PHOTO

- Fawry continues its strong momentum into 2025, delivering exceptional growth in 1Q2025 with revenues up 65.1% and net income surging 97.1% year-on-year. The performance reflects sustained strategic business expansion and disciplined cost control, reinforcing the company's ability to scale efficiently while maintaining profitability.

- A key milestone this quarter was EBITDA surpassing EGP 1.0 billion—marking the highest quarterly result in the company’s history—and reflecting Fawry’s continued success in combining operational scale with strong financial discipline.

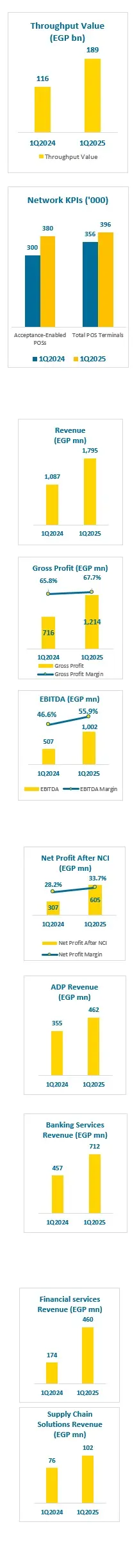

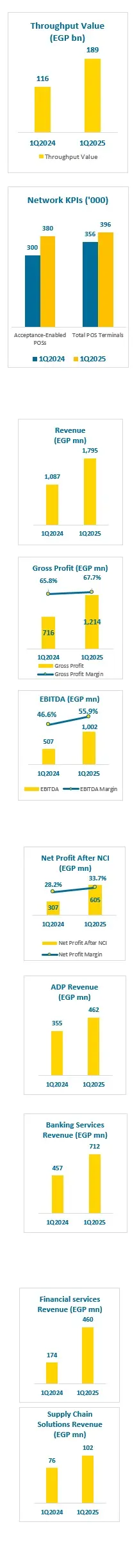

1Q2025 Highlights

Cairo, Egypt: Fawry (the “Company”, FWRY.CA on the Egyptian Exchange), Egypt’s leading Fintech Company, announced today its consolidated results for the quarter ended 31 March 2025. The Company booked revenues of EGP 1,794.8 million in 1Q2025, up by 65.1% year-on-year (y-o-y). Strong top-line performance was driven by the expansion and diversification of the Company’s business offerings, which alongside effective cost control measures resulted in robust profitability margins. Net profit for the quarter stood at EGP 605.4 million, up by an impressive 97.1% y-o-y yielding an associated net profit margin (NPM) of 33.7%.

Summary Profit & Loss Statement – First Quarter

| (EGP 000s) | 1Q2024 | 4Q2024 | 1Q2025 | Y-o-Y Change | Q-o-Q Change |

| Total Revenues | 1,087,190 | 1,665,373 | 1,794,765 | 65.1% | 7.8% |

| Alternative Digital Payments (ADP) | 354,837 | 460,939 | 461,960 | 30.2% | 0.2% |

| Banking Services | 456,941 | 717,900 | 712,209 | 55.9% | -0.8% |

| Acceptance | 227,432 | 408,065 | 382,799 | 68.3% | -6.2% |

| Agent Banking | 229,508 | 309,835 | 329,410 | 43.5% | 6.3% |

| Financial Services | 174,188 | 358,777 | 460,215 | 164.2% | 28.3% |

| Supply Chain Solutions | 75,639 | 93,839 | 102,304 | 35.3% | 9.0% |

| Technology & Others | 25,586 | 33,919 | 58,077 | 127.0% | 71.2% |

| Gross Profit | 715,620 | 1,080,034 | 1,214,290 | 69.7% | 12.4% |

| Gross Profit Margin | 65.8% | 64.9% | 67.7% | 1.8 pts | 2.8 pts |

| EBITDA1 | 506,615 | 867,737 | 1,002,396 | 97.9% | 15.5% |

| EBITDA Margin | 46.6% | 52.1% | 55.9% | 9.3 pts | 3.7 pts |

| Net Profit Before NCI | 333,719 | 543,681 | 641,668 | 92.3% | 18.0% |

| Net Profit After NCI | 307,090 | 500,108 | 605,378 | 97.1% | 21.0% |

| Net Profit Margin | 28.2% | 30.0% | 33.7% | 5.5 pts | 3.7 pts |

1 EBITDA - The Company defines EBITDA as its EAS operating profit, excluding: (a) depreciation, amortization, provisions; (b) noncash ESOP expense included in EAS net profit; (c) interest income not related to the operating cycle; (d) taxes; (e) leasing charges; and certain other non-operating costs including provisions.

2 Financial services Revenue – Include Microfinance, Consumer finance, Insurance, Prepaid Card and Money market fund revenues. All except for Microfinance have been reallocated from Others.

Financial & Operational Highlights

- Throughput increased by 62.2% y-o-y, to EGP 188.5 billion in 1Q2025, mainly on Banking Services which continue to outpace ADP and Supply Chain in Throughput growth and contribute to 66.1% of total throughput vs. 56.2% in 1Q2024.

- Total loan portfolio reached EGP 3.7 billion by the end of 1Q2025, representing a 2.5x increase compared to 1Q2024. This remarkable growth highlights Fawry’s enhanced ability to meet rising demand from both MSME and consumer segments, reinforcing its position as a key enabler of financial inclusion.

- Top-line revenue climbed 65.1% year-on-year to EGP 1,794.8 million, fueled by strong momentum across all business lines—particularly in Financial Services and Acceptance, which delivered standout performances.

- Fawry’s strategic push to diversify its revenue streams is bearing fruit, with all key business verticals expanding significantly: Banking Services revenue rose 55.9% y-o-y, now comprising nearly 40% of total revenue. Financial Services revenue soared 164.2% y-o-y, accounting for 25.6% of revenue. Supply Chain Solutions saw a healthy 35.3% y-o-y increase, while Technology and Other Revenue surged by 127.0% y-o-y, reflecting innovation and expanded service offerings.

- ADP (Alternative Digital Payments) registered a solid 30.2% y-o-y revenue growth, driven by expanded POS infrastructure, greater customer and merchant engagement, and higher average ticket sizes in inflation-sensitive industries. However, its share of total revenue declined to 25.7% from 32.6% in 1Q2024, as faster-growing segments gained traction.

- EBITDA nearly doubled, rising 97.9% y-o-y to EGP 1,002.4 million, highlighting Fawry’s ability to scale efficiently, unlock service synergies, and control operational costs effectively.

- Net profit soared 97.1% y-o-y to EGP 605.4 million, reflecting both robust revenue expansion and significant improvement in EBITDA margin.

Chief Executive’s Review

I am pleased to report that Fawry has started 2025 on a strong footing, delivering continued operational and financial growth in the first quarter, while making significant strides in advancing our long-term value creation strategy. In 1Q2025, Fawry recorded a robust 65.1% year-on-year increase in top-line performance. Profitability also remained solid, with EBITDA margin improving by 9.3 percentage points to 55.9%, and bottom-line growth soaring by 97.1%, accompanied by a 5.5 percentage-point expansion in net margin to 33.7%.

From a segmental perspective, Financial Services was the primary driver of growth, contributing 40% to overall top-line expansion and delivering a remarkable 164.2% year-on-year increase. Our Banking Services segment—Fawry’s second-largest revenue contributor—also delivered impressive results, with revenues growing 55.9% year-on-year. Meanwhile, Supply Chain Solutions saw a 35.3% increase in revenues, reflecting our strategic evolution into a holistic ecosystem offering a broad range of value-added services. Additionally, our Alternative Digital Payments segment maintained solid momentum, growing 30.2% year-on-year and continuing to serve as the backbone of our interconnected ecosystem as it matures alongside other expanding verticals.

A key driver of our continued growth has been Fawry’s strategic focus on expanding its digital service offerings—empowering consumers to seamlessly meet their everyday financial needs while enabling businesses to grow and compete more effectively through our integrated digital platforms. At the same time, we have made targeted investments in streamlining our internal operations, strengthening our ability to serve clients with greater agility, efficiency, and precision.

We are also placing strong emphasis on monetizing our Technology, as evidenced by a 125% year-over-year increase in technology-related revenues. This significant growth highlights the success of our efforts so far. Technology monetization will remain a core strategic priority and is expected to play an increasingly important role in driving our revenue growth in the coming years.

On the consumer front, the myFawry app and Prepaid Yellow Card continue to operate as a unified financial hub, offering a wide suite of services including bill payments, promotional offers, Buy Now Pay Later (BNPL) solutions, medical insurance, and access to our Money Market Fund. Annualized throughput on myFawry surged by 117.5% to EGP 27.4 billion. This integrated offering has enabled strong momentum in our Consumer Finance portfolio, with BNPL loan balances exceeding EGP 1.3 billion as of the end of 1Q2025. Simultaneously, the NAV of our Money Market Fund crossed EGP 1.8 billion, further reinforcing the app’s growing role as a neo-banking platform.

On the business side, we continue to enhance Fawry Business, our digital platform tailored for enterprises. In addition to payroll cards and acceptance solutions, we have introduced corporate cards and supplier payment tools that give businesses tighter control over expenses and improved cash flow visibility. These offerings reflect our growing focus on embedded financial services that deliver operational efficiency and real-time financial management.

To further support small and medium enterprises (SMEs), we have embedded working capital financing directly into the payment journey, providing seamless, on-demand access to credit at the point of transaction. This embedded finance approach eliminates friction, enhances liquidity for merchants, and aligns with our mission to create a more inclusive and digitally empowered business ecosystem.

Additionally, we are advancing our strategy to leverage our big data and AI platform across key areas such as dynamic customer engagement, fraud detection, credit scoring, and code generation. These initiatives aim to deliver more personalized customer experiences, enable behavior-driven decision-making, and boost operational productivity.

Lastly, we are proud to have achieved a major regional and global milestone with the successful MPOC certification of our in-house developed Soft POS solution, Tap N Pay. Fawry is now the first company in the MENA region to secure both CPOC and MPOC certifications, and the 10th globally to receive MPOC. Tap N Pay stands as the first fully Egyptian-built Soft POS platform, with full copyright ownership retained by Fawry.

These achievements are a testament to our unwavering focus on innovation and our commitment to meeting the diverse needs of our customers. Our strong performance in 1Q2025 underscores our ability to execute on our strategic priorities while continuing to expand our offerings, improve customer experience, and lead the digital transformation of financial services in Egypt.

Looking ahead, Fawry remains firmly committed to delivering sustainable growth and long-term value for all stakeholders, while playing an active role in the development of Egypt’s financial sector and broader digital economy.

Eng. Ashraf Sabry

Chief Executive Officer

| Operational Developments

Fawry’s total throughput value reached EGP 188.5 billion in 1Q2025, up by a significant 62.2% from the EGP 116.2 billion booked in 1Q2024.

Consolidated Financial Performance

Segments Overview Alternative Digital Payments

Banking Services

Financial Services

Supply Chain Solutions

|

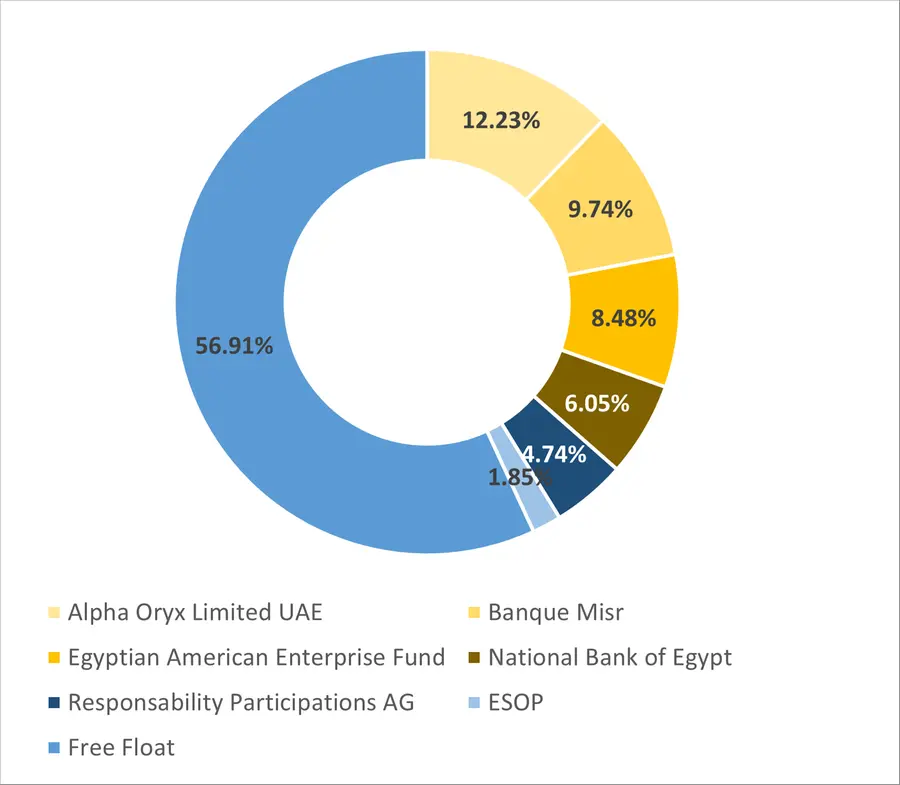

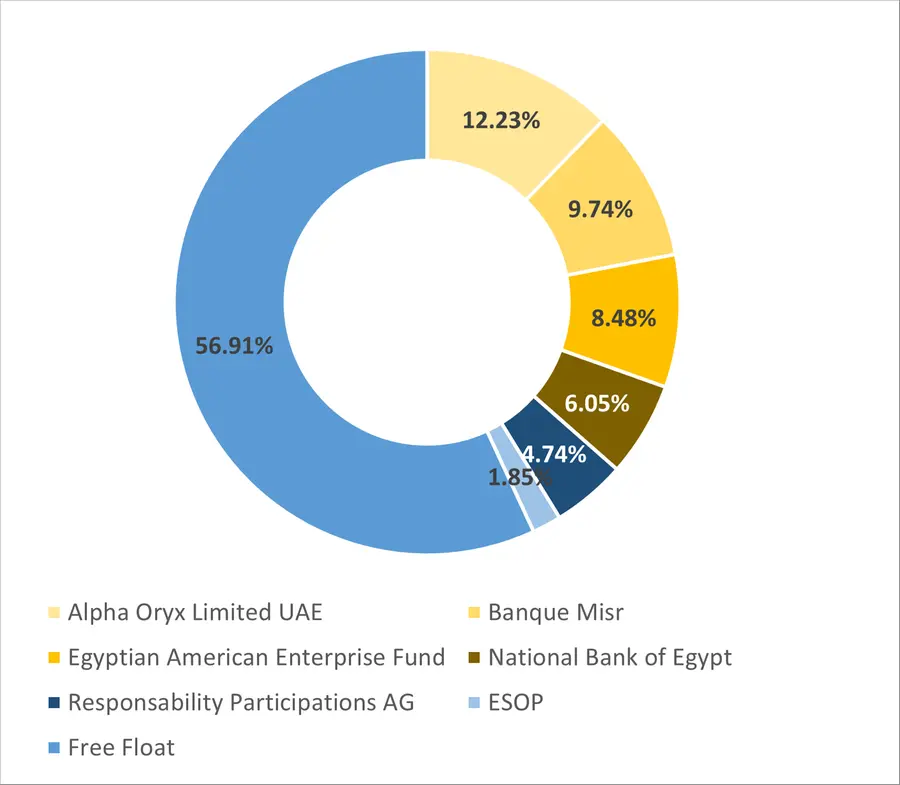

About Fawry for Banking Technology and Electronic Payments

Founded in 2008, Fawry is the largest e-payment platform in Egypt serving the banked and unbanked population. Fawry’s primary services include enabling electronic bill payments, mobile top-ups and provisions for millions of Egyptian users. Other digital services also include e-ticketing, cable TV, and variety of other services. Through its peer-to-peer model, Fawry is enabling corporates and SMEs to accept electronic payments through a number of platforms including websites, mobile phones, and POSs. With a network of 36 member banks, its mobile platform and 396 thousand agents, Fawry processes more than 6 million transactions per day, serving an estimated customer base of 53.8 million users monthly. Learn more at www.fawry.com.

INVESTOR RELATIONS CONTACT

For further information, please contact:

Hassan Abdelgelil

Director of Investor Relations

investor.relations@fawry.com

Building 221 – F12 – Financial district – Smart Village