PHOTO

- Revenue surged by 63.8%, while net profit doubled, reflecting the company's enhanced operational efficiency and market traction.

1H2025 Highlights

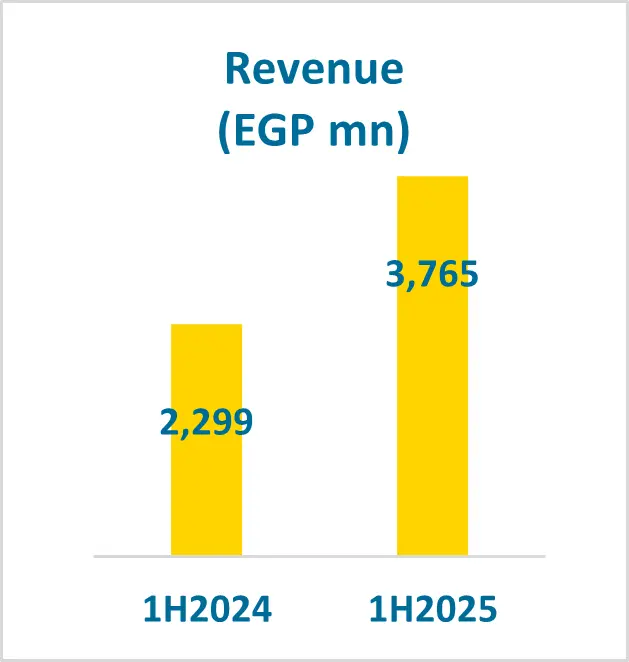

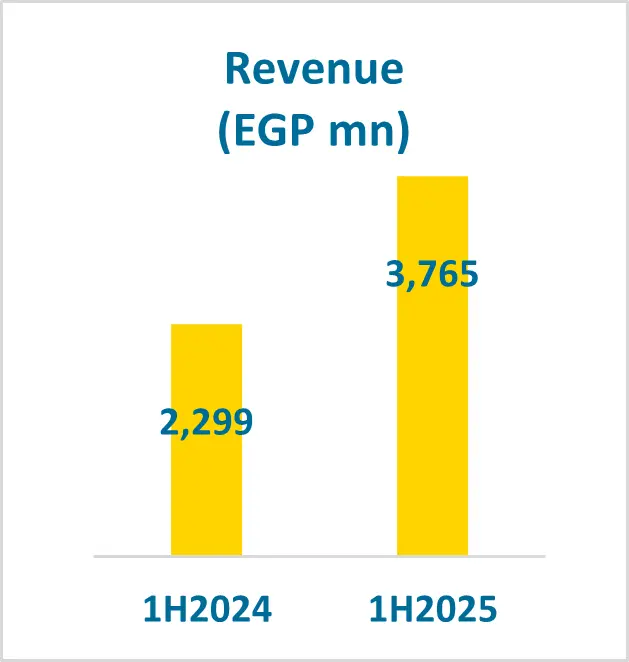

Cairo, Egypt: Fawry (the “Company”, FWRY.CA on the Egyptian Exchange), Egypt’s leading provider of e-payments and digital finance solutions, announced today its consolidated results for the quarter ended 30 June 2025. The Company booked revenues of EGP 3,765.5 million in 1H2025, up by 63.8% year-on-year (y-o-y). The Company’s strong top-line growth was underpinned by the continued diversification of its service portfolio. This, along with effective cost management and sound treasury practices, supported the delivery of healthy profitability margins leading to a net profit growth of 99.9% to reach EGP 1,257.0 million. Net profit for the quarter stood at EGP 651.6 million, up by an impressive 102.6% y-o-y yielding an associated net profit margin (NPM) of 33.1%.

Summary Profit & Loss Statement – Second Quarter

| (EGP 000s) | 2Q 2024 | 1Q 2025 | 2Q 2025 | Y-o-Y Change | Q-o-Q Change |

| Total Revenues | 1,212,174 | 1,794,765 | 1,970,717 | 62.6% | 9.8% |

| Banking Services | 475,162 | 712,209 | 733,411 | 54.3% | 3.0% |

| Acceptance | 249,021 | 382,799 | 430,683 | 73.0% | 12.5% |

| Agent Banking | 226,141 | 329,410 | 302,728 | 33.9% | -8.1% |

| Financial Services | 203,501 | 460,215 | 562,325 | 176.3% | 22.2% |

| Alternative Digital Payments (ADP) | 410,266 | 461,960 | 505,733 | 23.3% | 9.5% |

| Supply Chain Solutions | 84,433 | 102,304 | 119,491 | 41.5% | 16.8% |

| Technology & Others | 38,812 | 58,077 | 49,757 | 28.2% | -14.3% |

| Gross Profit | 801,545 | 1,214,290 | 1,352,753 | 68.8% | 11.4% |

| Gross Profit Margin | 66.1% | 67.7% | 68.6% | 2.5 pts | 1.0 pts |

| EBITDA1 | 570,176 | 1,002,396 | 1,112,704 | 95.2% | 11.0% |

| EBITDA Margin | 47.0% | 55.9% | 56.5% | 9.4 pts | 0.6 pts |

| Net Profit Before NCI | 352,193 | 641,668 | 693,367 | 96.9% | 8.1% |

| Net Profit After NCI | 321,682 | 605,378 | 651,586 | 102.6% | 7.6% |

| Net Profit Margin | 26.5% | 33.7% | 33.1% | 6.5 pts | (0.7 pts) |

1 EBITDA - The Company defines EBITDA as its EAS operating profit, excluding: (a) depreciation, amortization, provisions; (b) noncash ESOP expense included in EAS net profit; (c) interest income not related to the operating cycle; (d) taxes; (e) leasing charges; and certain other non-operating costs including provisions.

2 Financial services Revenue – Include MSME lending, Consumer finance, Insurance brokerage, Prepaid Card and Money market fund revenues. All except for Microfinance have been reallocated from Others.

Summary Profit & Loss Statement – First Half

| (EGP 000s) | 1H 2024 | 1H 2025 | Y-o-Y Change |

| Total Revenues | 2,299,365 | 3,765,482 | 63.8% |

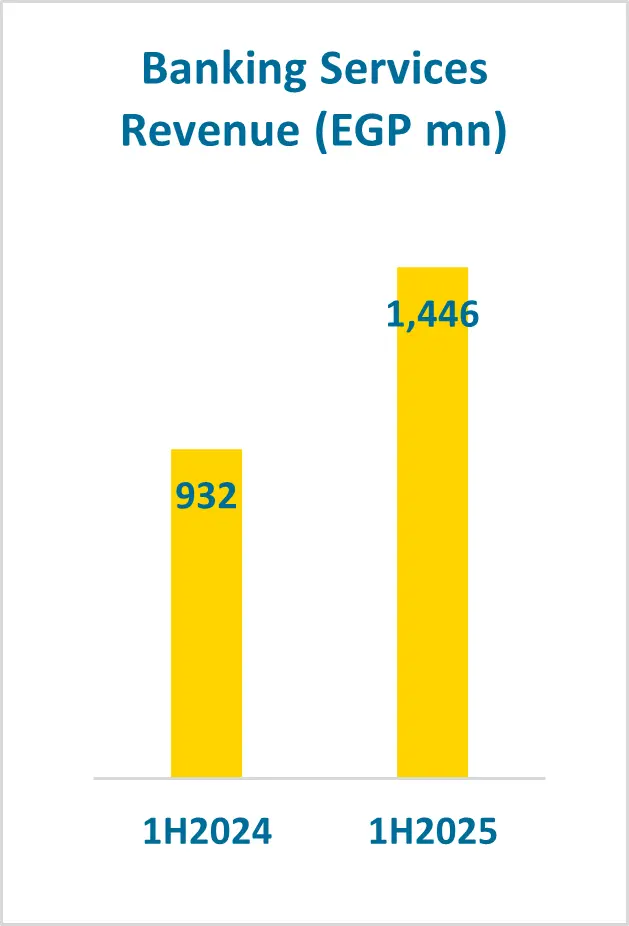

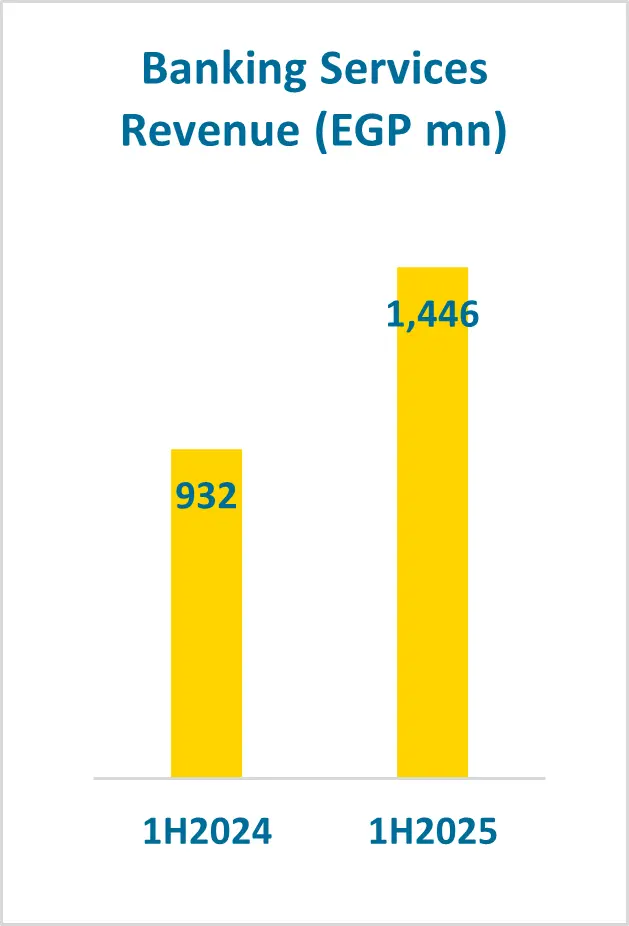

| Banking Services | 932,103 | 1,445,620 | 55.1% |

| Acceptance | 476,453 | 813,482 | 70.7% |

| Agent Banking | 455,649 | 632,138 | 38.7% |

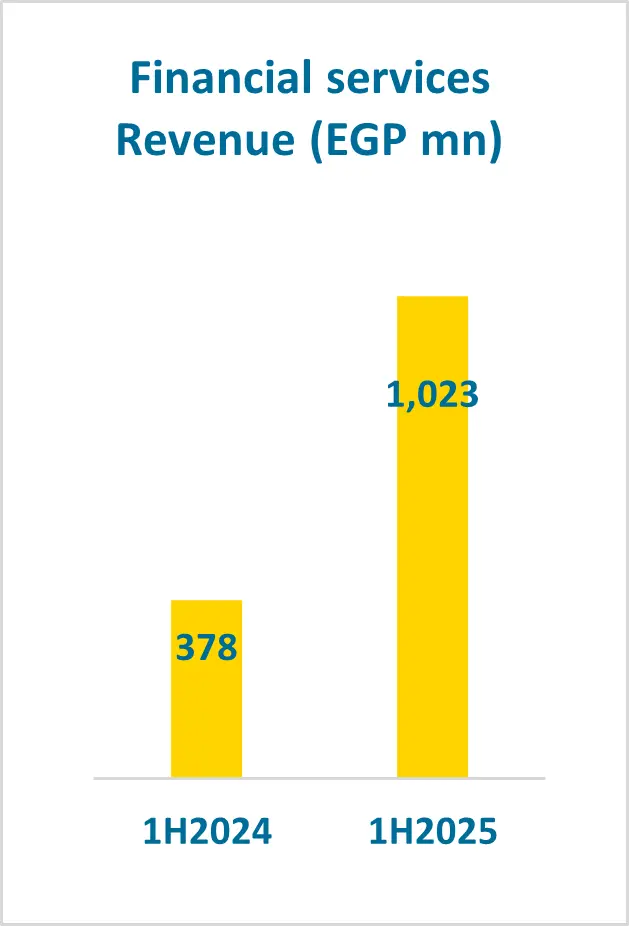

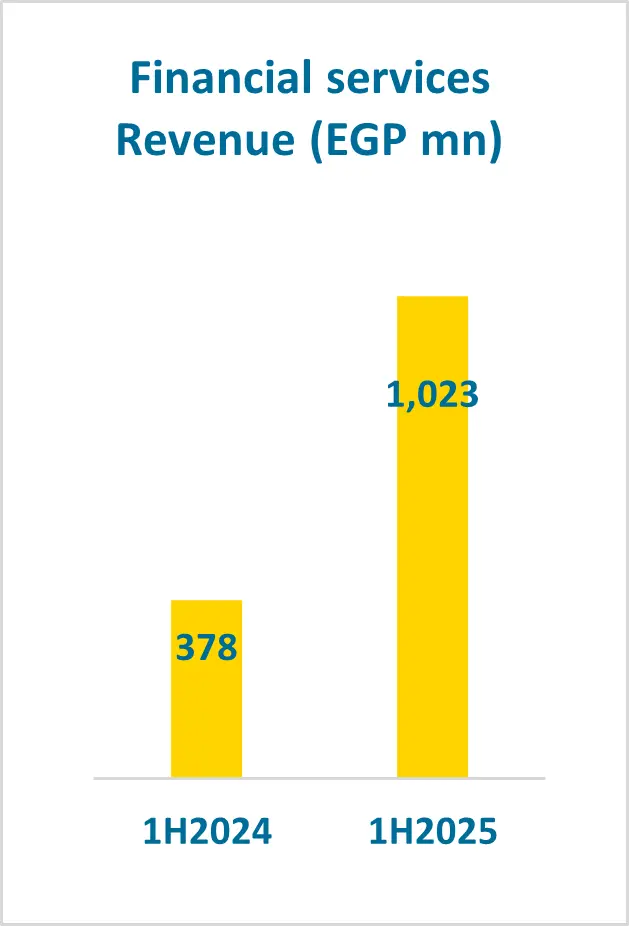

| Financial Services | 377,689 | 1,022,540 | 170.7% |

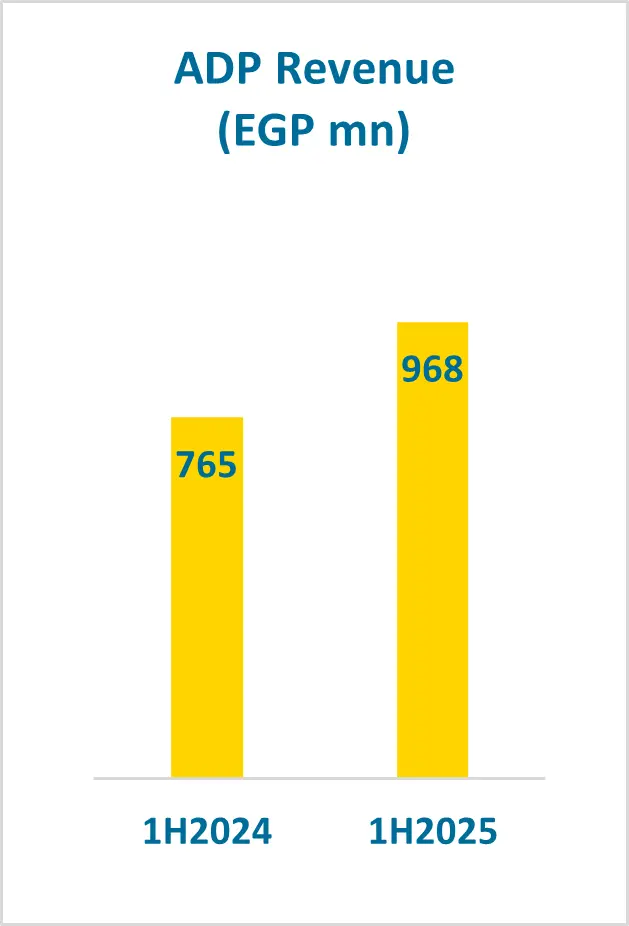

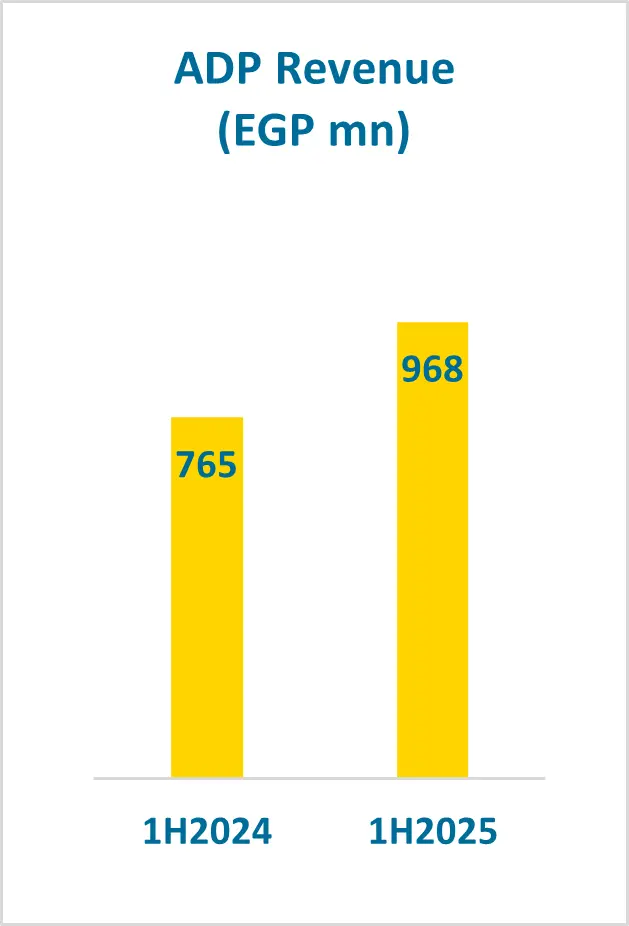

| Alternative Digital Payments (ADP) | 765,103 | 967,693 | 26.5% |

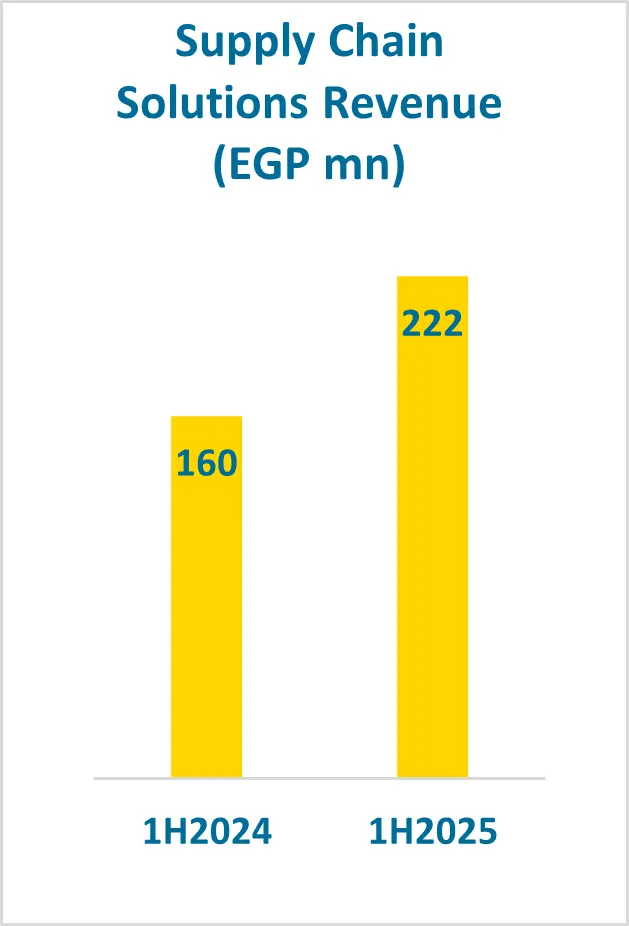

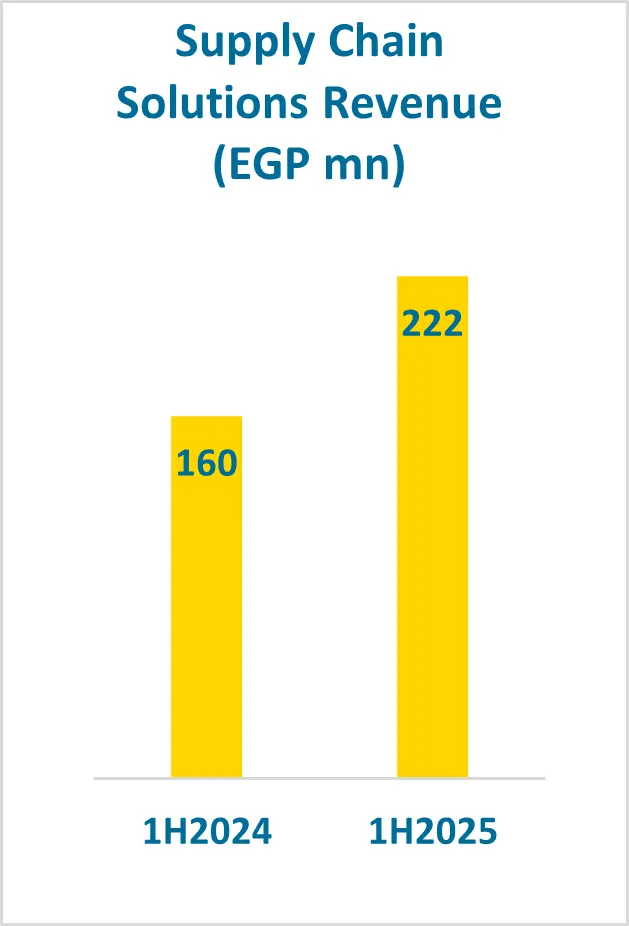

| Supply Chain Solutions | 160,072 | 221,795 | 38.6% |

| Technology & Others | 64,398 | 107,835 | 67.5% |

| Gross Profit | 1,517,164 | 2,567,043 | 69.2% |

| Gross Profit Margin | 66.0% | 68.2% | 2.2 pts |

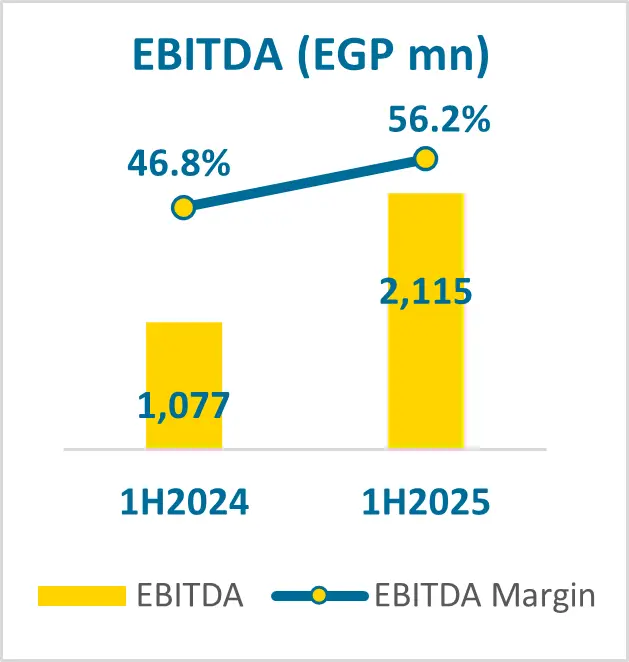

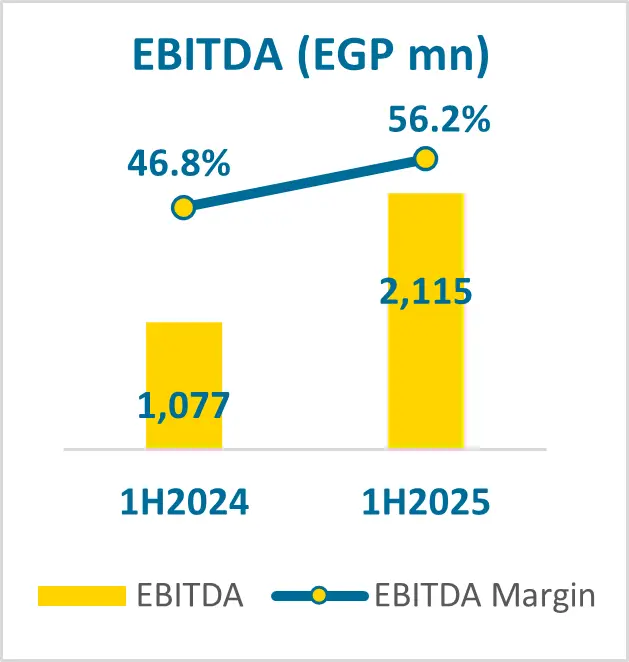

| EBITDA1 | 1,076,791 | 2,115,101 | 96.4% |

| EBITDA Margin | 46.8% | 56.2% | 9.3 pts |

| Net Profit Before NCI | 685,912 | 1,335,034 | 94.6% |

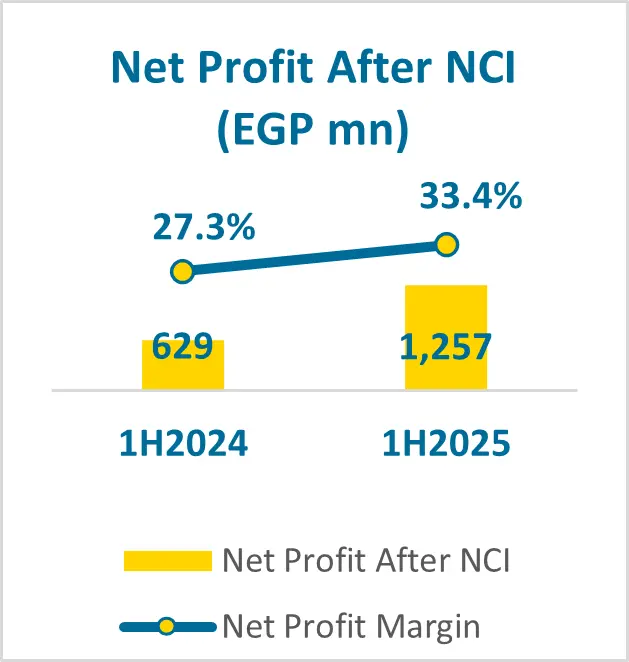

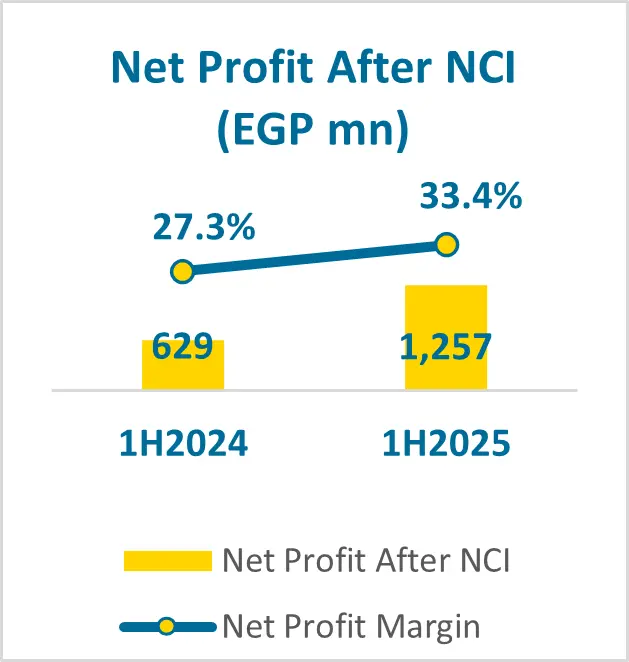

| Net Profit After NCI | 628,772 | 1,256,964 | 99.9% |

| Net Profit Margin | 27.3% | 33.4% | 6.0 pts |

1 EBITDA - The Company defines EBITDA as its EAS operating profit, excluding: (a) depreciation, amortization, provisions; (b) noncash ESOP expense included in EAS net profit; (c) interest income not related to the operating cycle; (d) taxes; (e) leasing charges; and certain other non-operating costs including provisions.

2 Financial services Revenue – Include MSME lending, Consumer finance, Insurance brokerage, Prepaid Card and Money market fund revenues. All except for Microfinance have been reallocated from Others.

Financial & Operational Highlights

- Fawry delivered a strong top-line performance in the first half of 2025, with revenues rising by 63.8% year-on-year to EGP 3,765.5 million. This robust growth was underpinned by solid contributions across the Company’s diverse business lines.

- Fawry’s revenue diversification strategy continued to gain strong momentum in 1H2025, with robust year-on-year growth across key business lines. Banking Services, now the Company’s largest revenue contributor, grew by 55.1%, accounting for 38.4% of total revenue for the period. Financial Services posted the highest growth rate, surging by 170.7% to represent 27.2% of total revenue. Meanwhile, ADP maintained solid performance with a 26.5% year-on-year increase, contributing 25.7% of total revenue—down from its position as the top revenue generator just two years ago, now ranking as the third-largest segment. Supply Chain Solutions advanced by 38.6%, making up 5.9% of total revenue, while Technology and Other segments grew by 67.5%, contributing 2.9%.

- Total Gross loan portfolio across Micro, SME and Consumer Businesses increased by 121.0% y-o-y to reach EGP 3,859.7 million.

- EBITDA nearly doubled in 1H2025 to EGP 2,115.1 million, underscoring Fawry’s success in scaling its operations while leveraging service synergies, optimizing treasury management, and driving improved cost efficiency.

- Net profit grew by 99.9% year-on-year to EGP 1,257.0 million, supported by top-line expansion and improved EBITDA margins, underscoring the Company’s operational leverage.

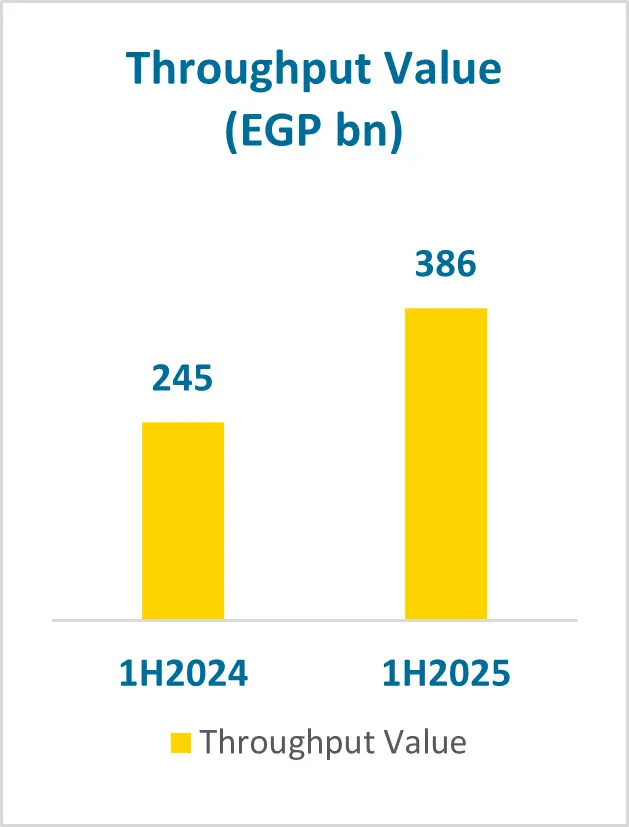

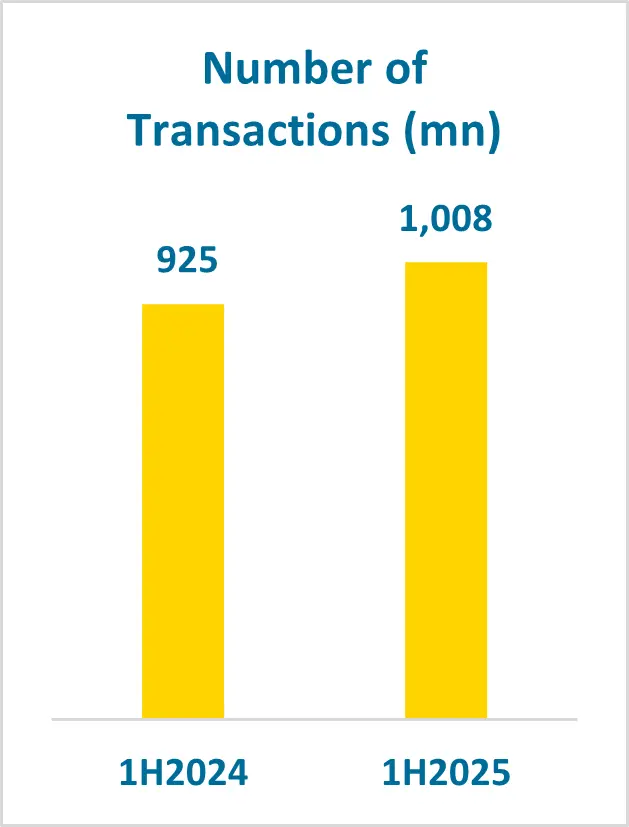

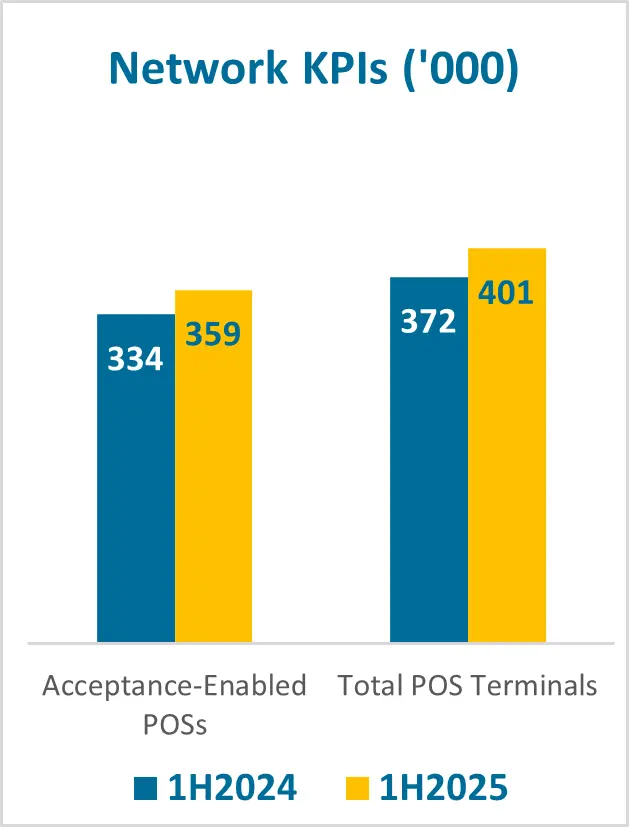

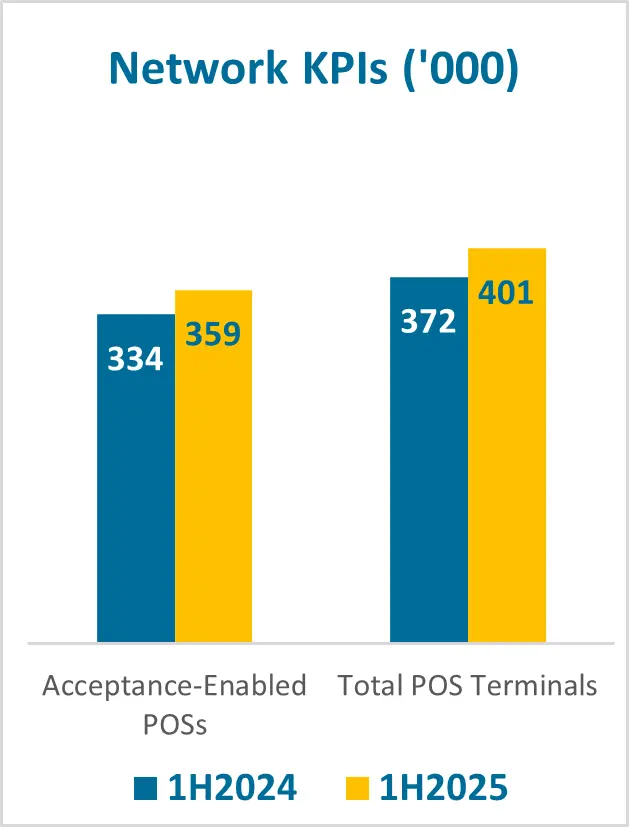

- Throughput value continued its strong upward trend, increasing by 57.6% year-on-year to reach EGP 385.9 billion in 1H2025. This growth was fueled by Fawry’s success in broadening its service portfolio to cater to a wide and diverse user base across Egypt.

Chief Executive’s Review

I am proud to report that in 2Q2025, Fawry has continued its upward trajectory, achieving substantial operational and financial growth, and making significant progress on our long-term value creation and revenue diversification strategy. Overall, Fawry’s top-line recorded a solid 62.6% year-on-year increase in 2Q2025, while profitability remained robust with an impressive EBITDA margin of 56.5% (+9.4 points), and bottom-line growth of 102.6%, with an associated margin enhancement of 6.5 percentage points to 33.1%.

On a segment basis, in 2Q2025, Financial Services was the primary driver of our top-line expansion (47.3% of the y-o-y growth), delivering a notable 176.3% year-on-year growth, reaping the rewards of its expansion into neobanking, with the nascent venture. Banking Services came in second in terms of contribution of the top line expansion (34.0% of the y-o-y growth), highlighting our commitment to diversifying revenue streams. While Alternative Digital Payments segment contributed to only 12.6% of the y-o-y revenue growth, it still, demonstrated solid growth of 23.3% year-on-year, underscoring its pivotal role as the foundation of our interconnected ecosystem while maturing alongside other expanding business lines. Lastly, the Supply Chain Solutions division saw a significant revenue increase of 41.5%, showcasing our transformation into an ecosystem offering a wide array of value-added services beyond our core offerings.

For consumers, we remain committed to delivering convenience, trust, and a broad range of accessible financial services. The myFawry app is evolving into a comprehensive personal finance hub, enabling bill payments, mobile top-ups, and digital wallet services, complemented by lending and insurance offerings. This quarter, we launched our credit card program, expanding consumer access to credit and flexible payment solutions beyond BNPL. We also broadened our investment portfolio beyond the money market fund , adding an EGX30 index fund, a gold fund, and a Sharia-compliant fund, empowering customers with diverse savings and investment tools. In parallel, we upgraded the Yellow Card program with richer rewards, added benefits, and exclusive offers. By combining intuitive design with AI-driven personalization, we are deepening customer engagement, strengthening loyalty, and setting new benchmarks for everyday financial convenience.

For retail merchants, we remain committed to providing tools that boost sales, enhance operational efficiency, and support sustainable growth. Our Buy Now, Pay Later (BNPL) for Business program now serves 120,000 merchants, with purchase volumes reaching EGP 5 billion. This working capital solution is helping retailers expand their businesses and meet customer demand more effectively. We also pilot-launched “Ordarak Fawry,” a dedicated marketplace connecting retailers and suppliers. While still in its pilot stage, our expanding portfolio of services positions retailers to broaden their offerings, attract more customers, and operate with greater efficiency.

For enterprise clients, we launched Fawry Business, an end-to-end platform for collections, payments, and expense management. The solution features a corporate card program to streamline expense payments and improve cost control, a payroll solution integrated with myFawry, and our recently acquired ERP system. With unified tools for managing cash flow, collections, and supplier payments, Fawry Business enables enterprises to both drive growth and optimize financial operations. This solidifies our position as a strategic partner for large organizations seeking greater efficiency and business expansion.

I would also like to re-iterate the new milestones achieved this year in our lending business with total gross loan portfolio growing by 121.0% y-o-y reaching EGP 3,859.7 million as of 30 June 2025. This is achieved despite offloading part of our loan portfolio due to the successful securitization issuance achieved during the quarter reflecting the credibibility of our portfolio . It is also worth mentioning that our fully owned subsidiary Fawry MSME Finance has officially obtained an Islamic financing license from the Financial Regulatory Authority (FRA). This milestone marks a significant expansion in Fawry’s offerings, allowing the company to provide Sharia-compliant financial solutions tailored to the growing demand for Islamic finance in Egypt.

We are accelerating our efforts to unlock the full value of our technology assets. Technology-related revenues grew by 28.2% year-on-year, reflecting strong initial traction and validating the commercial potential of our platforms. Looking ahead, we see technology monetization as a long-term growth lever, with an expanding role in shaping our revenue mix and strategic roadmap.

Additionally, I would like to emphasize that we are committed to leverage our big data and AI capabilities across mission-critical functions. These include personalized customer engagement, fraud prevention, credit decisioning, as well as automated code generation. These applications are designed to enhance customer experience, support data-driven strategy, and drive operational efficiency at scale.

Eng. Ashraf Sabry

Chief Executive Officer

| Operational Developments

Consolidated Financial Performance

Segments Overview Banking Services – 38.4% of revenue

Financial Services – 27.2% of revenue

Alternative Digital Payments – 25.7% of revenue

Supply Chain Solutions – 5.9% of revenue

|

About Fawry for Banking Technology and Electronic Payments

Founded in 2008, Fawry is the largest e-payment platform in Egypt serving the banked and unbanked population. Fawry’s primary services include enabling electronic bill payments, mobile top-ups and provisions for millions of Egyptian users. Other digital services also include e-ticketing, cable TV, and variety of other services. Through its peer-to-peer model, Fawry is enabling corporates and SMEs to accept electronic payments through a number of platforms including websites, mobile phones, and POSs. With a network of 36 member banks, its mobile platform and more than 400 thousand agents, Fawry processes more than 6 million transactions per day, serving an estimated customer base of 54.1 million users monthly. Learn more at www.fawry.com.

INVESTOR RELATIONS CONTACT

For further information, please contact:

Hassan Abdelgelil

Director of Investor Relations

investor.relations@fawry.com

Building 221 – F12 – Financial district – Smart Village

-Ends-