PHOTO

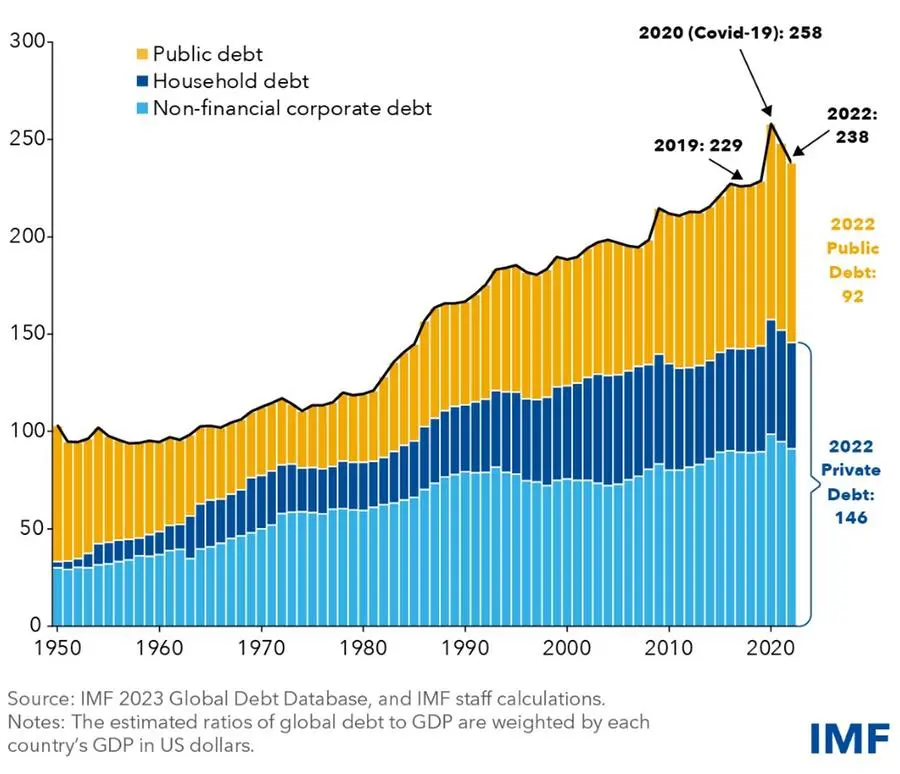

The global debt as a share of GDP fell for the second straight year to $235 trillion in 2022, but it remains significantly above its already-high pre-pandemic level, the International Monetary Fund (IMF) said on Wednesday.

The decline in the last two years has reversed about two-thirds of the spike in borrowings during the pandemic, mainly driven by the rebound in economic activity and inflation, the Washington-based lender said in its latest Global Debt Monitor.

Last year, total debt stood at 238% of the global gross domestic product (GDP), falling 10 percentage points compared to 248% in 2021 and 258% in 2020. The overall decline has been driven by lower household and non-financial corporation borrowings.

However, despite the decline, the overall debt is still higher by 9 percentage points compared to 2019 and may return to its long-term rising trend, the lender said in a separate blog.

Public debt levels remain elevated due to fiscal deficits incurred by governments, which opted to allocate more funds to boost growth and respond to inflation.

Private debt, which includes household borrowings and non-financial corporate debt, posted faster declines, dropping 12 percentage points of GDP. The fall was not enough to recoup the pandemic surge, the IMF said.

“As a result, public debt declined by just 8 percentage points of GDP over the last two years, offsetting only about half of the pandemic-related increase,” the lender said.

Pre-pandemic rise

Prior to the COVID-19 pandemic, the global debt-to-GDP ratio had been rising for years.

It tripled since the mid-1970s to reach 92% of GDP, or more than $91 trillion, by the end of last year. Private debt shared the same trend, tripling to 146% of GDP, or nearly $144 trillion, between 1960 and 2022.

A major driver of global debt growth is China, whose borrowing outpaced the growth in the economy, while debt in low-income developing countries also posted a significant rise in the last 20 years.

The IMF urged governments to find ways to lower debt vulnerabilities and reverse long-term debt trends.

“Policymakers will need to be unwavering over the next few years in their commitment to preserving debt sustainability,” it said.

To address high private sector debt, it said policies can be put in place to include monitoring of household and non-financial corporate debt burdens and related financial stability risks.

“For public debt vulnerabilities, building a credible fiscal framework could guide the process to balance spending needs with debt sustainability,” the lender said.

(Reporting by Cleofe Maceda; editing by Seban Scaria)