PHOTO

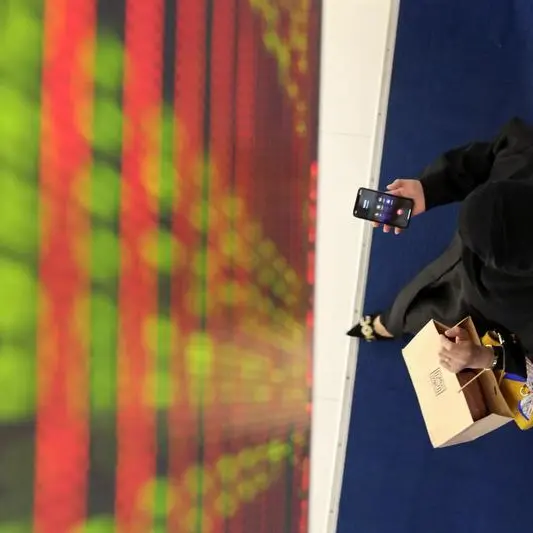

UK stocks edged lower on Monday after three straight days of gains at the start of a holiday-shortened week, as the latest data confirmed Britain's economy grew at a sluggish pace last quarter.

The UK's blue-chip FTSE 100 was down 0.4% at 1121 GMT amid quiet trading, while the domestically focussed midcap FTSE 250 index eased 0.3% from a seven-week high.

Official data showed GDP grew just 0.1% in the third quarter, in line with estimates, with April-June growth revised down to 0.2% from 0.3%. The figures suggest higher taxes and sticky inflation are weighing on activity, despite increased household spending and reduced savings.

The slowdown raised concerns about consumer resilience and corporate earnings heading into 2026.

Among sectors, consumer staples lagged. Beverage stocks led losses, down 2.6%, with Coca-Cola UK falling 2.1%. The personal care, drug and grocery sub-index fell 1%, with Ocado Group sliding 3.3% and Tesco down 1.3%.

Gold miners kept losses in check as Rio Tinto, Glencore, Endeavour Mining and Fresnillo benefited from gold surging above $4,400 an ounce for the first time.

Despite Monday's dip, the FTSE 100 is on track for its best year since 2009 with a 20.6% year-to-date climb, buoyed by defence and financial stocks.

By comparison, Wall Street's benchmark S&P 500 index has risen 16% so far.

Among individual stocks, North Sea-focused Harbour Energy was down 4.7% after the company said it would buy deepwater oil and gas exploration and production company LLOG Exploration for $3.2 billion.

AstraZeneca was down 0.6% after a late-stage trial testing its blockbuster therapy Imfinzi in combination with its experimental drug ceralasertib failed to improve the overall survival of patients with advanced lung cancer.

Trading volumes usually taper off toward year-end with traders away on holidays and markets closed on December 25 and December 26 for Christmas and Boxing Day, respectively.

(Reporting by Tharuniyaa Lakshmi in Bengaluru; Editing by Vijay Kishore)