Saudi Arabia has been witnessing since the beginning of the year an increased activity in terms of both of Sukuk and initial public offerings (IPOs). This comes with no surprise as the Kingdom's entities - both governmental and corporate - seek various means to raise capital whether through debt or equity to finance their expansion plans, projects and restructure their debts.

Politically the situation in the Arab gulf this year is better when compared to last year's unrest that hit neighboring Bahrain and Yemen which encourages issuers to tap the market. Liquidity is abundant domestically while foreign investors who are diversifying away from Eurozone debt seek alternative safe investment pools and both Saudi companies and government entities are perceived highly by investors given their strong financial position and secure long term revenue stream.

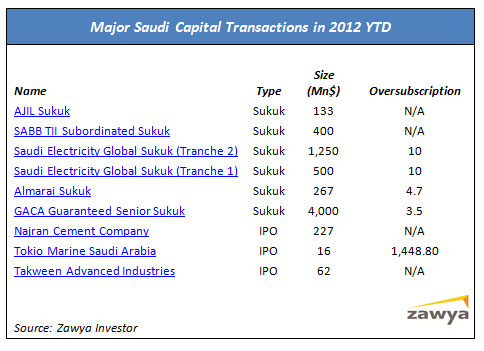

In the first 4 months of 2012, Saudi alone sold a total of USD 6.5 billion of Islamic bonds (sukuk) via 5 issues. The General Authority for Civil Aviation (GACA) landmark SAR15 billion (USD 4 billion) Sukuk was sold in January and marked the beginning of a new age of Islamic bond sales in the Kingdom. GACA's sukuk was a milestone in terms of size, nature of the government-backed issuer, and was essential to create a benchmark, triggering other issuers to sell debt. Yet, the sale was met by criticism given that it targeted local investors exclusively.

The response came from the incumbent electric utility of the Kingdom, Saudi Electricity, and two month later, as the latter sold its benchmark dual-tranche USD1.75 billion in the international markets and secured overwhelming demand form foreign investors. Lesson learned here, Saudi issuers can go big, public and international when they choose to. Orders of USD 17.5 billion were received.

Prior to that Almarai's sukuk came as a shout that not only government-owned and government-backed entities are to sell sukuk but private companies as well. Food and Dairy Products' Almarai sukuk also showed issuers can be from outside the circle of main sectors that usually sell sukuk, i.e. financial institutions, real estate and oil-related industries. The structure of the deal was mudaraba-murabaha which "may appeal to many issuers because it allows issuers to access the market with tradable sukuk where a portion of the financing is murabaha" said Blake Goud in his recent article.

Saudi British Bank (SABB) USD 400 million sukuk - which was privately placed - signaled that traditionally conventional issuers are eager to tap the Islamic bond market. All previous issues by SABB were conventional bonds according to Zawya Bonds Monitor.

Ajil Financial Services Sukuk was also privately placed in April and marked further diversification in size, type of issuer among other features.

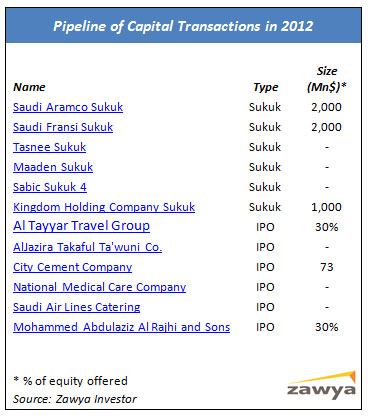

The trend is expected to roll on with many issuers revealing their plans to tap the Islamic bond market. National Industrialization Company (Tasnee), Kingdom Holding Company, Sabic, Maaden, Aramco, and Saudi Fransi all either expressed their interest, got approval or already established their respective programs and ready to make a move, Zawya's Sukuk Monitor's pipeline shows. Al Rajhi however chose to sell sukuk in the Malaysian market.

IPO

Saudi Arabia witnessed three IPOs in the first four months of 2012, as opposed to non in the same period last year. The three IPOs raised a combined total of USD305 million according to data compiled by Zawya IPO Monitor. These included Najran Cement Company, Takween Advanced Industries, and Tokio Marine Saudi Arabia. The latter was oversubscribed by 1448.86% making it one of the highest IPO subscriptions in the Kingdom.

Data compiled by the IPO Monitor also shows that the Kingdom witnessed the largest amount of IPOs in 2011 among its peer Arab states with USD 460 million from 5 transactions, yet well below the 2010 figure of USD 1 billion raised in 2010 from 9 transactions. It is worth noting that Saudi Telecom's IPO that raised USD 4 billion in 2003 remains the largest IPO that the Kingdom witnessed to date.

Further IPOs are expected to take place this year including Al Tayyar Travel Group which received approval from the capital market authority to float 30% of its shares. "City Cement Company and National Medical Care Company are two IPOs expected in 2012", Nadine Sharrouf of Zawya reported.

Funds

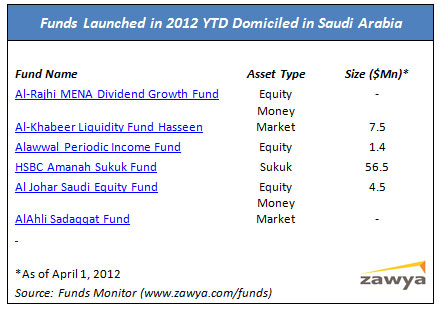

The recent hike in Sukuk and IPOs in the Kingdome is certainly providing extra investment pools and choices for fund and asset managers in the Kingdom or from abroad. Benefiting from improved investors' sentiment and strong economic fundamentals, the funds industry in Saudi Arabia continues to thrive.

Saudi Arabia presents considerable opportunities for asset managers targeting the GCC region. According to Zawya's Funds Monitor, 249 funds are domiciled in the Kingdom as of end of 2011. A recent report showed Saudi Arabia, with USD 17.5 billion in assets, had the highest AUM to GDP ratio of 3.1 percent in the region.

Six Saudi-domiciled funds were launched this year to date. Al-Rajhi MENA Dividend Growth Fund, Al-Khabeer Liquidity Fund Hasseen, Alawwal Periodic Income Fund , HSBC Amanah Sukuk Fund, Al Johar Saudi Equity Fund, and AlAhli Sadaqqat Fund.

The domestic AlAhli Sadaqqat Fund was launched in April by NCB Capital - which leads the list of the region's large asset management companies with $5.6 billion in assets - part of its plan to launch four investment funds this year, two of which will be domestically focused. The domestic funds will invest in small- and medium-sized businesses in the Kingdom as well as real estate, NCB added.

Adnan Halawi is Team Leader of Fixed Income at Zawya and can be contacted at ahalawi@zawya.com

© Zawya 2012