PHOTO

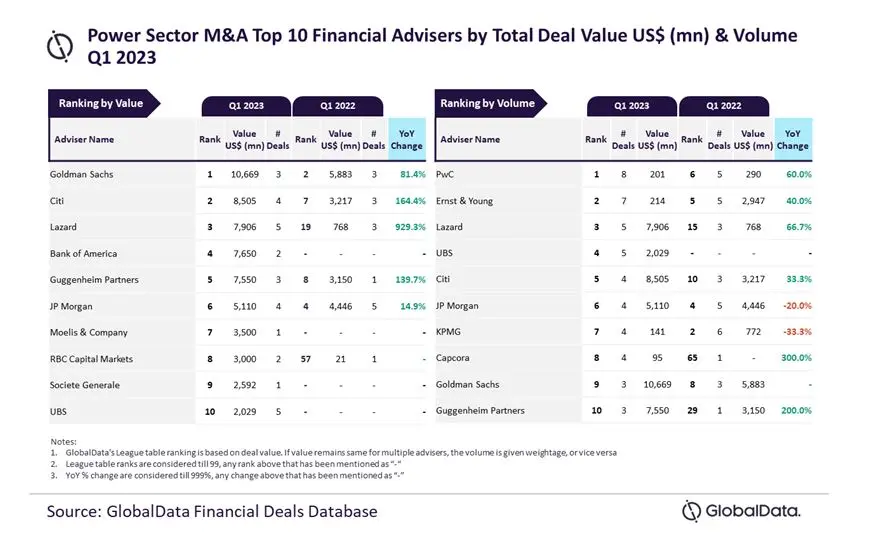

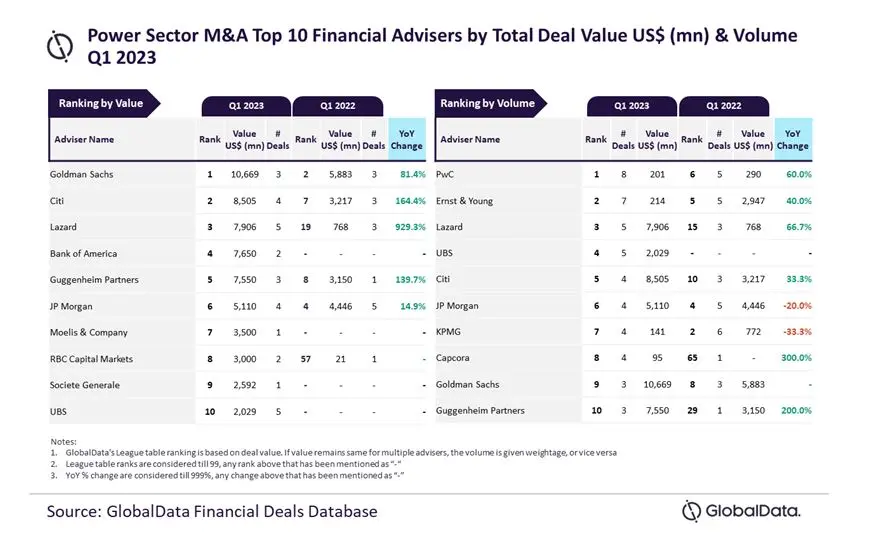

Goldman Sachs and PwC were the top financial advisers for mergers and acquisitions (M&A) in the power sector in Q1 2023 by value and volume, respectively, according to London-based data and analytics firm GlobalData.

Goldman Sachs achieved the top slot in value terms by advising on $10.7 billion worth of transactions. On the other hand, PwC led by volume, having advised eight deals.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “Goldman Sachs was the clear winner by value as it was the only adviser that managed to surpass the $10 billion mark during Q1 2023.”

The US investment bank took the ninth position by volume, he added.

However, the average deal size of deals advised by PwC in Q1 2023 was $25.2 million, which is much less than Goldman Sachs’ average deal size of $3.6 billion.

An analysis of GlobalData’s financial deals database found that Citi took the second position in terms of value by advising on $8.5 billion worth of deals, followed by Lazard ($7.9 billion), Bank of America ($7.7 billion) and Guggenheim Partners ($7.6 billion).

Ernst & Young occupied the second position in terms of volume with seven deals, followed by Lazard (five), UBS (five), and Citi (four).

Meanwhile, US-based Jones Day and Kirkland & Ellis were the top M&A legal advisers in the power sector in Q1 2023 by value and volume, respectively.

Jones Day topped in value by advising on $11.2 billion worth of deals, Kirkland & Ellis led in terms of volume by advising on nine deals, GlobalData said.

(Editing by Seban Scaria seban.scaria@lseg.com)