PHOTO

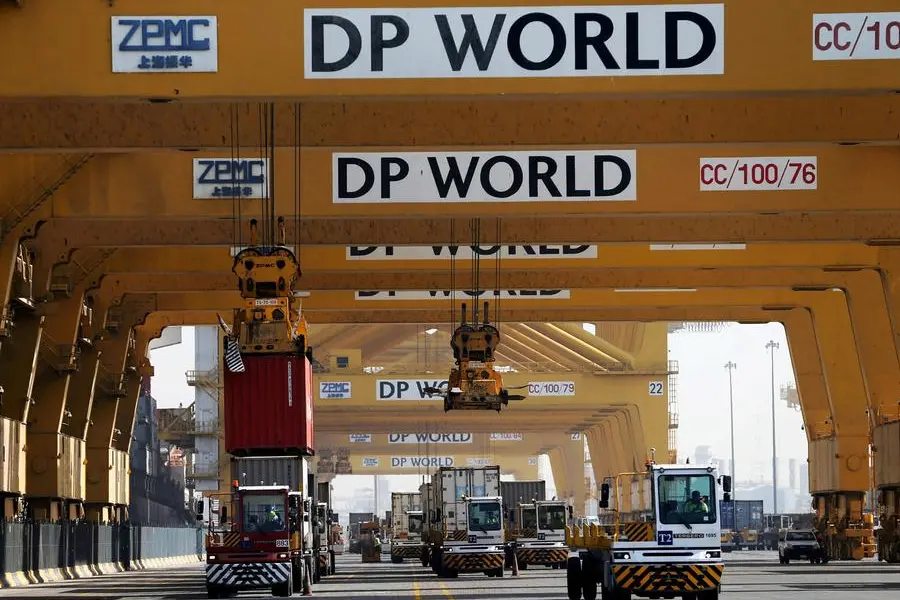

DP World (DPW) reported a drop of 28.9% in its 2024 profit attributable to owners after separately disclosed items at $591 million.

The global port operator reported 2% lower net profit for 2024 at $1.5 billion on higher finance costs and uncertain outlook due to geopolitical risks and changing global trade landscape.

Revenue grew by 9.7% to $20 billion.

DP World capacity exceeded 100 million TEU (Twenty-foot Equivalent Unit) due to infrastructure investment in key growth markets.

For 2024, capital expenditure came in at $2.2 billion, versus $2.1 billion in 2023.

The company has budgeted a capital expenditure for 2025 of approximately $2.5 billion to be invested mainly in Jebel Ali (UAE), Drydocks World and Jebel Ali Freezone (UAE), Tuna Tekra (India), London Gateway (UK), Ndayane (Senegal) and Jeddah (Saudi Arabia).

Group Chairman and CEO, Sultan Ahmed bin Sulayem, said the company maintained a positive medium-term outlook, supported by strong industry fundamentals and will seek bolt-on acquisitions

“As part of our long-term strategy, we continue to invest in our portfolio through targeted bolt-on acquisitions, expand into new locations and add high-value capabilities that align with our clients' evolving needs.”

(Writing by Brinda Darasha; editing by Seban Scaria)