PHOTO

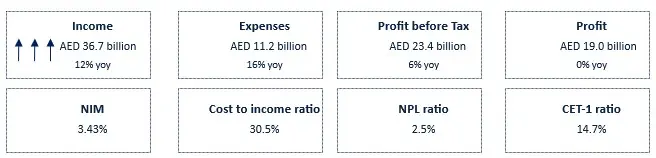

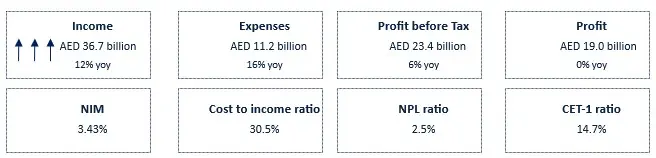

Emirates NBD delivered AED 36.7 billion income for the first nine months of 2025 as the Group continues strong growth momentum in both interest income and non-funded income across all countries, segments, and products. Operating profit increased by 10% yoy, fuelled by outstanding loan growth more than offsetting the impact of interest rate cuts. Profit before tax up 6% to AED 23.4 billion despite lower recoveries during the quarter. Lending surged by an impressive record AED 99 billion (19%) in the first nine months of 2025, driven by strong domestic and international demand. Deposits grew by AED 94 billion (14%) in the first nine months, boosted by AED 56 billion increase in low-cost Current and Savings Account balances.

Emirates Islamic continued strong growth momentum delivering record profit before tax of AED 3.2 billion during the first nine months of 2025. KSA continued to outperform with lending growing 38%, in the first nine months. Emirates NBD’s Digital Wealth platform has boosted Group Assets Under Management up to USD 53 billion, strengthening the Group’s product offering and wealth management strategy. Strategic investment in the Group’s regional footprint, digital and GenAI are driving income growth which more than offsets the impact of lower interest rates.

On the 18th of October 2025, Emirates NBD entered into a Share Subscription Agreement with RBL Bank Limited to acquire a 60% stake through the Issuance of Preferential Equity Shares for a total compensation of INR 268.5 billion (USD 3.0 billion). As part of the Transaction, Emirates NBD would be required to launch a Mandatory Tender Offer to existing shareholders post receiving the requisite regulatory approvals for the Transaction. Emirates NBD would also merge its existing three branches in India with RBL Bank in due course. The transaction is expected to be completed by the end of the second quarter of 2026, subject to obtaining necessary regulatory approvals. The Transaction is in line with our strategy to increase our presence in core markets, with India being one of them, representing strong long-term growth potential.

Key highlights – 9M’25

- Income 12% higher yoy reflecting strong growth momentum in both interest income & non-funded income

- Operating profit up 10% yoy to AED 25.5 billion reflecting incredibly strong loan and deposit growth

- Record loan growth up 19% in 9M’25, adding an impressive AED 99 billion to the loan book, driven by robust growth in the Group’s core market and KSA

- Deposits grew AED 94 billion, including AED 56 billion increase in low-cost Current and Savings Accounts

- Impairment credit of AED 0.3 billion, on continued healthy credit environment and buoyant economy with improved impaired loan ratio 2.5%

- Emirates Islamic continued growth momentum delivering record profit before tax of AED 3.2 billion

- Emirates NBD’s investment in customer focused services & products is propelling business growth

- 35% market share of UAE Credit card spend; # 1 Credit Card issuer across MEA

- Emirates NBD one of region’s top banks for Customer Experience with Net Promoter Score of 52

- Emirates NBD KSA continued to outperform as lending grew 38% in 9M’25, with 2 further branches expected to open by year end, totalling 23 branches

- Emirates NBD Capital ranked #1 in the 9M’25 League Table for UAE IPOs having led all UAE IPOs year to date

- First dedicated freighter financing, two Boeing 777-200LRF aircraft USD 350 million for Emirates Airline

- New Structured Credit, Commodity and Investment products introduced, driving a substantial increase in income from both local and international clients

- Record Retail CASA AED 35 billion growth backed by strong loan acquisition

- Digital wealth platform surpassed AED 5 billion in trading volumes within its first year of launch

- Assets Under Management across the Group grew to USD 53 billion, strengthening Groups’ wealth management strategy

- Looking to the future, Emirates NBD is transforming into a data-first, digital-focused and environmentally responsible regional powerhouse

- More than 2.4 million ENBD X active users across UAE and KSA reflecting 49% increase since 2023

- Local equity trading via ENBD X digital wealth platform, exceeded AED 5 billion within one year of zero transaction fee model launch

- First-in-Region solution to offer fully automated transaction dispute capability

- Advanced Analytics portfolio crossed more than 50 use cases spanning across all business, international locations and support functions

- GenAI Executive Council is ensuring the adoption of standardised GenAI application development, platform and model management, guardrails, data governance across the bank

- Emirates NBD deepens integration of 155 APIs, delivering seamless connectivity and customer centric digital experiences

- Emirates NBD ranks # 1 on the sustainable issuance league table for the MENAT region

- Highest ESG rating for any bank in the region by S&P Global

- Ranked #1 Middle East bank with 35 LEED Platinum and Gold certifications

- Financed and facilitated over USD 8 billion in sustainable finance transaction in 9M’25

- Emirates Islamic issued world’s first USD 500 million sustainability-linked financing sukuk, reinforcing Group’s leadership in ESG-Islamic integrated Islamic finance