PHOTO

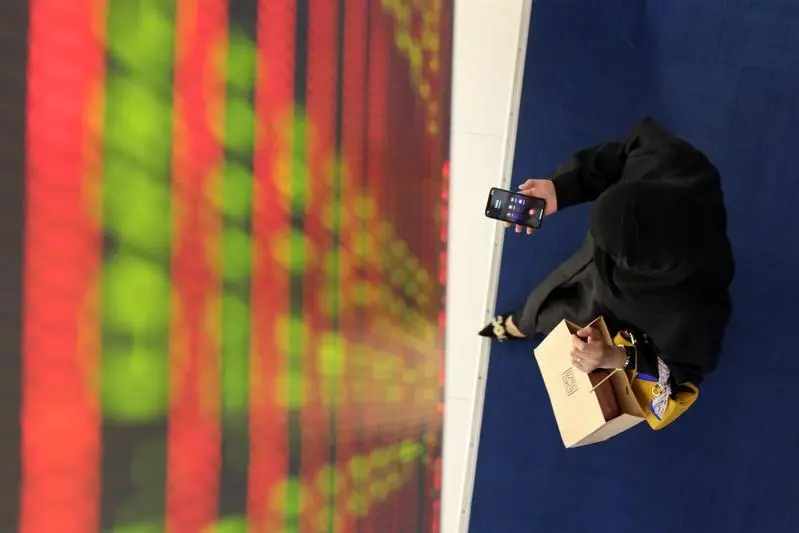

Stock markets in the UAE declined on Friday, as investors remained reluctant to place bets ahead of a crucial U.S. jobs report that could help shape expectations for the Federal Reserve's interest-rate path.

Monetary policy shifts in the U.S. tend to have a significant impact on Gulf markets, where most currencies are pegged to the dollar.

Dubai's main market closed 0.4% lower, snapping a week-long rally, on broadly negative sentiment. Burj Khalifa Developer Emaar Properties slipped 1.7%, while tollgate operator Salik Company shed 1.1%.

Abu Dhabi's benchmark index dropped 0.3%, extending losses from the previous session, with Adnoc Gas and Adnoc Drilling falling 1.4% and 1.9%, respectively. Separately, the Abu Dhabi National Oil Company has set the February official selling price of its benchmark Murban crude at $63.06 a barrel, it said on Friday, down from January's OSP of $65.53 a barrel.

However, oil prices - a key catalyst for the Gulf's financial markets - jumped on the day on concerns of potential disruption to Iran's output and uncertainty about supply from Venezuela.

Brent crude was up 0.8% to $62.49 a barrel by 1130 GMT.

- ABU DHABI fell 0.4 to 10,475 points

- DUBAI was down 0.4% to 6,226 points

(Reporting by Mohd Edrees in Bengaluru; Editing by Harikrishnan Nair)