PHOTO

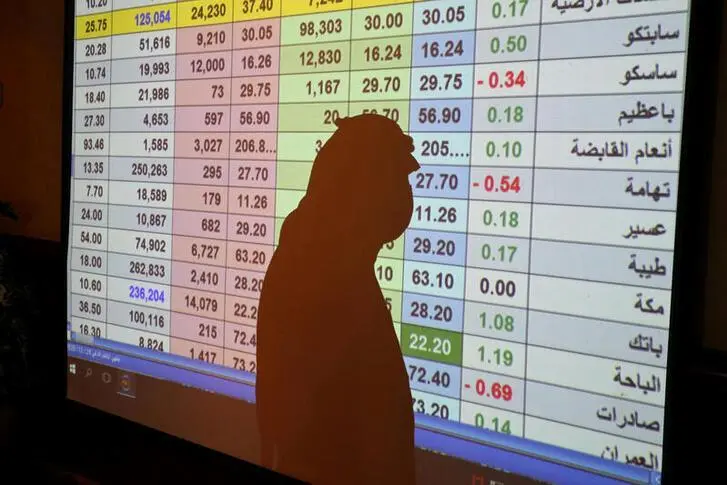

Major stock markets in the Gulf were in negative territory early on Thursday as oil prices eased, with the Saudi index on course to post its fifth weekly loss.

Crude prices - a key catalyst for the Gulf's financial markets - declined, hovering around two-month lows, as the proposed price cap on Russian oil from Group of Seven (G7) nations was considered higher than the current trading levels, alleviating concerns over tight supply.

The G7 is looking at a cap on Russian seaborne oil at $65-$70 a barrel, according to a European official, though European Union governments have not yet agreed on a price.

Saudi Arabia's benchmark index fell 0.8%, dragged down by a 2.9% drop in Dr Sulaiman Al-Habib Medical Services , while oil giant Saudi Aramco retreated 1.2%.

Saudi Basic Industries Corp (SABIC) and Aramco are planning to start a joint project to convert crude into petrochemicals in Ras Al Khair, the kingdom's energy minister Prince Abdulaziz bin Salman said on Wednesday.

Shares of SABIC were down 1.3%.

Dubai's main share index eased 0.1%, hit by a 0.8% fall in Emirates NBD Bank.

In Abu Dhabi, the index lost 0.2%.

However, the losses were limited by the possibility of the U.S. Federal Reserve soon slowing its pace of interest rate hikes.

Most Gulf Cooperation Council countries, including Saudi Arabia, the United Arab Emirates and Qatar, have their currencies pegged to the dollar and generally follow the U.S. Federal Reserve's policy moves, exposing the region to a direct impact from monetary tightening in the United States.

The Qatai stocks dropped 0.4%, with Qatar Islamic Bank losing 0.8%.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Maju Samuel)