PHOTO

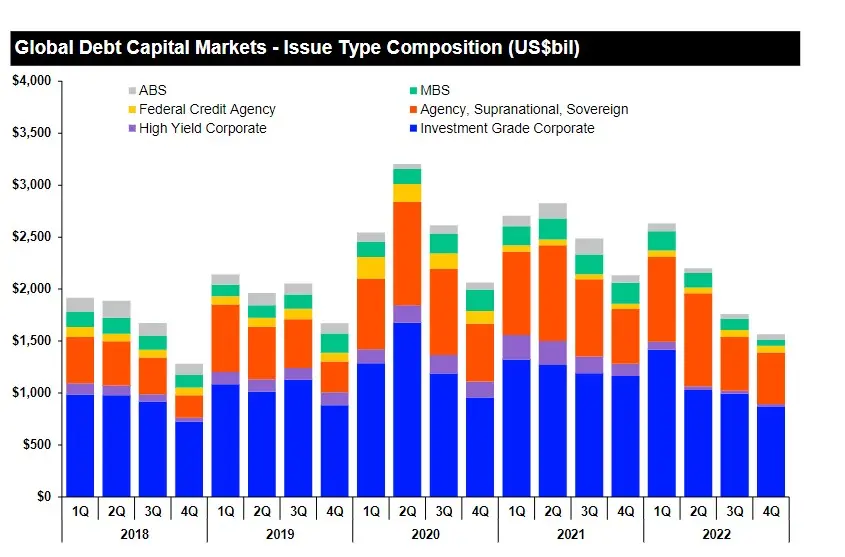

Overall global Debt Capital Markets (DCM) activity totaled $8.3 trillion during full year 2022, down 19% compared to 2021 and slowest annual period for DCM activity since 2019, according to data compiled by Refinitiv.

The number of new offerings brought to market during 2022 totaled 26,625, a 12% decline compared to a year ago and a three-year low.

DCM issuance during the fourth quarter of 2022 has decreased 13% compared to the third quarter of this year and fell below $2 trillion for the second consecutive quarter for the first time since the fourth quarter of 2018.

Corporate debt issuance down

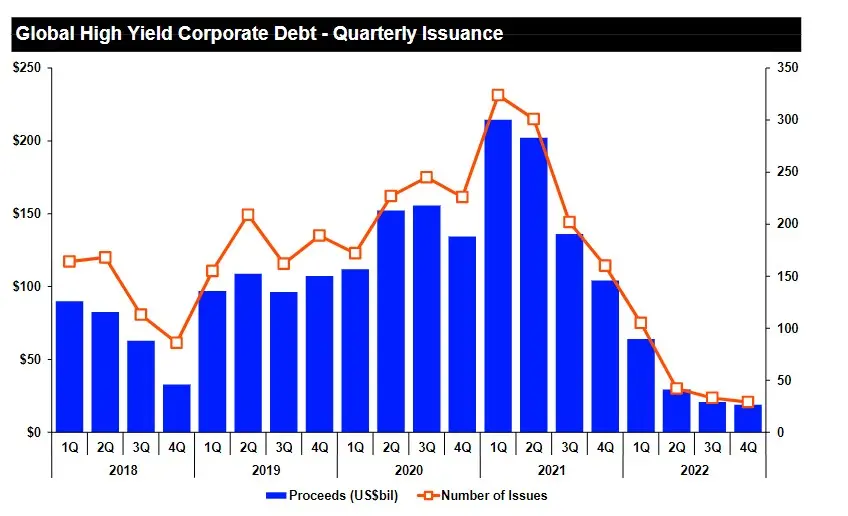

Global Investment Grade corporate debt offerings totaled $4.1 trillion during full year 2022, a 13% decrease compared to 2021 levels and the slowest annual period for global high-grade corporate debt since 2019.

Investment Grade debt issuance totaled $825.7 billion during the fourth quarter of 2022, a 11% decline compared to the third quarter of the year and the third consecutive sub-$1 trillion quarter.

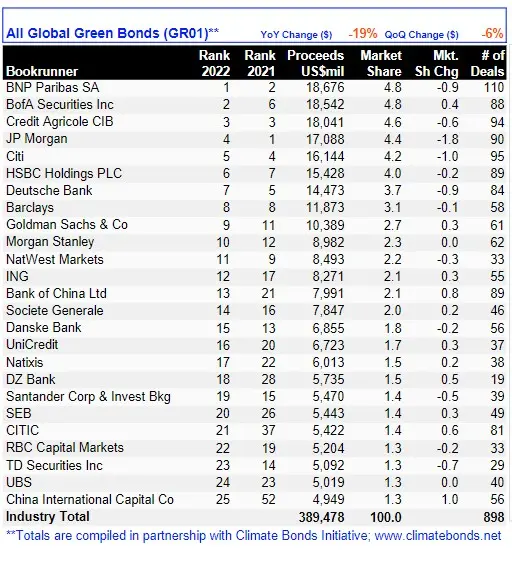

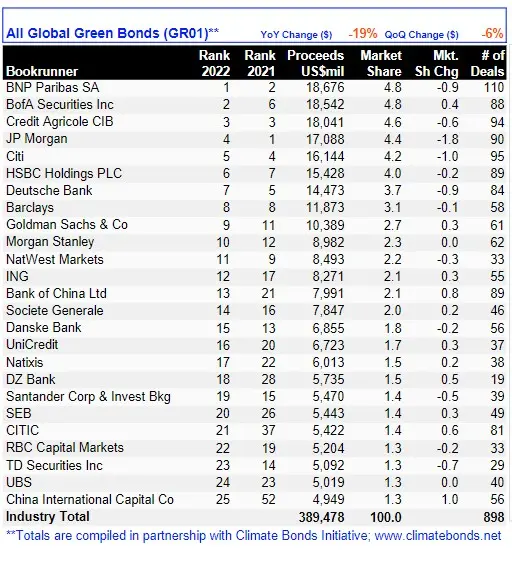

Green bond issuance declines

According to figures compiled by Refinitiv and The Climate Bonds Initiative, green bond issuance totaled $389.5 billion during 2022, a 19% decrease compared to year ago levels and the first annual year-over-year decline since records began in 2015.

The fourth quarter of 2022 marked the second consecutive quarter to register below $100 billion in two years.

Debt issuance from agency, sovereign and supranational issuers totaled $2.7 trillion during full year 2022, down 9% from a year ago, Refinitiv said in its 2022 Global DCM review.

International bond offerings, meanwhile, declined 30% to $3.6 trillion in 2022. Debt from emerging market corporate issuers totalled $225.8 billion during the full year, down 42 per cent compared to a year ago, the report said.

(Writing by Seban Scaria seban.scaria@lseg.com; editing by Daniel Luiz)