PHOTO

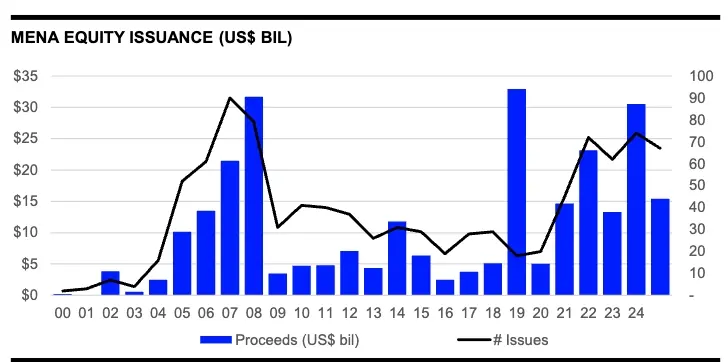

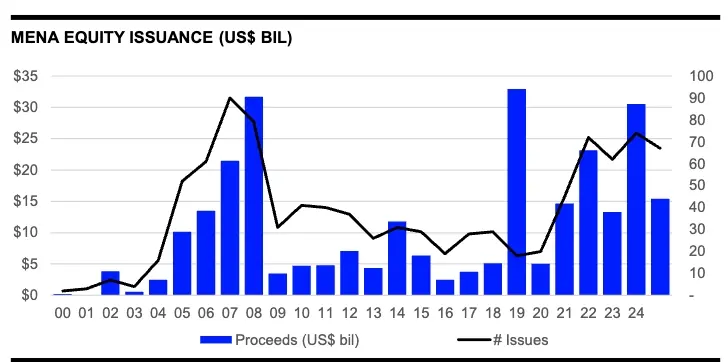

The pipeline for MENA equity and equity‑related issuances is expected to be robust in 2026 as companies that postponed IPOs during a turbulent year marked by volatility and uncertainty return to the market.

MENA equity and equity‑related issuance totalled $15.4 billion in 2025, a 49% decline from 2024, according to LSEG data. The number of deals also fell 9% year‑on‑year.

But Christopher Laing, Head of ECM at EFG Hermes Investment Banking, said that while “2025 was a good year for MENA equity issuance, but 2024 was a fantastic year with a number of very large transactions… so year‑on‑year comparisons were always going to be difficult.”

The exceptional 2024 activity included several landmark transactions such as the Aramco follow‑on offering, which raised more than $11 billion, the $2 billion IPO of Oman Exploration & Production, and the multibillion‑dollar IPOs of Talabat and Lulu in the UAE.

EFG Hermes topped the 2025 MENA ECM underwriting league table with a 9% market share. However, proceeds raised from its 12 issuances fell by half to $1.45 billion, reflecting the broader regional slowdown.

Laing said he remains “very confident and excited” about the next few quarters, with a heavy pipeline of IPOs expected after Ramadan.

“We are working with a large number of clients helping to prepare them for IPOs, and in addition, a number of significant shareholders are considering reducing their holdings in some of their portfolio companies. This year will see a mix of IPOs and secondary offerings, and what remains clear to us is that the quality of the companies remains very high and that bodes well for a successful year.”

Issuance breakdown

According to LSEG data, follow on issuance accounted for 53% of 2025 activity, raising $8.2 billion. The number of follow on deals also declined, falling to 18 in 2025 from 20 in the previous year.

Major deals included ADNOC Gas’s $2.84 billion marketed share sale to institutional investors and ACWA Power’s $1.9 billion rights issue in July. Abu Dhabi Commercial Bank also raised $1.66 billion through a rights issue.

IPOs made up the remaining 47%, with 49 IPOs, albeit five fewer than in 2024, raising $7.2 billion, down 42% from the previous year.

Low‑cost airline Flynas raised $1.1 billion in its May debut on Saudi Arabia’s Tadawul, making it the largest IPO of 2025 in the region. The $521.2 million listing of Moroccan construction firm SGTM was the largest in Q4.

Energy & power led the market, raising $3.5 billion and accounting for 23% of 2025 capital raised. Industrials followed with 18%.

League tables

EFG Hermes participated in several major 2025 transactions, including the ADNOC Gas follow‑on, and IPOs for Asyad Shipping, Almasar Alshamil Education, and Amanat on the DFM.

Laing said Saudi Arabia was the firm’s most lucrative market in 2025.

“The Saudi economy is the largest in the GCC, and it's not surprising this is the most active ECM and secondary market, followed by the UAE, which has performed fantastically well over recent years and built a strong local equity culture,” he said.

HSBC ranked second in LSEG’s league tables with an 8% market share, helping raise $1.3 billion through four deals—a 48% decline from 2024.

Looking ahead, Laing remains upbeat. “Fundamentally, the GCC economies remain robust and are growing strongly. Capital is attracted to the region, and the quality of the pipeline is high. So we have all the ingredients for a very successful year.”

Equity capital markets underwriting fees declined 19% to $331.6 million during 2025, a two-year low.

LSEG Investment Banking fees are imputed for all deals without publicly disclosed fee information.

(Reporting by Brinda Darasha; editing by Seban Scaria)