PHOTO

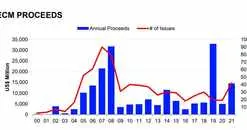

MENA equity capital markets (ECM) raised $14.5 billion from 42 offerings in 2021, a 193 percent increase in proceeds from last year and a 13-year-high in the number of ECM deals, according to Refinitiv data.

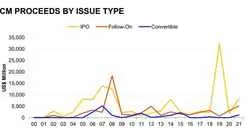

IPOs raised $8.2 billion in 2021, accounting for 56 percent of total proceeds, a 341 percent increase from 2020. Follow-on issuances totalled $5.1 billion in 2021, a 65 percent increase from last year and a thirteen-year high.

The largest equity offering of the year was Saudi Telecom’s follow-on issuance of $3.2 billion after the sovereign wealth fund, Public Investment Fund, sold 6 percent of its stake. This was followed by ACWA Power International’s IPO which raised $1.2 billion. Abu Dhabi ADNOC Distribution raised $1.19 billion in a convertible bond sale. Also, in an IPO of a part of its drilling subsidiary, ADNOC raised $1.10 billion. Finally, the Saudi Tadawul Group Holding Co. raised just over $1 billion in share sale.

Saudi Arabia was the most active country with $8.9 billion in ECM proceeds followed by United Arab Emirates with $4.3 billion.

In terms of sector profiles of the issuers, Energy and Power took the top spot, with total proceeds at $4 billion. Telecommunications with around $3.25 billion was next, followed by Financials at $2.5 billion.

Among the banks involved in deals, Citi takes the top spot in the MENA ECM league table advising on $2.5 billion of deals. HSBC followed advising on $1.7 billion of deals.

(Writing by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022