PHOTO

1/BEAR HUGS After swallowing markets from Germany to China, the bears reached U.S. shores in December

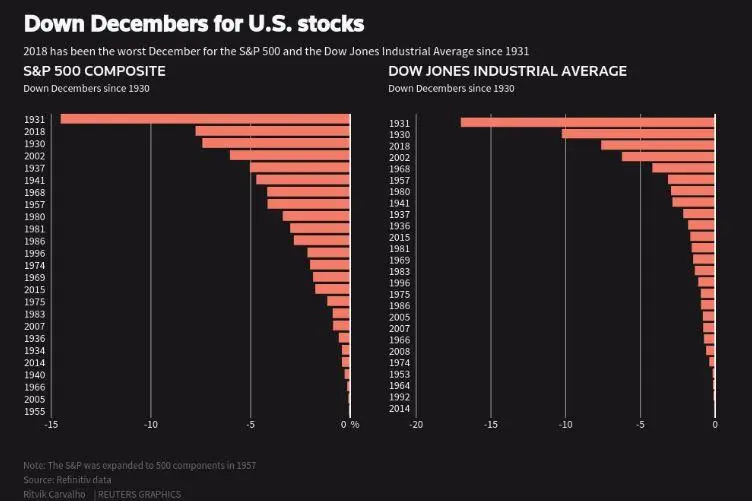

Markets there are fighting back but the outlook is not great. For one, growing numbers of global indices have notched up the 20 percent peak-to-trough drop denoting a bear market. U.S. stocks, which seemed invincible until mid-year, have posted the worst December performance since the Great Depression. Second, the world economic outlook is steadily darkening and upcoming PMI data should confirm that.

Sure, the U.S. economy is still expanding nicely. But when high-growth, investor-darling tech stocks fall prey, it shows optimism about growth is fizzling. And segments such as the Russell 2000 small-cap benchmark are stuck deep in the bears' lair. Small firms often carry higher debt loads than larger peers so falling share prices highlight credit risks.

In Europe, Germany's DAX fell to the bears in early December and the euro zone bank and auto sectors are down a whopping 40 percent and 36 percent respectively from this year's peaks. This week, the leading pan-European equity index confirmed it too had entered bear territory, following Wall Street's Christmas Eve shakeout.