PHOTO

- Fawry continues its stellar performance, achieving outstanding growth with year-over-year revenue increase of 68.4% for FY2024 and 124.6% for the bottom-line for the same period, which reflected in the highest FY EBITDA and net income margins since the company’s inception, 49.9% and 29.2%, respectively.

Cairo, Egypt; Fawry (the “Company”, FWRY.CA on the Egyptian Exchange), Egypt’s leading provider of e-payments and digital finance solutions, announced today its consolidated results for the quarter ended 31 December 2024. The Company booked revenues of EGP 5,510.6 million in FY2024, up by 68.4% year-on-year (y-o-y). Strong top-line performance was driven by the expansion and diversification of the Company’s business offerings, which alongside effective cost control measures resulted in robust profitability margins leading to a net profit growth of 124.6% to reach EGP 1,606.7 million. Net profit for the quarter stood at EGP 500.1 million, up by an impressive 118.6% y-o-y yielding an associated net profit margin (NPM) of 30.0%.

Summary Profit & Loss Statement – Fourth Quarter

| (EGP 000s) | 4Q2023 | 3Q2024 | 4Q2024 | Y-o-Y Change | Q-o-Q Change |

| Total Revenues | 954,691 | 1,545,882 | 1,665,373 | 74.4% | 7.7% |

| Alternative Digital Payments (ADP) | 336,448 | 481,996 | 460,939 | 37.0% | -4.4% |

| Banking Services | 384,453 | 662,052 | 717,900 | 86.7% | 8.4% |

| Acceptance | 188,537 | 312,428 | 408,065 | 116.4% | 30.6% |

| Agent Banking | 195,916 | 349,623 | 309,835 | 58.1% | -11.4% |

| Financial Services | 142,301 | 277,169 | 358,777 | 152.1% | 29.4% |

| Supply Chain Solutions | 64,912 | 93,277 | 93,839 | 44.6% | 0.6% |

| Technology & Others | 26,577 | 31,389 | 33,919 | 27.6% | 8.1% |

| Gross Profit | 612,727 | 1,025,105 | 1,080,034 | 76.3% | 5.4% |

| Gross Profit Margin | 64.2% | 66.3% | 64.9% | 0.7 pts | (1.5 pts) |

| EBITDA1 | 406,669 | 802,612 | 867,737 | 113.4% | 8.1% |

| EBITDA Margin | 42.6% | 51.9% | 52.1% | 9.5 pts | 0.2 pts |

| Net Profit Before NCI | 259,757 | 519,473 | 543,681 | 109.3% | 4.7% |

| Net Profit After NCI | 228,797 | 477,775 | 500,108 | 118.6% | 4.7% |

| Net Profit Margin | 24.0% | 30.9% | 30.0% | 6.1 pts | (0.9 pts) |

1 EBITDA - The Company defines EBITDA as its EAS operating profit, excluding: (a) depreciation, amortization, provisions; (b) noncash ESOP expense included in EAS net profit; (c) interest income not related to the operating cycle; (d) taxes; (e) leasing charges; and certain other non-operating costs including provisions.

2 Financial services Revenue – Include MSME lending, Consumer finance, Insurance brokerage, Prepaid Card and Money market fund revenues. All except for Microfinance have been reallocated from Others.

Summary Profit & Loss Statement – Full Year

| (EGP 000s) | FY 2023 | FY 2024 | 2024 Y-o-Y Change |

| Total Revenues | 3,272,016 | 5,510,620 | 68.4% |

| Alternative Digital Payments (ADP) | 1,268,491 | 1,708,038 | 34.7% |

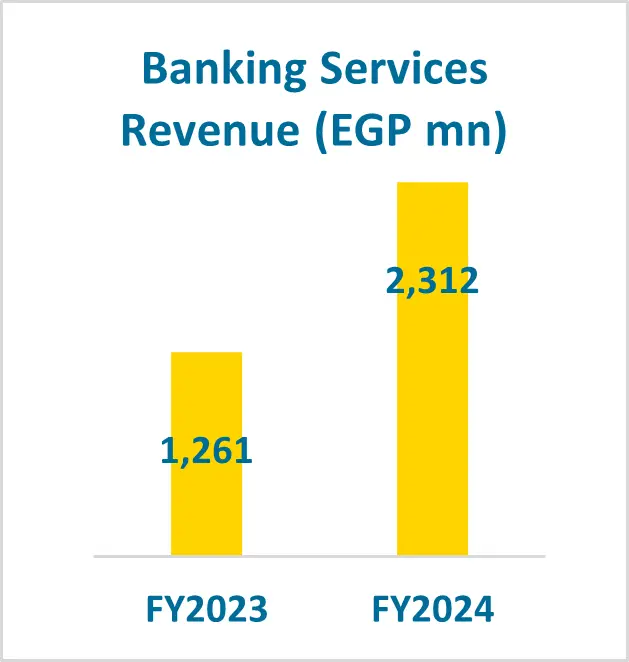

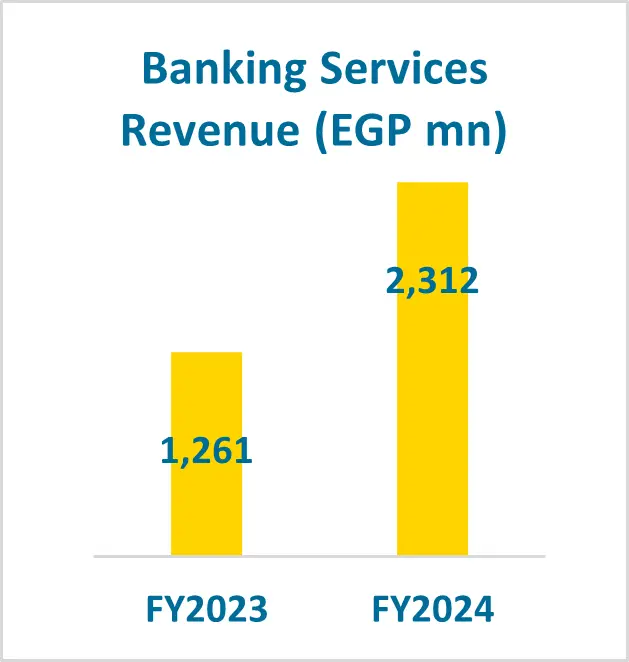

| Banking Services | 1,261,384 | 2,312,054 | 83.3% |

| Acceptance | 609,304 | 1,196,947 | 96.4% |

| Agent Banking | 652,080 | 1,115,108 | 71.0% |

| Financial Services | 426,407 | 1,013,634 | 137.7% |

| Supply Chain Solutions | 226,309 | 347,188 | 53.4% |

| Technology & Others | 89,424 | 129,706 | 45.0% |

| Gross Profit | 2,061,822 | 3,622,303 | 75.7% |

| Gross Profit Margin | 63.0% | 65.7% | 2.7 pts |

| EBITDA1 | 1,318,230 | 2,747,140 | 108.4% |

| EBITDA Margin | 40.3% | 49.9% | 9.6 pts |

| Net Profit Before NCI | 815,968 | 1,749,062 | 114.4% |

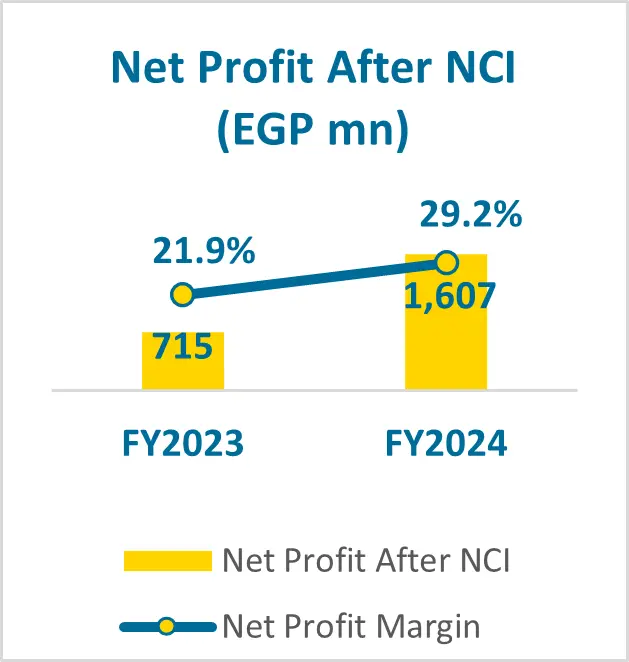

| Net Profit After NCI | 715,338 | 1,606,652 | 124.6% |

| Net Profit Margin | 21.9% | 29.2% | 7.3 pts |

1 EBITDA - The Company defines EBITDA as its EAS operating profit, excluding: (a) depreciation, amortization, provisions; (b) noncash ESOP expense included in EAS net profit; (c) interest income not related to the operating cycle; (d) taxes; (e) leasing charges; and certain other non-operating costs including provisions.

2 Financial services Revenue – Include MSME lending, Consumer finance, Insurance brokerage, Prepaid Card and Money market fund revenues. All except for Microfinance have been reallocated from Others.

Financial & Operational Highlights

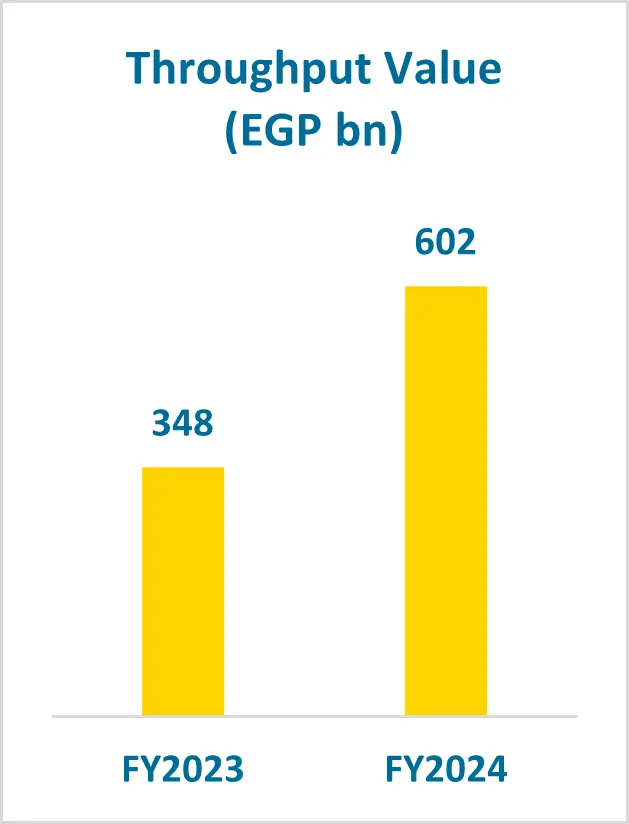

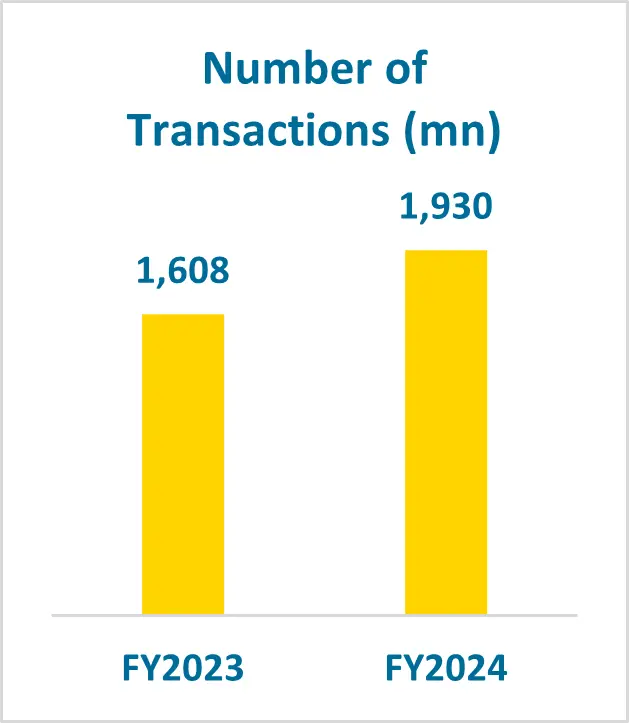

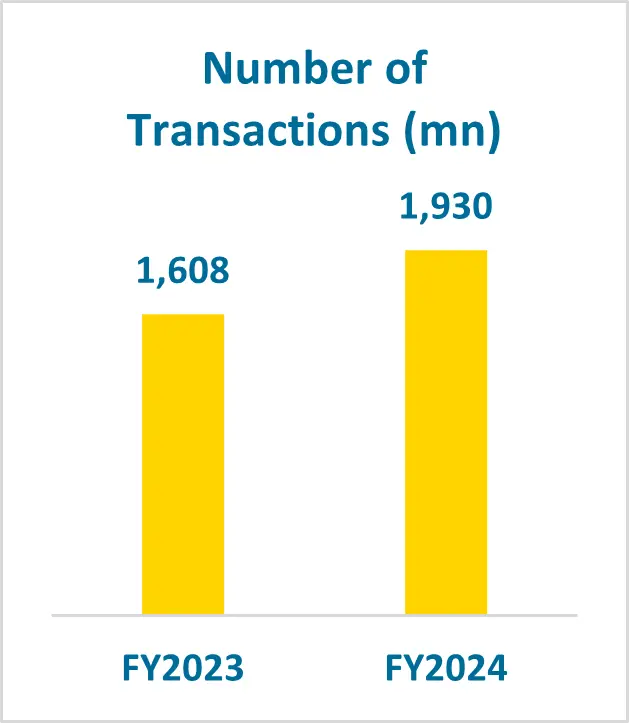

- Throughput value maintained its upward momentum, up 72.9% year-on-year to EGP 601.7 billion in FY2024, supported by the company’s ability to broaden its portfolio to address a diverse user base in Egypt.

- The company’s gross loan portfolio for both MSMEs and Consumers by end of 2024 came 2.6x that of 2023, surpassing EGP 3.1 billion.

- Fawry's top-line increased by 68.4% year-on-year, marking its highest growth rate since 2015, reaching EGP 5,510.6 million in FY2024. While for 4Q2024, topline year-on-year growth recorded a whopping 74.4%. This robust performance was driven by strong results across the company's business lines.

- The ADP segment experienced substantial year-on-year growth of 34.7%, fueled by the continuous addition of new billers, expansion of Point of Sale (POS) services, increased engagement with customers and merchants, and a rise in average ticket sizes driven by price increases in select industries. Despite this growth, ADP's contribution decreased to 31.0% in FY2024 from 38.8% in FY2023 as other revenue streams continued to grow.

- As a testament for the company’s success in its revenue diversification strategy, Banking services saw revenues increase by 83.3% year-on-year, financial services surged by 137.7% year-on-year, supply chain solutions experienced a notable year-on-year increase of 53.4%, and the technology and other sectors grew by 45.0% year-on-year.

- EBITDA more than doubled in FY2024 to EGP 2,747.1 million, reaching an EBITDA margin of 49.9%, with an EBITDA margin expansion of 9.6 ppts year over year, reflecting the company's success in growing its revenue streams while capitalizing on service synergy and improving operational cost efficiency. It is worth mentioning that the EBITDA margin has gone up by 19.2% vs. FY2022.

- Fawry’s bottom-line increased by an impressive 124.6% year-on-year to EGP 1,606.7 million in FY2024, reflecting both revenue growth and EBITDA margin enhancement.

Chief Executive’s Review

I am thrilled to share our FY2024 results, where we have once again exceeded market expectations, achieving unprecedented growth across both revenue and profitability. Our continued success reflects our commitment to expanding and diversifying our offerings across multiple verticals, advancing our long-term strategy for value creation and revenue diversification.

Fawry’s top-line surged by 68.4% year-on-year in FY2024, while profitability remained strong, with an exceptional EBITDA margin of 49.9% (+9.6 points)—the highest since the company’s inception. Bottom-line growth reached 124.6%, with an associated margin improvement of 7.3 percentage points to 29.2%, also marking an all-time high. These achievements were driven by increased customer engagement, revenue diversification, enhanced cross-selling initiatives, and cost-control measures.

Banking Services remained a primary driver of revenue growth, achieving an impressive 83.3% year-on-year increase, reflecting our strategy to diversify revenue streams and enhance financial inclusion.

Financial Services for MSMEs and Consumers saw exceptional momentum, with neobanking services fueling a 137.7% year-on-year revenue increase in FY2024. This growth was propelled by the launch of SME lending services and the Overdraft (BNPL for Business) product, leading to a 102.2% increase in the MSME gross loan portfolio, now reaching EGP 2.1 billion.

Fawry’s Consumer BNPL portfolio continued its strong expansion, surpassing EGP 1.0 billion as of December 31, 2024. This growth is further propelled by the increasing capabilities of the myFawry app, which has evolved into a comprehensive financial platform. The seamless integration of Prepaid Cards, BNPL services, and the Money Market Fund “Fawry Yawmy,” along with the recent addition of Emergency and Medical insurance options, has significantly enhanced the app’s value proposition. These strategic enhancements have cemented Fawry’s position as a leading provider of holistic financial solutions, driving a threefold year-on-year increase in myFawry’s throughput to EGP 26.8 billion.

Our Alternative Digital Payments segment maintained robust growth of 34.6% year-on-year, reinforcing its role as the backbone of our digital ecosystem. Additionally, our Supply Chain Solutions division recorded a 53.4% increase in revenue, further cementing Fawry’s transformation into a comprehensive financial services ecosystem.

Operationally, Fawry delivered outstanding performance in FY2024, with mobile wallet transactions increasing by 53.9% year-on-year, and total processed value via mobile wallets growing by 155.7% y-o-y to EGP 486.3 billion.

As we look to the future, our focus remains on building a multi-sided platform that fosters seamless interactions across our network. Through continuous innovation and service expansion, we are committed to addressing the diverse needs of our customers while driving financial inclusion for Egypt’s unbanked and underserved communities.

We are also particularly excited about the launch of “Fawry Business”, which will significantly enhance our position as a one-stop digital business solutions provider. By expanding Fawry Business capabilities in ERP and financial management tools, integrating seamless digital payment solutions, and developing tailored fintech innovations for SMEs and large enterprises, we are paving the way for a more interconnected and efficient digital economy.

FY2024 has been a landmark year for Fawry, and we remain steadfast in our mission to drive innovation, expand access to financial services, and deliver long-term value for all stakeholders.

Eng. Ashraf Sabry, Chief Executive Officer

| Operational Developments

Consolidated Financial Performance

Segments Overview Alternative Digital Payments

Banking Services

Financial Services

Supply Chain Solutions

|

|

|

INVESTOR RELATIONS CONTACT

For further information, please contact:

Hassan Abdelgelil

Director of Investor Relations

investor.relations@fawry.com

Building 221 – F12 – Financial district – Smart Village

About Fawry for Banking Technology and Electronic Payments

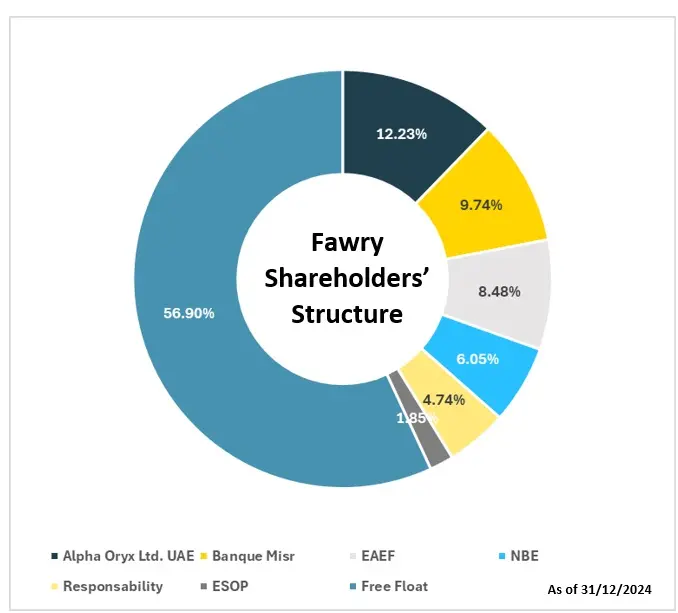

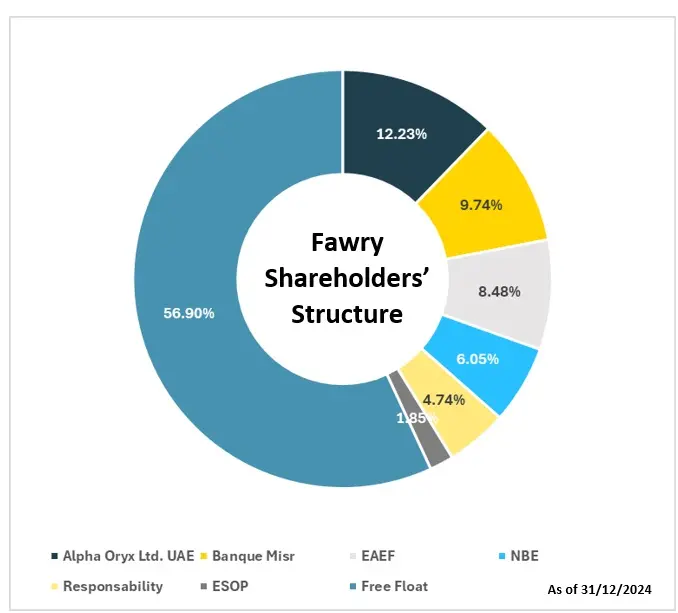

| As of 31/12/2024 |

Founded in 2008, Fawry is the largest e-payment platform in Egypt serving the banked and unbanked population. Fawry’s primary services include enabling electronic bill payments, mobile top-ups and provisions for millions of Egyptian users. Other digital services also include e-ticketing, cable TV, and variety of other services. Through its peer-to-peer model, Fawry is enabling corporates and SMEs to accept electronic payments through a number of platforms including websites, mobile phones, and POSs. With a network of 36 member banks, its mobile platform and more than 372 thousand agents, Fawry processes more than 6 million transactions per day, serving an estimated customer base of 53.1 million users monthly. Learn more at www.fawry.com.

-Ends-

[1] These figures reflect total processed value and transactions from bank and operators’ wallets processed on the Fawry Network and not included in the company’s total throughput.