PHOTO

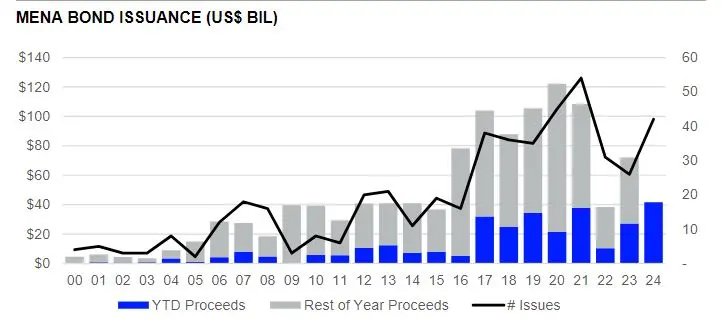

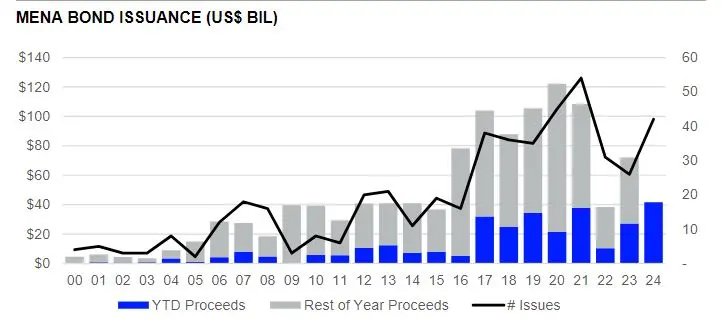

MENA debt issuances totalled $41.6 billion during Q1 2024, marking a 52% year-on-year (yoy) jump, according to Refinitiv. This is the highest first quarter total since Refinitiv's records began.

The number of issues increased 62% over the same period.

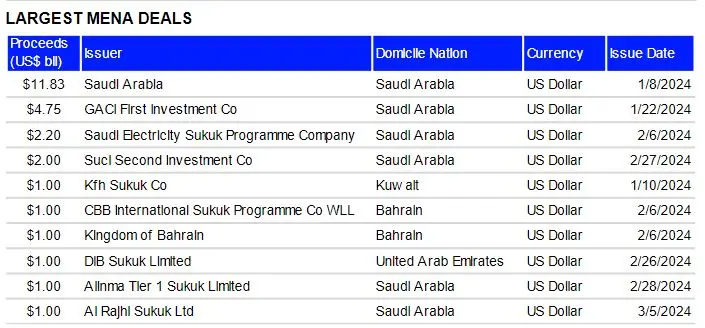

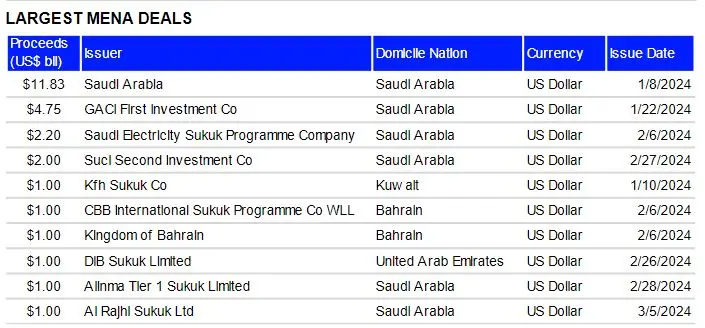

Saudi Arabia was the most active issuer during Q1 2024. The kingdom issued bonds and sukuk worth $22.78 billion. Of this, the Saudi government accounted for bonds worth $11.83 billion. GACI First Investment Co. accounted for issuances worth $4.75. Saudi Electricity Sukuk Programme Co. issued debt worth $2.20 while Suci Second Investment Co. issued $2 billion.

The UAE followed with $2.8 billion. The issuances were DIB Sukuk ($1 billion), Mamoura Diversified Global Holding ($1 billion) and FAB Sukuk ($0.80 billion).

Financial issuers accounted for 61% of proceeds raised during the period while Government & Agencies accounted for 31%, according to Refinitiv.

Islamic bonds in the region raised $16.5 billion during Q1 2024, a first quarter record. Sukuk account for 40% of total bond proceeds raised in the region, compared to 23% last year.

HSBC took the top spot in the MENA bond bookrunner ranking during the first quarter of 2024 with $4.7 billion of related proceeds, or an 11% market share. HSBC also took first place in the MENA Islamic bonds league table.

(Writing by Brinda Darasha; editing by Seban Scaria)