applies best-practice ESG principles across all operations, with environmental and socially linked projects comprising c.20% of its USD 5.8bn loan portfolio. The Arab Energy Fund is the only energy-focused financial institution in the MENA region rated ‘Aa2’ by Moody’s, ‘AA+’ by Fitch and ‘AA-’ by S&P.

About Nasdaq Dubai:

Nasdaq Dubai is the international financial exchange serving the region between Western Europe and East Asia. It welcomes regional as well as global issuers that seek regional and international investment. The exchange currently lists shares, derivatives, Sukuk (Islamic bonds), conventional bonds and Real Estate Investment Trusts (REITS). The majority shareholder of Nasdaq Dubai is Dubai Financial Market with a two-thirds stake. Borse Dubai owns one third of the shares. The regulator of Nasdaq Dubai is the Dubai Financial Services Authority (DFSA).

For further information, please contact:

Noora Al Soori

Communications and Public Relations

Dubai Financial Market

E: nalsoori@dfm.ae

Yasa Ahmad

Communications Department

The Arab Energy Fund

E: Yasa.Ahmad@edelmansmithfield.com

Shruti Choudhury

Associate Director

Edelman Smithfield

E: dfmedelmansmithfield@edelman.com