PHOTO

From IPO boom to the rise of block trades, the Middle East's equity capital markets are evolving at rapid speed – driven by hefty issuance volumes – and attention is now turning to equity-linked products.

The UAE has produced some high-profile deals over the years – from Emaar Properties, Adnoc, DP World and a massive US$3.52bn pre-QPO issue from Nakheel in 2006 – but has fallen off the radar recently. While Saudi Arabia has yet to produce deals, below the waterline, activity among bankers, investors and lawyers is intensifying.

“This is something quite a few people are pitching in Saudi. Large exchangeables from investment-grade issuers is something I can see more of,” said one regional banker, referencing the approach taken by Adnoc with its US$1.2bn exchangeable bond into Adnoc Distribution in 2021. He cited talk of Sabic listing its gas unit as an example of the increasing opportunities for exchangeables.

“A number of sovereign wealth funds are looking at equity-linked in the region and it absolutely could work,” said a European equity-linked banker. “There has been development in the markets, the DFM in Dubai has made significant developments in borrow and hedging, with the ADX in Abu Dhabi and then [Saudi Arabia's] Tadawul making progress but a little behind.”

Bankers report a range of issuers considering proposals including Saudi sovereign wealth fund PIF which is said to be considering exchangeable sukuk as part of its capital recycling programme with Saudi Aramco a potential subject.

According to a banker not involved, PIF has gone as far as to mandate a bank and legal adviser for one potential exchangeable sukuk.

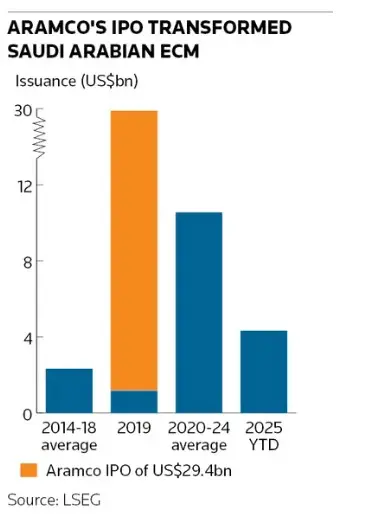

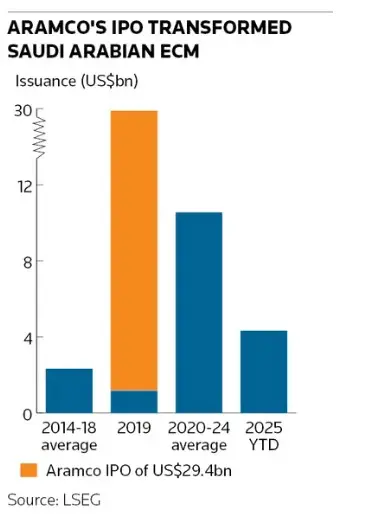

Those desperate for a revival in structured equity in EMEA are excited by the mere mention of Aramco, having seen how its IPO in 2019 transformed equity capital markets in the country.

Average equity issuance in Saudi for the five years after the IPO is 4.5 times the level in the preceding five years. PIF into Aramco would be a seismic event.

PIF did not respond to a request for comment.

Convincing issuers

There are other mandates being worked on.

A second regional banker has begun work on an exchangeable sukuk potentially into a listed company, in addition to two convertible deals for private companies. While the two private deals will be denominated in Saudi riyal, the exchangeable could be US dollar denominated to allow for greater international participation.

As one lawyer focused on the region noted, Saudi's Capital Market Authority and stock exchange rules allow for convertible and exchangeable issuance and so there is no regulatory barrier, however, there is a need for issuers and investors to catch up.

“From the issuer point of view they’re not yet seeing the point of these instruments,” said the lawyer. “Saudi is an equity-dominated market, people understand that better. Fixed income is complicated. Equity-linked requires an ecosystem of share borrowing and market-making which is done less in the Middle East.”

An investor in the region was also cautious around how compelling the product would be for issuers who are largely well financed, cash generative and have access to cheap borrowing alongside an investor base mostly unfamiliar with equity-linked structures.

“The international market will buy paper into something well known, but in the local market education is not there,” said a third banker in the region. “People will need to understand [an EB] is not an exit. We saw that with ABBs in the past, people didn’t understand it, though now they do.”

For companies seeking to raise capital, pre-emption is important with rights issues the standard approach and primary ABBs almost non-existent.

“An obvious point is how easy is it to have a non-pre-emptive capital increase,” said the first banker. “Most company articles do not allow this and would need some exemption from shareholders or the regulator. The UAE regulator is usually more flexible while the regulator in Saudi can be more bureaucratic.”

“There are a few issues; availability of borrow and the need to be sharia compliant,” said the investor, though they noted longer-term changes could shift the landscape.

“As M&A picks up and there’s an evolution of the corporate landscape, fragmentation of groups and more consolidation, and tech companies requiring funds [that could drive activity]. It’s definitely going to evolve.”

Bankers are busy educating and much more optimistic.

“The reality of the matter is companies are trying to explore other ways to raise capital and we believe this product will pick up some heat,” said the second regional banker. “There’s a lot of interest from foreign investors as an opportunity to get a block of stock. They’re more eager and receptive as they’ve done these deals before.”

He had also spoken to around 10 local family offices and asset managers about CBs and EBs.

“A lot of family offices are able to invest across debt and equity which would be very beneficial to equity-linked,” said the first banker. “The difficulty is marketing something with a lower coupon and premium to the market; I’m not sure how many family offices are set up to value that and have a feeling these would become predominantly international.”

Who first?

A sukuk deal is most likely to be used for the first offers in the region as, while not legally required, sharia compliance provides the best chances of maximum interest domestically and internationals are familiar with the various structures. The right name is also key.

“It needs one pathfinder to set the scene for the market,” said the third regional banker. “It should be something large; one could argue a government-related entity.”

“We already see a number of sovereigns pricing international bonds, not just sukuk deals, but also large bank facilities and margin loans across the stakes they own, so there is no obvious reason why a name like PIF could not do multiple [exchangeable] issues,” said the European banker. “You might want to limit exposure to the same credit, but if it is a different underlying there should not be an issue.”

While large privatisations proved key in opening the IPO market, equity-linked may have greater appeal to early stage, high growth companies, including pre-IPO.

The second regional banker said their most advanced deal is an around US$200m-equivalent convertible sukuk in a high-growth unlisted company, expected to launch towards the end of the year. A second offer is expected to launch in 2026 for a pre-IPO CB ahead of listing in 2027.

“We’re seeing companies considering convertibles as convertibility allows them to minimise liquidity discount [at IPO],” said the second banker.

Source: IFR