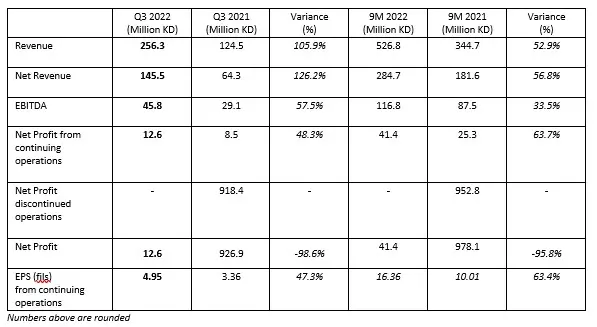

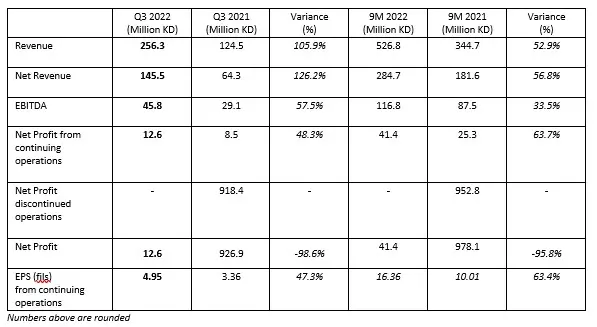

KUWAIT:– Agility, a long-term investor and operator in supply chain services, infrastructure, and innovation, today reported third-quarter earnings of KD 12.6 million, or 4.95 fils per share, an increase of 48.3% over the same period in 2021 excluding the earnings reported last year from GIL. Agility’s EBITDA increased 57.5% to KD 45.8 million and revenue was KD 256.3 million, an increase of 105.9%.

The Q3 numbers include two months of results from Menzies Aviation, which was acquired by Agility during the quarter. On a like-for-like basis, excluding Menzies numbers, earnings stood at KD 10.8 million, an increase of 27.7% over the same period in 2021, again excluding the earnings reported last year from the sale of GIL. Agility’s EBITDA increased 21% to KD 35.2 million and revenue was KD 166.8 million, an increase of 32.2%.

For continuing operations, Agility’s earnings through nine months of 2022 were KD 41.4 million, or 16.36 fils per share, an increase of 63.7%. EBITDA for the nine months was KD 116.8 million, an increase of 33.5%; revenue was KD 526.8 million, an increase of 52.9%.

Q3 2022 performance

Agility Vice Chairman Tarek Sultan said: “Agility reported good results in this quarter despite challenging market and geopolitical conditions. Our controlled businesses continued to perform well and execute their growth strategies. Our investment segment was impacted by the broader stock market performance. However, Agility is a strategic investor. We look beyond the movement in the daily share price as we take a strategic long-term view of these businesses, and we have conviction that they will deliver value, growth and returns for our shareholders over the long term.”

Sultan said “Agility’s acquisition of UK-based aviation-services provider John Menzies PLC, completed in Q3, is part of Agility’s strategy to add and grow core businesses with the potential for strong returns. By combining our National Aviation Services (NAS) business with Menzies, we’ve created a global industry leader with a footprint in developed and developing aviation markets around the world.”

“Agility is a different company today than it was two years ago, but we continue looking to accelerate growth across our portfolio by unlocking value for shareholders, customers, employees, partners and communities,” Sultan said. “Agility will continue to create long-term value by operating and investing in growing sectors and geographies.”

Agility-Controlled Businesses

Agility’s controlled businesses are those the company controls and operates. The performance of this segment is consolidated and reported through Agility’s profit and loss statement. For Q3 and going forward, Agility’s consolidated results will include the performance of Menzies Aviation, which was merged with Agility’s NAS business unit.

For the third quarter of 2022, this segment reported EBITDA of KD 47 million and revenue of KD 256.3 million, increases of 44% and 106%, respectively, over the same period in 2021.

Agility Logistics Parks (ALP) Q3 revenue grew 9.7%. To meet the increasing demand for warehousing space, ALP is optimizing its existing land bank, developing new projects, and looking to acquire additional land, especially in the Middle East and Africa.

In Kuwait, an ALP affiliate is developing 1.2 million sqm of land as industrial and storage complexes in Sabah Al Ahmed residential area. In Saudi Arabia, Agility recently signed an agreement to build a logistics park near Jeddah and operate the park under a 25-year concession. The ALP-Jeddah is to open in 2025.

Tristar, a fully integrated liquid logistics company, reported revenue growth of 75.5% for the third quarter 2022. Tristar won renewal of two large long-term contracts to supply fuels for peacekeeping missions, solidifying the company’s position as the top supplier among those listed on United Nations procurement website. In addition, Tristar’s acquisition of a 51% ownership stake in HG Storage International Limited contributed to its Q3 growth.

Menzies Aviation results, as discussed, combine the Q3 performance of NAS and two months of performance by John Menzies PLC. Menzies Aviation has roughly 35,000 employees and operates t at 254 airports in 58 countries.

United Projects for Aviation Services Company (UPAC) saw a 28.7% third-quarter revenue increase. The increase was mainly attributable to a rebound in airport-related services and parking following the reopening of Kuwait International Airport and easing of post-COVID restrictions, which resulted in an increase in flight and passenger volumes. UPAC expects this trend to continue with a gradual increase in airport traffic in 2022 and beyond.

UPAC is a co-investor in Abu Dhabi’s Reem Mall, on Reem Island, a project with an estimated value of USD $1.3 billion. The retail, entertainment, and leisure attraction is expected to be completed and fully operational in 2023. Carrefour, Reem Mall’s anchor tenant, opened in February 2022. The mall will be the region's first, fully integrated omni-channel retail ecosystem with digital, e-commerce, and logistics capabilities, bringing together all consumer and retailer services to ensure a seamless customer experience.

At Global Clearinghouse Systems (GCS), Agility’s customs-modernization company, Q3 2022 revenue declined 8.1% from third quarter 2021. The decrease resulted from lower trade volumes. GCS is still pursuing opportunities to increase future growth and diversify its sources of income.

Last month, Agility signed an agreement with the Egyptian government to develop and operate two customs and logistics centers in the Suez Canal Economic Zone, one of the most important trade hubs in the region.

Agility’s Investments

Agility holds non-controlling minority stakes in a number of businesses, both listed and non-listed, with a carrying value of roughly KD 1.2 billion. The carrying value of those stakes declined from the Q2 level of KD 1.4 billion as the result of broader declines in global equity markets. Global markets have been volatile amid increases in interest rates, supply chain disruption, and ensuing economic impact.

As a long-term investor, Agility is focused on the growth potential of these business and their ability to generate value.

Recap of Agility Q3 2022 Financial Performance (Continuing Operations)

- Agility’s Net Profit from continuing operations grew 48.3% compared to the same period in 2021.

- Agility’s EBITDA increased 57.5% to KD 45.8 million.

- Agility’s Revenue increased 105.9%, to KD 256.3 million and Net Revenue increased 126.2%.

- Agility enjoys a healthy balance sheet with KD 3.1 billion in assets. Net Debt stood at KD 794.8 million as of September 30, 2022 (this excludes lease obligations). Agility has announced that it has increased its credit facilities to finance its business growth plan, which includes the recent acquisition of John Menzies. Reported operating cash flow was KD 45.9 million for the first nine months of 2022.

-Ends-

About Agility

Agility is a global leader in supply chain services, infrastructure and innovation. With a workforce of 50,000+ across its group of companies, Agility has a footprint in six continents and is a pioneer in emerging markets. Agility owns and operates businesses that include the world’s largest aviation services company; the market leader in industrial warehousing and logistics parks in the Middle East, South Asia, and Africa; a commercial real estate business developing a $1.2 billion mega-mall in the UAE; a liquid fuel logistics business; and companies specializing in customs digitization, remote infrastructure services, e-commerce enablement, digital logistics, and more. Agility invests in innovation, sustainability and resilience, and owns stakes in listed and non-listed companies that are reshaping logistics and transportation, energy, e-commerce, and other industries. Agility is a publicly-listed company in Kuwait and Dubai.

For more information about Agility, visit:

Website: www.agility.com

Twitter: twitter.com/agility

LinkedIn: linkedin.com/company/agility

YouTube: youtube.com/user/agilitycorp