PHOTO

Food and retail companies in Saudi Arabia have performed strongly this year after a royal handout spurred consumer spending, and the outlook remains positive ahead of the Muslim fasting month of Ramadan.

The retail and food sectors saw profits rise 15.5% and 11.6% respectively in the first quarter - some of the best performing sectors on the Saudi stock market, according to Al Rajhi Capital.

"For Q2 2015, we believe the sector's top-line growth will remain at higher levels as some benefits from the two-month bonus payment spill over to the second quarter and sales related to the holy month of Ramadan, which will begin in mid-June this year," Al Rajhi said.

Investment bank Securities Investment and Co (SICO) said that 30% of consumer companies reported higher than expected earnings in the first quarter, while another 30% of sector's earnings were in line with analysts' estimates.

The revenue growth has been largely fuelled by an increase in disposable income after King Salman ordered a two-month bonus salary to all state employees and pension to retired government workers at the start of the year.

"Saudi's February 2015 point of sale (POS) revenues rose by 42% year-on-year, the highest since 2011. POS in the first quarter reached SAR 49 million, up 26% year-on-year vs 11% year-on-year growth in 1Q14, benefitting most consumer names in the kingdom," SICO said

Saudi Arabia, which plans to open its stock market to direct foreign investment in June, is the second-largest retail market in the region after Egypt, and has one of the world's youngest and fastest-growing consumer bases.

Most of the retail companies in the kingdom have announced major expansion plans to take advantage of the favourable demographics.

FRAGMENTED MARKET

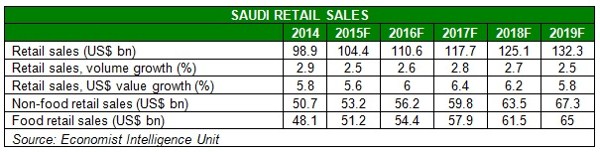

Saudi retail sales are expected to cross USD100 billion this year and exceed USD130 billion by 2019, according to the Economist Intelligence Unit (EIU).

Demand for consumer goods has been high between 2011 and 2013 due to a strong economy and government stimulus measures, but growth has slowed due to the knock-on effect of lower oil prices on spending.

"We expect retail growth to remain relatively slow over the forecast period, averaging some 2.6% a year in volume terms and 6% in value terms, as disposable income growth slows and the continued substitution of foreign workers with Saudis depresses population growth," EIU said in a January report.

The Saudi retail market remains fragmented with the top five firms controlling 10.6% of the market. Market concentration is likely to increase as large firms aggressively leverage their buying power and take advantage of economies of scale, according to EIU.

Jarir Marketing Co, the largest listed retailer, said late last year that it plans to invest SAR 1.1 billion (USD 293 million) over the next five years to roughly double the number of its stores in Saudi Arabia and the Gulf.

Savola Group, the largest company in the food sector in terms of turnover, has said it plans to add 100 convenient stores and 20 supermarkets to its existing capacity of 405 outlets. Savola also owns the Panda retail chain and a 36.5% share in Almarai, the second-largest firm in the Saudi food sector.

"Its (Savola) dominance will increasingly be challenged by Abu Dhabi-based Lulu Hypermarket, which in January announced plans to open eight new hypermarkets in the kingdom," EIU said.

Food remains the largest retail sub-sector in Saudi Arabia.

EIU said consumer spending on food, beverages and tobacco in Saudi Arabia rose by an estimated 5.9% in 2014 to USD 64 billion, or one-quarter of total consumer spending.

"The growing spending power of Saudis, combined with a rising population, will ensure further growth in spending in 2015-19, but the rate is set to decline, to an annual average of 5.1% (compared with 8.7% in 2011-14) as overall demand is softened by lower oil prices, and initially, reduced global foodstuffs prices."

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2015